Polygon (MATIC) price noted a bounce back from a key support line in the last 24 hours as the altcoin followed Bitcoin’s cues.

MATIC is expected to note further rise based on the investors’ actions, though the altcoin might still be consolidated.

Polygon Investors May Accumulate

At the time of writing, the MATIC price is observing a recovery, which will likely be fueled by Polygon investors themselves. This is because MATIC as an asset is undervalued, and in the macro timeframe, it is still a good bet.

The Market Value to Realized Value (MVRV) Ratio further substantiates this. The MVRV ratio assesses investor gains or losses, and Polygon’s 90-day MVRV hitting 10% indicates losses. This might possibly lead to accumulation. Historically, BTC tends to recover within the -14% and -31% MVRV range, labeling it an opportunity zone for accumulation.

This places MATIC in a good spot, as accumulation would drive the rally.

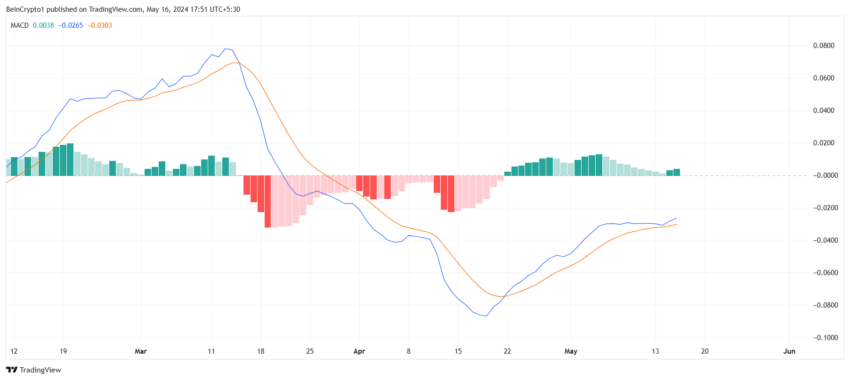

Secondly, the broader market cues are also bullish, as is evident in the Moving Average Convergence Divergence (MACD). MACD is a momentum indicator that utilizes the difference between two exponential moving averages to signal potential buy and sell opportunities in financial markets.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

The indicator nearly marked a bearish crossover, but the recent recovery flipped the outcome. As a result, the uptrend is continuing.

MATIC Price Prediction: Consolidation Ahead

MATIC price trading at $0.68 is above the critical support of $0.64, and based on the above-mentioned factors, a recovery is likely. However, this recovery might be halted by the resistance at $0.75.

This price level has acted as the limit to MATIC’s rise for over a month. The support of $0.64, along with this resistance, has formed a consolidation zone, and the Polygon native token will likely remain within this zone.

Read More: Polygon (MATIC) Price Prediction 2024/2025/2030

However, if MATIC’s price falls back down, it could potentially slip through the support zone. This would send the altcoin to $0.60, invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.