Fetch.ai’s (FET) price is trading at $2.58 after breaching the critical resistance of $2.50, but this may not induce the rally investors are anticipating.

The reason behind this is the potential selling FET is witnessing as the altcoin is noting a market top.

Fetch.ai Could Note Some Drawdowns

Fetch.ai’s price is breaking out of consolidation and above a key resistance level, which suggests a rally might be on the cards. However, the case is the opposite this time since the altcoin established a market top this week.

A market top is the highest point of a security’s price before a significant decline, indicating a peak in bullish activity. Generally, this is followed by corrections as the market cools down, along with selling at the hands of investors.

This can be confirmed if the total supply in profit ends up being more than 95% of the circulating supply. Such is the case with FET, as 95.3% of the supply is in profit. Thus, a market top has already been formed for Fetch.ai’s price.

Thus, profit-taking is likely, and based on investors’ behavior, this pattern could be followed.

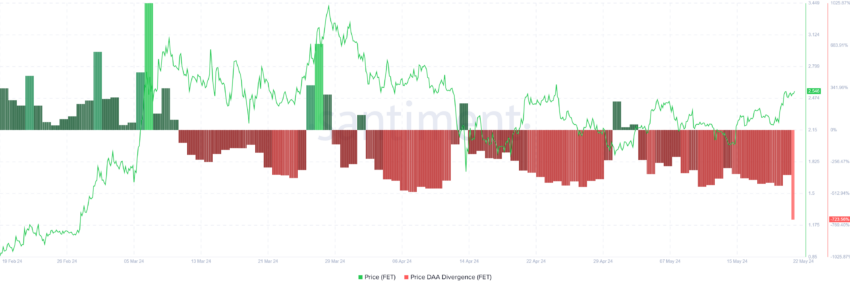

Further substantiating this thesis is the Price Daily Active Addresses (DAA) Divergence. Price DAA Divergence analyzes the discrepancy between an asset’s price movement and the number of active addresses transacting on its network. Generally, when the price rises but participation declines, a sell signal is flashed.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

If this is followed, FET holders could soon begin selling their holdings to secure the gains achieved to date.

FET Price Prediction: Bearish Impact Likely

Fetch.ai’s price breached the $2.50 resistance to trade at $2.58, noting a nearly 18% rise in the span of three days. This enabled the altcoin to escape a month-long consolidation, which FET could reenter soon.

This is because the abovementioned conditions suggest a bearish outcome for the asset. Accordingly, Fetch.ai’s price could lose support to $2.50 and fall to $2.26 or lower.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

On the other hand, a bounce back from the support of $2.50 could lead to sideways momentum until the market cools down and demand remains high. This gradual uptick could keep the price rising, invalidating the bearish thesis.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.