With spot Bitcoin exchange-traded funds poised to start trading after official approval, the crypto industry can let out a collective breath. Investors can start looking toward the next big narrative — Ethereum restaking.

Crypto market analytics platform CoinGecko has just launched a new category for restaking tokens, leading analysts to speculate that this could be a big growth area this year.

Ethereum Restaking Narratives

In essence, restaking allows users to stake the same ETH on both Ethereum and other protocols. This secures all of these networks simultaneously, allowing for the leverage of existing trust networks.

By leveraging Ethereum’s validators and staked tokens, smaller and newer blockchains can benefit from its robust security and trust system. This reduces the risks of attacks or failures for them.

On January 10, DeFi researcher Ignas said,

“I believe it will be the fastest-growing category in 2024.”

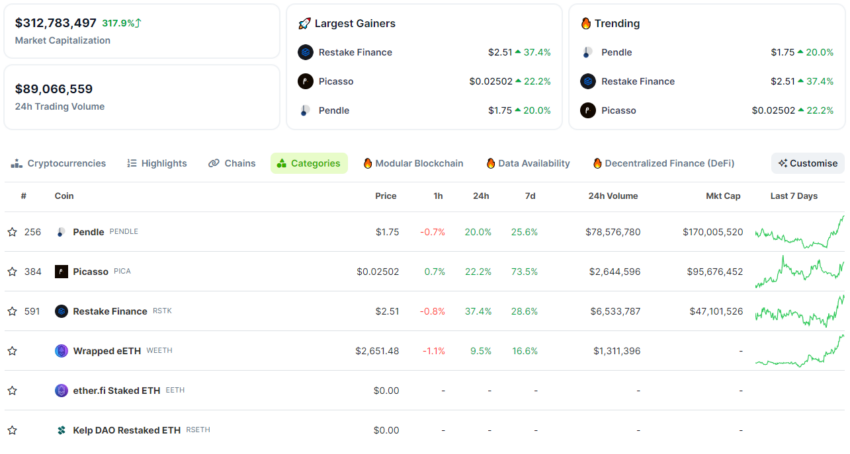

According to the new CoinGecko category, the restaking market capitalization is around $300 million. It currently only lists a few restaking platform tokens, but they have surged in price over the past 24 hours.

Pendle Finance is the largest, with a market capitalization of $164 million. Furthermore, its native PENDLE token has surged by 20% on the day to reach $1.73, just 30% down from its May 2021 peak.

Picasso (PICA) is the second largest restaking token by market cap, and it jumped 20% in value on the day. PICA prices are currently $0.024, cooling from its all-time high last week.

Read more: Top 7 High-Yield Liquid Staking Platforms To Watch in 2023

Restake Finance (RSTK) has skyrocketed 42% on the day to reach an all-time high of $2.64 on January 10.

EigenLayer is one of the largest restaking middleware platforms, launched to mainnet in June 2023. The venture capital-backed platform doesn’t have its own native token but provides the ability to stake other liquid staking tokens. It currently has a total value locked of $1.7 billion.

ETH Price Surges

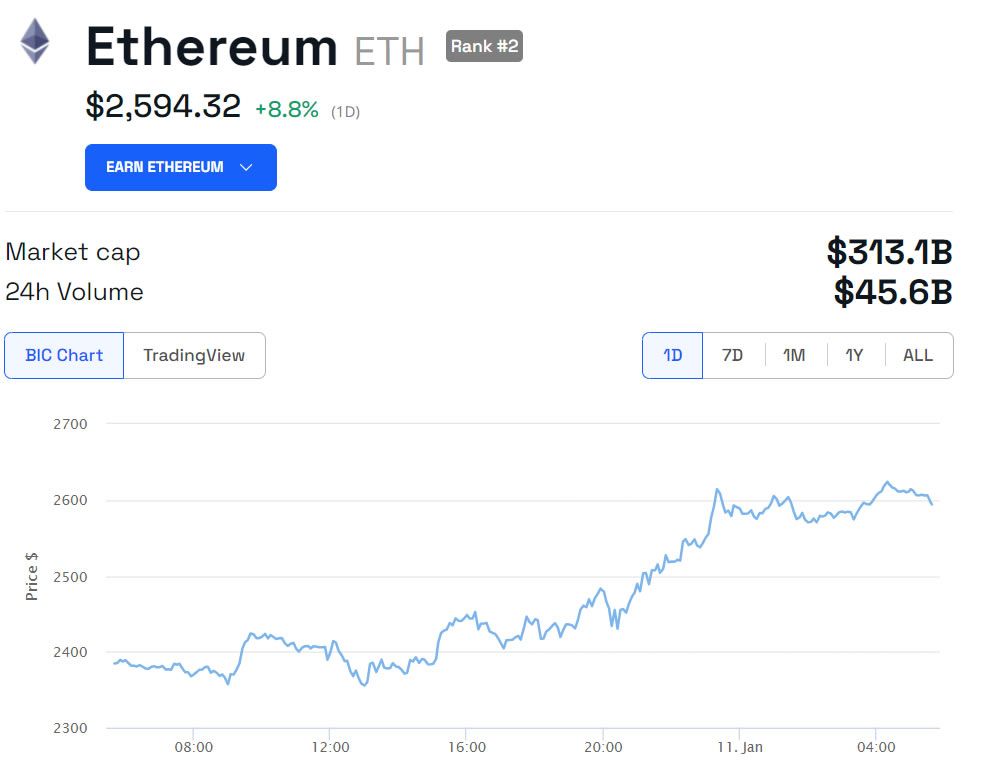

The bedrock asset for all of these restaking initiatives is Ethereum, and its native ETH asset has surged today.

ETH prices have jumped 9.4% to top $2,600 for the first time in almost two years. After months of lackluster performance, the asset is finally outperforming its big brother.

Moreover, the big move has pushed Ethereum’s market cap back over $300 million, giving it a 17% share of the total crypto market.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.