Gary Schollsberg, a Global Strategist for Wells Fargo, said that the U.S. Federal Reserve won’t likely be adopting negative interest rates anytime soon.

These thoughts were relayed to CNBC via an interview with Schollsberg yesterday.

“The Fed will do what’s necessary to maintain liquidity,” however negative interest rates seem unlikely at the moment. Europe has already tried the idea with mixed results and Schollsberg argues that there are far too many ‘unintended consequences’ when it comes to negative interest rates.

Schollsberg also said that bond yields could drop further if the deflationary crisis in the United States worsens.

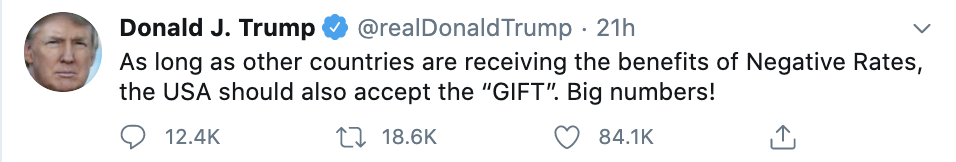

However, Schollberg’s comments are contrary to what President Trump himself has said — recently tweeting that he supported the idea of negative interest rates since other countries have been benefitting from it.

Negative interest rates would effectively mean that the Federal Reserve would be charging commercial banks for holding money. However, this ‘fee’ would likely be passed onto consumers as well.

Last year, BeInCrypto reported that German banks were already been toying with the idea for some time.

If negative interest rates become the ‘new normal,’ then Bitcoin could emerge as a suitable hedge and would be a natural catalyst for the public to move away from mainstream banking.

Negative interest rates would effectively mean that the Federal Reserve would be charging commercial banks for holding money. However, this ‘fee’ would likely be passed onto consumers as well.

Last year, BeInCrypto reported that German banks were already been toying with the idea for some time.

If negative interest rates become the ‘new normal,’ then Bitcoin could emerge as a suitable hedge and would be a natural catalyst for the public to move away from mainstream banking.

With Bitcoin’s third halving now behind us, BTC currently has a lower inflation rate than all other fiat currencies. Currently, at half of the world’s average, its yearly emissions stand at around 1.8%.

If the U.S. Fed adopted negative interest rates, it would be unprecedented. Although it may boost consumer spending in the short-term, its consequences could be far more severe than economists and policymakers realize. Luckily, there are emerging alternatives to traditional banking which provide us with a way out.

With Bitcoin’s third halving now behind us, BTC currently has a lower inflation rate than all other fiat currencies. Currently, at half of the world’s average, its yearly emissions stand at around 1.8%.

If the U.S. Fed adopted negative interest rates, it would be unprecedented. Although it may boost consumer spending in the short-term, its consequences could be far more severe than economists and policymakers realize. Luckily, there are emerging alternatives to traditional banking which provide us with a way out.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored