Fetch.ai (FET) price is close to noting correction for multiple reasons, including potential selling at the hands of investors.

Furthermore, the altcoin is also susceptible to a death cross, which could pull FET down to $1.7.

Fetch.ai Loses Potential Investors

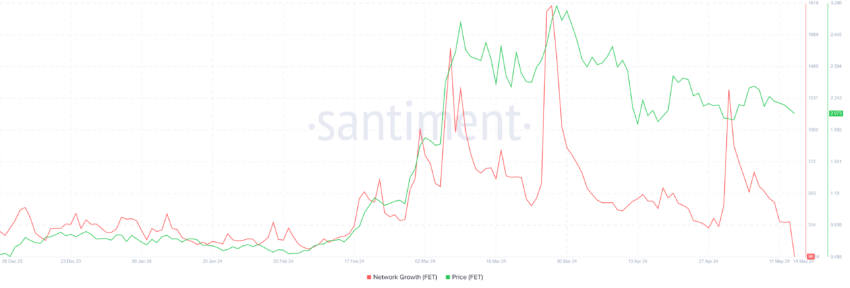

Fetch.ai’s price, at the time of writing, is close to noting a drawdown owing to the declining support from investors. The network growth has dipped to a seven-month low after spiking during the recent rally.

The network growth is used to assess the traction of a project in the market, whether it is losing or gaining. This is calculated by the rate at which new addresses are formed on the network. A decline in the same suggests that potential investors do not see much incentive to participate in the network.

This is probably due to the saturation of profits among FET holders. According to the Historical Break Even indicator, more than 97% of the supply is presently above the price it bought. The remaining 3% is divided among investors bearing losses, i.e., those who bought at an all-time high price.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

Thus, this presents a scenario where selling or profit-taking is the more dominant sentiment than HODLing. This is also a threat to the price action as massive dumping could lead to a correction.

FET Price Prediction: $2 Is the Crucial Support

Fetch.ai’s price has seen a drop of 12.7% in the span of a week, with the altcoin sitting at $2.08, close to the support at $1.96. The increasing bearishness at the hands of investors could cause a drop below this support.

Additionally, the altcoin is vulnerable to a death cross. A death cross occurs when a short-term 50-day Exponential Moving Average (EMA) crosses below a long-term 200-day EMA, indicating a potential bearish trend. This could drag FET down to $1.71.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

On the other hand, the support of $1.96 has been tested multiple times recently but has not been broken down below. If this level remains unbroken, Fetch.ai’s price could bounce back, pushing FET to $2.26.

Breaching and flipping it into support would enable a rise to $2.46 and beyond, in effect invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.