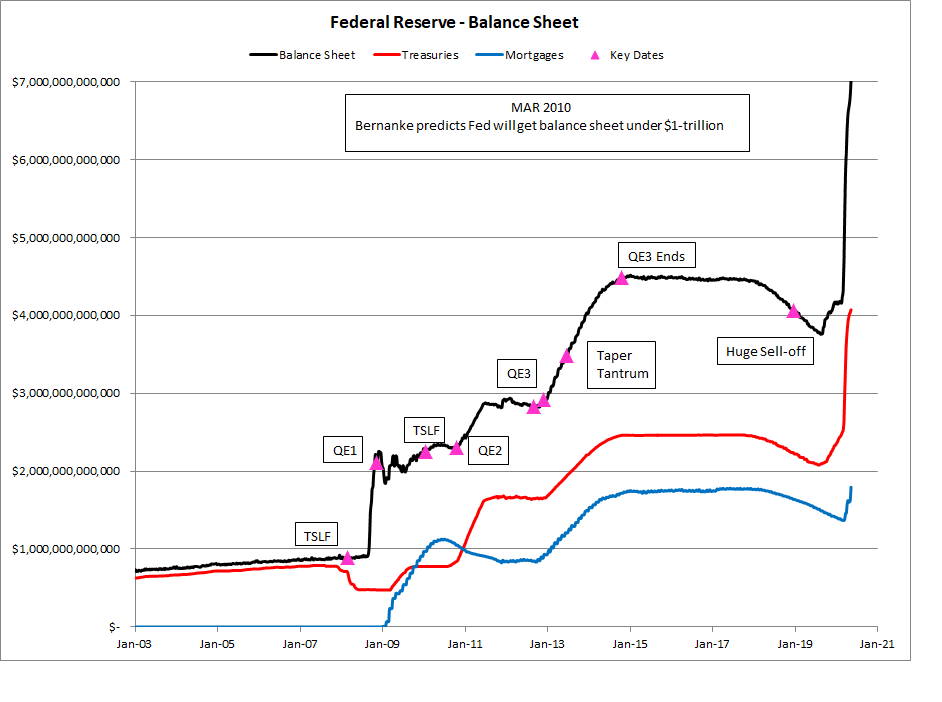

In a sudden reversal, the Federal Reserve (Fed) has become the largest holder of U.S. Treasury securities in the world.

The buying has apparently been driven by the COVID crisis and the mass proliferation of Treasury bonds.

The buying spree moved the overall Fed balance sheet from just above $2 trillion to nearly $4.2 trillion. The catastrophic jump took place in the course of just 60 days.With @federalreserve’s balance sheet expanding exponentially, Fed is now largest holder of @USTreasury securities (Fed data as of mid-June & other banks as of mid-May) @biancoresearch pic.twitter.com/gf3KhxO50d

— Liz Ann Sonders (@LizAnnSonders) July 20, 2020

The Fed Is Eating Its Own Tail

Many economists see the action as foreboding. The U.S. government is printing stimulus money at a rapid rate. The economy is dependent on the flows to such a degree that Treasury Secretary Steven Mnuchin even labeled it an ‘addiction’. However, the cost of pumping liquidity into the market comes with the substantial issuance of new Treasury assets. In particular, the 10 year Treasury note is witnessing some of the highest rates of growth since WWII. The flood of federal debt has swamped the market, causing the Fed to step in and buy. Ultimately, the government is buying government debt, a strange situation.Mortgage-Backed Securities

A rise in housing market prices has been hailed as a sign of market growth. However, the Fed is also buying up mortgage-backed secruties (MBS) like there’s no tomorrow. As the culprit for the 2008 crisis, the MBS market desperately requires buyers as liquidity dries up during the ongoing COVID pandemic. The Fed’s buying has, to be sure, stabilized the market, but the cost to do so remains an enigma.

As the culprit for the 2008 crisis, the MBS market desperately requires buyers as liquidity dries up during the ongoing COVID pandemic. The Fed’s buying has, to be sure, stabilized the market, but the cost to do so remains an enigma.

Borrowing From Peter…

The notion of buying bad debts is not new. The U.S. government has long been a substantial buyer of its own paper. However, the nature of the current crisis brings into question the long-term sustainability of this model. Eventually, the market must return to fundamentals, leaving someone to hold the bags.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored