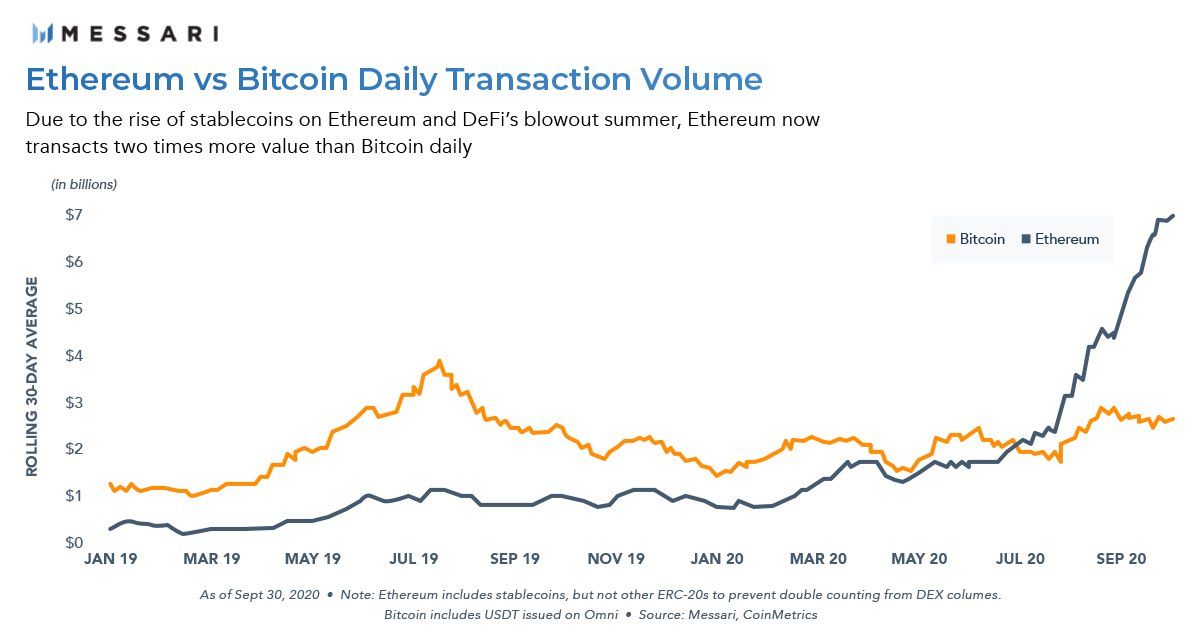

Massive spikes in stablecoin and decentralized finance (DeFi) transactions have seen Ethereum (ETH) overtake Bitcoin (BTC) in total value transaction volume.

The Ethereum network has also suffered multiple network congestions owing to this uptick. Fees spike on such occasions, resulting in miners earning more from transaction costs than the actual block rewards.

Ethereum May Soon See Annual Transactions Cross $1T

Tweeting on Oct. 21, Ryan Watkins of crypto research firm Messari revealed that the Ethereum chain saw two times more value transactions than Bitcoin. According to Watkins, the DeFi and stablecoin boom are responsible for this “flippening.”

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored