The crypto community has long debated whether Ethereum (ETH) might one day surpass Bitcoin (BTC) in market capitalization—a scenario often referred to as “the flippening.” However, Markus Thielen, head of research at 10x Research, remains skeptical.

According to Thielen, Ethereum’s weak fundamentals and recent performance trends strongly suggest that Bitcoin will maintain its dominance.

How Ethereum Has Been Lagging Behind

Often called digital gold, Bitcoin has solidified its role as a hedge against inflation and a key asset in the portfolios of “sovereign individuals” worldwide. This identity was reinforced in 2017 when Bitcoin developers decided to maintain a 1MB block size, emphasizing its status as a store of value rather than a currency.

This strategic move has made Bitcoin particularly appealing during economic uncertainties.

Conversely, Ethereum’s journey has been fraught with challenges. Despite playing a crucial role in the 2020-2021 bull cycle with innovations like NFTs and the potential for banking system replacements, Ethereum has struggled with significant scaling issues.

The long-overdue Dencun Upgrade (EIP-4844), intended to reduce high gas fees, only arrived three years after these problems became evident.

“While the Dencun Upgrade (EIP-4844) solved this in March 2024, it was three years too late. Crypto users (and traders) are not sitting around and waiting until a blockchain solves their bottlenecks; instead, those users move on, and today, most of the action is on Layer 2s,” Thielen said.

Consequently, Ethereum’s dominance in the crypto market has decreased from 17.8% to 15.8% post-upgrade. Moreover, the ETH/BTC trading pair has been in a downtrend since September 2022.

“Forget the flippening of BTC that many predicted,” Thielen boldly remarked.

Read more: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade?

Reflecting this disparity, Blackrock has shown a strong preference for Bitcoin over Ethereum. The market also mirrors this. For instance, Ethereum ETFs garnered just 15% of the inflows in Hong Kong compared to their Bitcoin counterparts, indicating limited investor interest in Ethereum.

Moreover, the regulatory environment remains a significant barrier for Ethereum. Recent SEC actions against exchanges like Kraken and Coinbase have left Ethereum’s classification as a security unclear. The regulatory uncertainty only deepens as the SEC is expected to deny Ethereum ETFs.

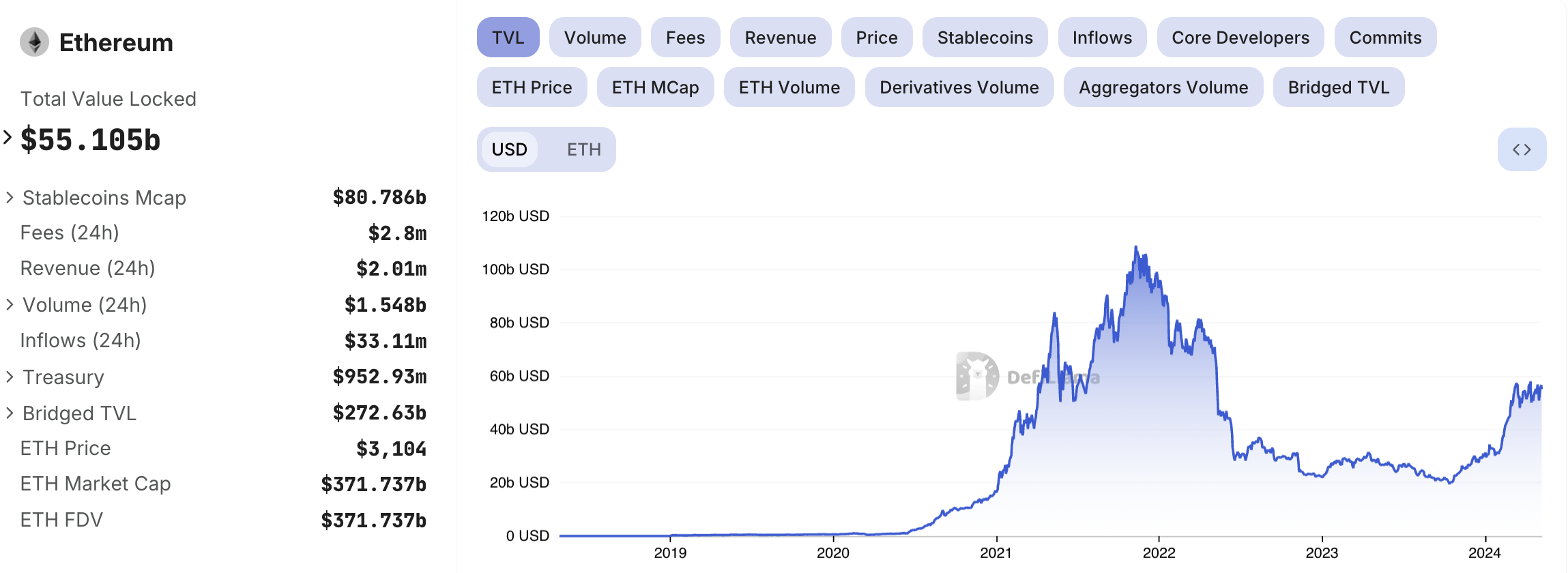

Financial indicators also highlight Ethereum’s struggles. The shift towards what some call “ultrasound money” has not resonated with investors as anticipated. Furthermore, Ethereum’s total value locked (TVL) in protocols is much lower than its peak, predominantly confined to staking and restaking activities.

“The concept of staking Ethereum became flawed as soon as US Treasury yields were available on-chain at much higher yields (5%). At the same time, the Ethereum use cases nosedived. The more people realize this, the less demand there will be for ETH,” Thielen explained.

Read more: Ethereum Restaking: What Is It And How Does It Work?

In addition, Ethereum has lost ground in the stablecoin market, a critical area of crypto transactions. Tron has surpassed Ethereum in USDT issuance thanks to its lower transaction costs, signaling a strategic failure by Ethereum to maintain its market share.

Given these insights, Thielen recommends caution regarding Ethereum.

“Right now, we would be more comfortable holding a short position in ETH than a long one in BTC as Ethereum’s fundamentals are fragile, which is not yet reflected in ETH prices,” Thielen remarked.