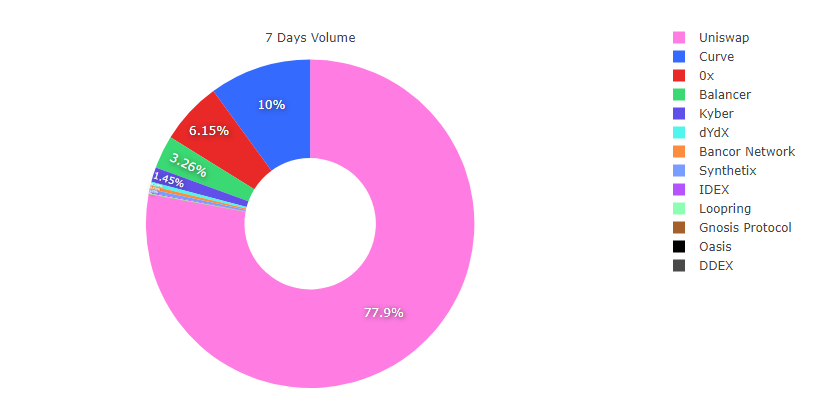

Uniswap experienced a massive surge in website traffic in September, while its centralized exchange counterparts saw a decline. The market’s most popular decentralized exchange (DEX) has attracted an increasing amount of traders as Ethereum works towards scalability.

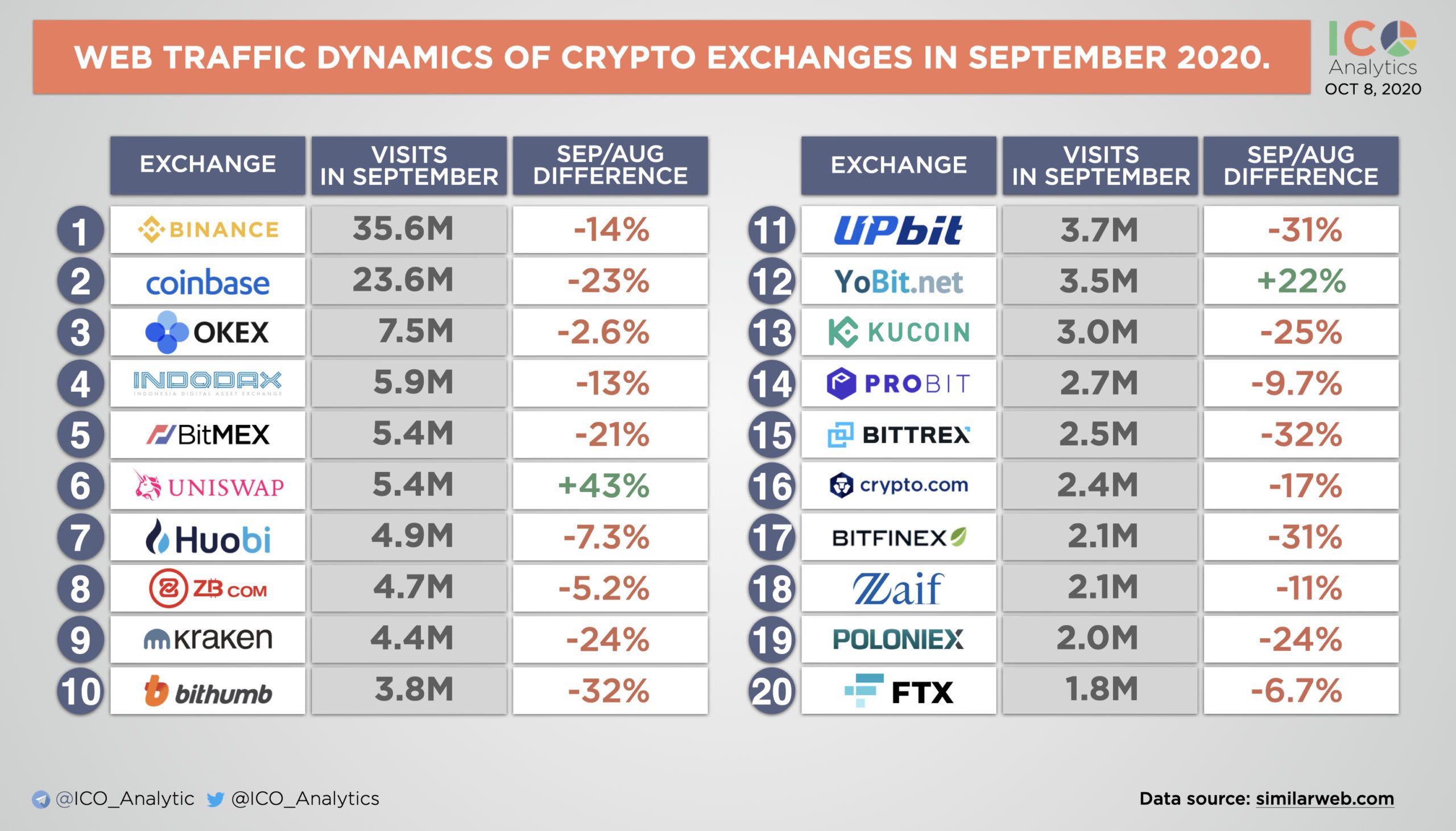

New data published by ICO Analytics offers an interesting insight into centralized exchange activity. Most centralized exchanges, including popular ones like Binance and Coinbase, have seen website traffic drops in excess of 10%. Uniswap, on the other hand, saw a 43% increase in website traffic.

Uniswap Reigns Among DEXs

DeFi Breathes New Life into Ethereum

Ethereum has spent much of 2020 slowly appreciating in price, and the ETH 2.0 upgrade seems to be just around the corner. The DeFi mania has spiked gas fees and extended transaction times, with the network struggling to support the demand. The ETH 2.0 upgrade will add sharding, a scalability solution that should help support the DeFi market growth. Phase 0 of ETH 2.0 is expected to be released in November, with other phases to follow as the months go by. Sharding will arrive in Phase 1, which will likely be implemented in 2021.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored