FTX exchange will launch a Visa debit card in 40 countries to allow its customers to pay for goods and services using crypto.

The card will initially roll out to FTX customers in Latin America, Europe, and Asia. Waitlisted users will be notified via email when it is available in their respective countries. FTX launched the card in the United States earlier this year.

FTX card: low fees but no perks with Visa

The cardholder’s FTX crypto balance will be debited at the point of sale without FTX charging any administrative or processing fees, although third parties may levy a fee.

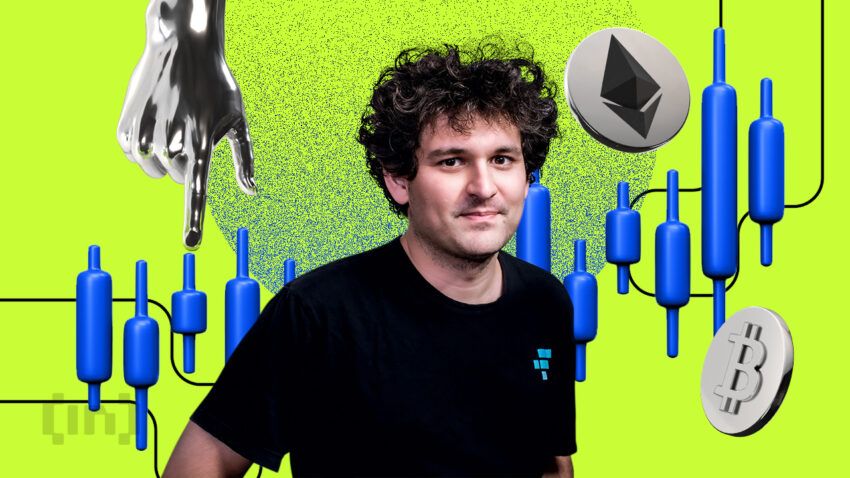

“We’re excited to partner with one of the world’s largest payment networks to give our users the ability to use their crypto to fund purchases at millions of merchants around the globe,” said FTX CEO Sam Bankman-Fried in a press release.

The card will allow FTX customers directly spend their crypto balances without having to deal with delays and fees associated with converting crypto to fiat for withdrawal at a bank. While FTX has not disclosed which crypto assets customers can spend, customers in the U.S. can first use USD balances. If a customer’s USD balance is insufficient, the card will use the highest crypto balance owned by the customer.

Unlike the BlockFi credit card, launched in partnership with Visa, the FTX cards currently in use in the United States do not offer rewards. Instead, users can spend yields earned on crypto deposits.

FTX has not publicized eligibility criteria for cardholder applicants during its extended rollout.

Visa competitor Mastercard partnered with crypto exchange Coinbase earlier this year to allow Coinbase customers to buy non-fungible tokens (NFTs) using a Mastercard debit or credit card. While this obviated the need to hold Ethereum in a crypto wallet, sales volumes have been lackluster. In July 2022, three months after Coinbase launched its NFT marketplace, sales volumes still trailed competitor OpenSea by 2,000,000%.

Visa embraces crypto with FTX

While FTX’s Visa card uses legacy payment rails, the payment provider also serves merchants through crypto rails.

In a recent interview at Token2049, an annual crypto conference held in Singapore and London, Checkout.com’s crypto strategy chief said merchants accepting Visa or Mastercard could use the company’s new stablecoin settlement feature to speed up payments processing.

When a customer pays using their Visa or Mastercard, Checkout.com gets the funds from the provider and exchanges them into a stablecoin that the merchant can instantly accept, negating the need for a wire transfer settlement.

However, the product is best suited to merchants that can pay suppliers directly using a stablecoin.

Following the announcement, FTX’s native token, FTT, rallied to $26.82 on Binance, before falling to $24.40 at the time of writing.

According to CoinMarketCap, the FTT token is used as collateral in certain derivative products. It is not available to customers in the U.S.

The token hit an all-time high of $80.49 in Sep. 2021.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.