Fantom (FTM) price is in the midst of forming a bullish pattern but despite the rally, it is observing bearish signals.

Can the altcoin fight this sentiment and carry on with its potential 102% increase, or will it face a 31% correction soon?

Crypto Market Bearish Cues Weigh Heavy on Fantom Price

Fantom price has maintained its presence above the $1 mark since the beginning of this week. Considering the historical movement, it seems like the altcoin will likely continue this rally, but broader market cues suggest the opposite.

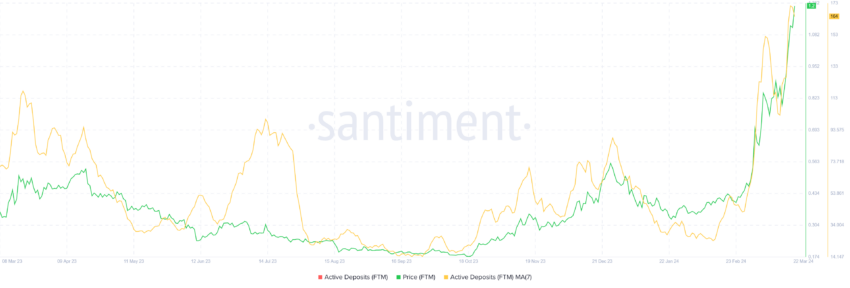

The surge in deposits on the network is a concerning development among FTM holders. This metric highlights the shift of tokens from investors’ wallets to exchange wallets. A spike in active deposits means that investors are preparing to potentially sell their holdings for profits or to offset losses.

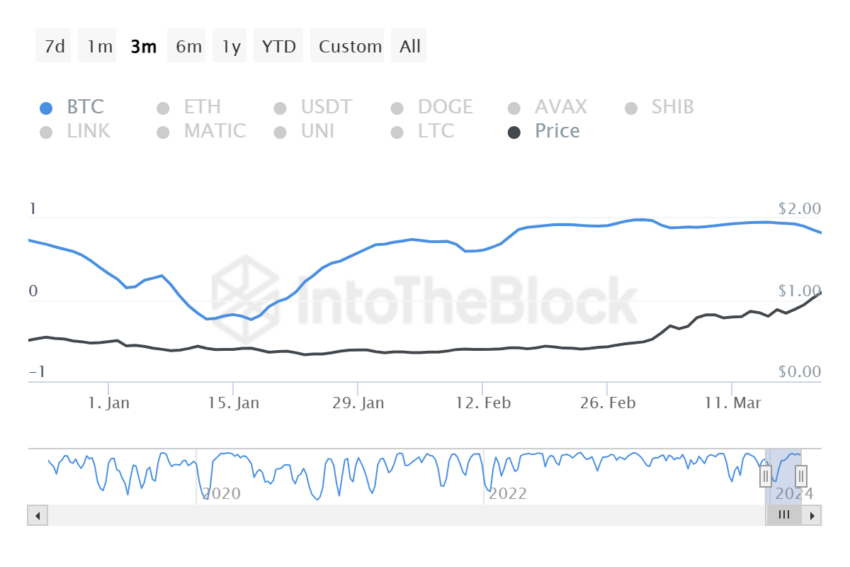

In the case of Fantom, it is the former. Additionally, the correlation of the altcoin is rather high, with Bitcoin at 0.86. High correlations suggest that the direction of the larger asset will impact that of the smaller one. Thus Fantom price could end up following the bearish cues of Bitcoin, which is currently in a decline.

Read More: Fantom (FTM) Price Prediction 2024/2025/2030

FTM Price Prediction: What Lies Ahead?

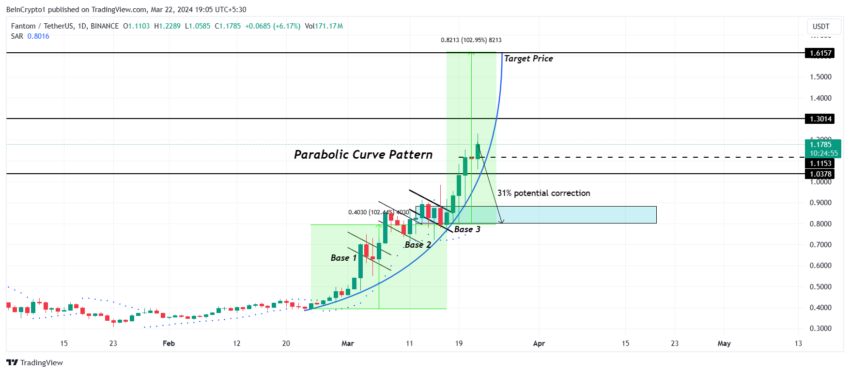

If the bearish cues bear an impact on the cryptocurrency, the Fantom price could see a 31% correction going ahead. This is based on the Parabolic Curve pattern forming on the daily chart at the moment.

This bullish pattern is confirmed when an asset forms three bases on the curve, with the third base generally triggering a rally. This rise can result in growth, which could double the price of the asset in a very short time.

Consequently, the target price is set at $1.61 for FTM. However, when corrections arrive, the asset could end up falling back to the support level established at base 3. However, since bearish cues are rising, if the Fantom price corrects now, it could note a 31% correction, falling to the base 3 level. It would end up testing the support range of $0.80 and $0.88.

Read More: 9 Best Fantom (FTM) Wallets in 2024

However, if Fantom’s price does not fall through the support line at $1.03, the bearish thesis could be invalidated. A bounce-off from this point would bring FTM back to test the support at $1.11.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.