Plaintiffs have filed a class action lawsuit against the prominent law firm, Fenwick & West. The firm stands accused of aiding and abetting FTX’s “largest financial fraud in US history.” For a prominent law firm, it’s not the PR coup of the century.

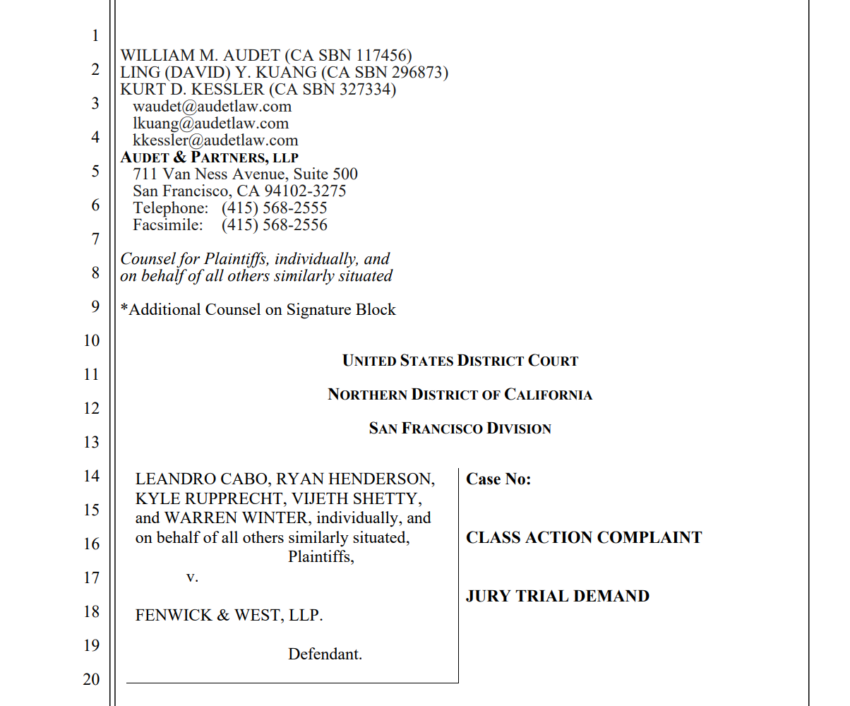

The plaintiffs, Leandro Cabo, Ryan Henderson, Kyle Rupprecht, Vijeth Shetty, and Warren Winter, filed the August 7 lawsuit in the United States District Court for the Northern District of California. They allege that the FTX Group, led by its founder and former CEO Samuel Bankman-Fried (SBF), stole billions of dollars from customers. And that Fenwick & West played a role in covering up the theft.

Fenwick Allegedly Provided Illegel Strategies for FTX

Fenwick & West, LLP, FTX’s principal law firm, is accused of aiding and abetting the alleged fraudulent activities. The plaintiffs argue that Fenwick played a central role in facilitating and providing illegal strategies for the schemes.

The law firm marketed itself as being “at the forefront Blockchain Revolution.” According to Fenwick, clients “across the blockchain ecosystem” relied on it for “strategic advice” in navigating the “business and regulatory landscape.”

The plaintiffs also accuse Fenwick of going beyond its usual legal responsibilities to FTX. Fenwick lawyers allegedly crafted strategies that were “not only creative, but illegal.” According to the complaint, Fenwick played a crucial role in establishing covert entities used by Bankman-Fried and the FTX Insiders for fraud.

Fenwick Allegedly Helped FTX Misuse Customer Funds

The firm also reputedly orchestrated FTX US acquisitions to evade regulatory scrutiny, offered guidance on regulatory circumventions, and supplied personnel for strategy execution.

Fenwick & West also allegedly helped hide FTX US’s handling of customer funds by forming and managing corporate entities. They mixed millions of dollars in customer funds from FTX.com into North Dimension bank accounts. They then co-mingled them with FTX Group funds for speculative trading, venture investments, and personal transactions.

The plaintiffs believe Fenwick advised FTX US on regulatory obligations, aware of this reckless handling of funds.

In communications, FTX executive Dan Friedberg disclosed that Alameda Research, an SBF-run investment firm, held cash and crypto assets owned by FTX. This was a breach of FTX US’s duty to exercise reasonable care with its customer deposits.

Friedberg stated that “we” (referring to FTX and Fenwick & West) needed to come up with any justification for the arrangement. He wrote:

“[S]ome FTX cash and crypto is held by Alameda for the benefit of FTX customers. As we wade into the audit, the explanation here is important. We propose a ‘cash management’ agreement between the affiliates somehow where FTX gets first dibs on Alameda’s cash.”

Bankman-Fried, currently awaiting a criminal trial, allegedly misused customer deposits, utilizing billions of dollars in customer funds for personal gain. Not to mention speculative ventures, political contributions, and charitable donations. The trial is due to begin in a few weeks.

Sam Bankman-Fried Will Face Trial in October

The lawsuit further alleges that the FTX Group engaged in the sale of unregistered securities. It also failed to provide necessary disclosures to investors. Despite warnings from regulatory bodies, the FTX Group is said to have deliberately evaded US regulations through deceptive practices.

The plaintiffs contend that these actions violated various laws, including those related to securities sales, consumer protection, professional malpractice, aiding and abetting fraud, negligence, breach of fiduciary duties, and the Racketeer Influenced and Corrupt Organizations Act (RICO).

Learn how FTX imploded, wiping out billions from the crypto markets: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

As a consequence of the alleged schemes, the FTX Group experienced a significant downfall, resulting in the loss of over $30 billion in value. On November 11, 2022, FTX filed for emergency Chapter 11 bankruptcy.

The lawsuit claims that FTX’s involvement in federal bankruptcy proceedings could potentially last for years. This leaves little guarantee of recovery for victims. The class action lawsuit is one of the few avenues for the victims to seek compensation.

This lawsuit is part of a larger multi-district litigation (MDL) case being pursued in the Southern District of Florida. The MDL defendants include various individuals and entities linked to the FTX Group.

Whatever the outcome of the class-action suit, it is not helping Fenwick & West’s reputation in the legal industry and beyond.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.