Today, $2.1 billion in Bitcoin (BTC) and Ethereum (ETH) options will be liquidated. The expiration of these crypto options contracts is particularly interesting, given that it will happen after the US core consumer price index (CPI) data has been released.

How will this impact the prices of these digital assets and the broader crypto market volatility?

How Does the Recent US Inflation Data Affect the Crypto Options Market?

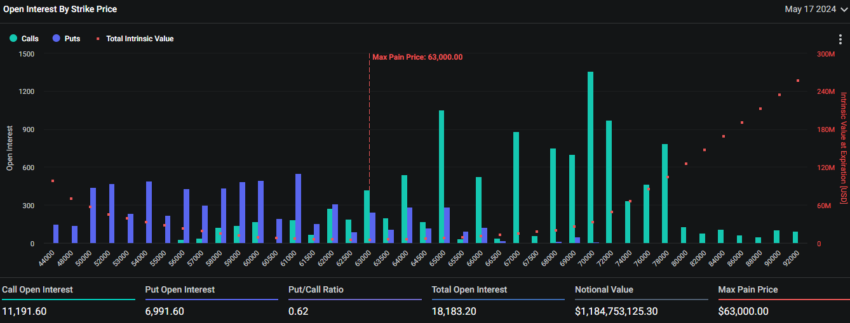

Approximately $1.18 million in 18,183 Bitcoin options contracts will expire. The tranche is very similar to the 18,359 contracts settled last week.

Deribit data indicates that Bitcoin’s put-to-call ratio is 0.62. This figure suggests a prevalence of purchase options (calls) over sales options (puts).

Furthermore, the data shows that Bitcoin’s maximum pain point is $63,000. The maximum pain point is the price at which the asset will cause financial losses to the greatest number of holders.

Read more: An Introduction to Crypto Options Trading

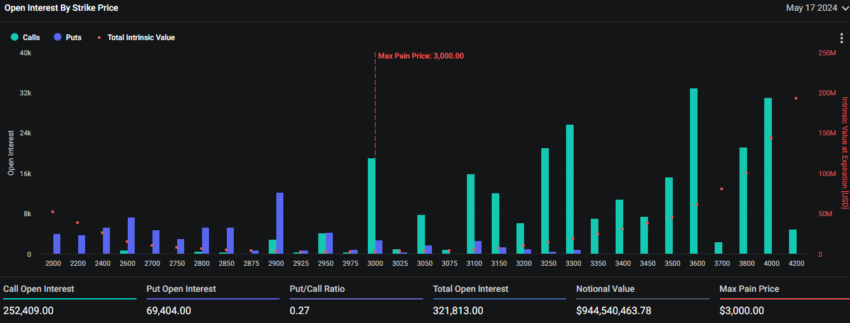

In addition to Bitcoin options, 321,925 Ethereum contracts will expire today. These expiring contracts have a notional value of over $940 million, with a put-to-call ratio of 0.27 and a pain point of $3,000.

Greeks.live, a tools provider for crypto options traders, shared its perspective on today’s expiring options contracts. It assessed the impact of the release of US inflation data on the crypto options market.

“The options market reacted significantly, with all major term [implied volatilities] IVs pulling up quickly to new highs for the month, with the recent flat market causing major term options IV to drop to new lows at one point this year, thus making them extremely cost effective for buyers, with every recent event driver worth buying options for,” Greeks.live noted.

BeInCrypto reported earlier that the April CPI figure suggests that US inflation grew slower. This news positively affected the crypto market.

Shortly after the data release, Bitcoin’s price jumped from $62,000 to $66,000. Major altcoins like Ethereum and Solana (SOL) also experienced significant gains.

Read more: 9 Best Crypto Options Trading Platforms

While option expirations can cause sharp price movements, the impact is usually temporary. The market generally stabilizes the next day, offsetting initial fluctuations. Nonetheless, traders should carefully analyze technical indicators and market sentiment before investing in this volatile environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.