The Ethereum (ETH) price has fallen since reaching its yearly high in April.

The decrease took the price to a long-term ascending support trendline and a horizontal support area.

Ethereum Bounces at Nearly 500-Day Support

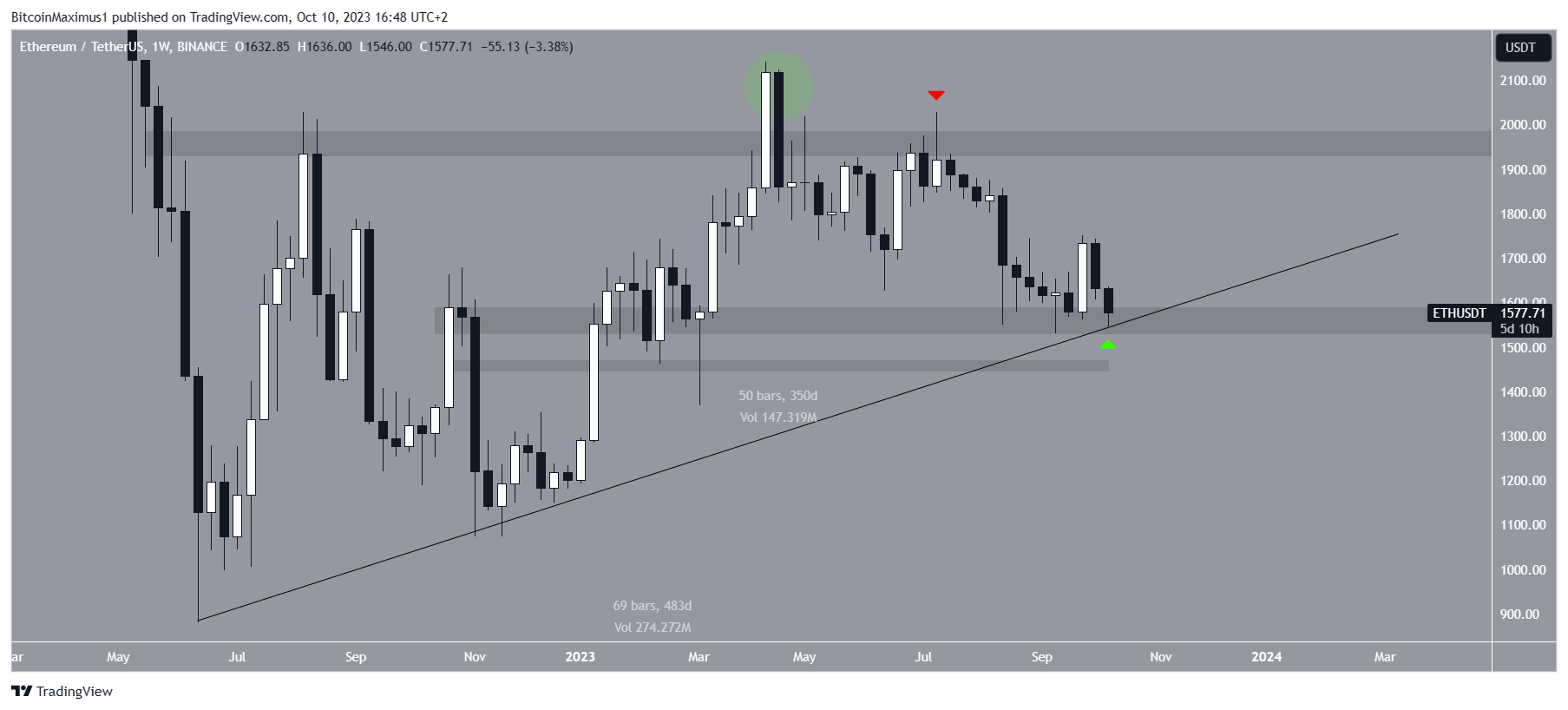

The weekly time frame chart shows that the ETH price has fallen since reaching a new yearly high of $2,140 in April. While it seemed that the price broke out from the $1,950 horizontal resistance area, this was only a deviation (green circle).

Then, the Ethereum price validated the area as resistance in July, creating a long upper wick (red icon). It has fallen at an accelerated rate since.

Crypto investing, simplified. Get Ethereum (ETH) price predictions here.

The Ethereum price fall led to a low of $1,546 this week. The ensuing bounce validated a nearly 500-day ascending support line and the $1,560 horizontal support area, which has been in place for 350 days.

Both these structures are of utmost importance since they have supported the upward movement for a long time.

News for the Ethereum network is mostly negative. A report raises concerns that the Ethereum blockchain has become more centralized after the merge and the Shanghai upgrade.

In order to quash these centralization concerns, Ethereum’s founder, Vitalik Buterin, introduced a proposal that would lead to the network adopting a two-tier staking system.

In it, the key participants would be Node Operators and Delegators. This would both address centralization concerns and would increase security in the staking pools.

Simply summarize, Node operators would be validators, while delegators would stake their assets in their chosen node operator.

On top of this, the underwhelming volume of the Ethereum Exchange-Traded Funds (ETFs) and the apparent selling of the Ethereum Foundation are causes for concern.

Check out the 9 best AI crypto trading bots to maximize your profits.

What Are the Analysts Saying?

The views from some of the top analysts are mixed.

@CryptoTony_ is decisively bearish. However, he does not believe that the ascending support trendline carries importance.

Rather, he suggests that the ETH price will initially bounce but then fall in the lower portion of a descending parallel channel (white).

Once it reaches the trendline near $1,400, he predicts an upward movement.

@TheCryptoCactus endorses this validity of the trendline (black). He believes that losing the long-term support area will cause a sharp drop to $1,100-$1,200. In advance, he is prepared to buy any wick lows in the area.

Unlike the former two analysts, well-known trader @IncomeSharks is decisively bullish. He believes that the support line will initiate a bounce towards the $1,900 resistance area.

ETH Price Prediction: Is Breakout or Breakdown Next?

A closer look at the weekly chart provides a bearish trend, indicating that a breakdown is more likely than a breakout.

The main reason for this is the Relative Strength Index (RSI). With the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage, but if the reading is below 50, the opposite is true.

In January, the RSI moved above 50 (green), indicating that the trend is bullish. However, it fell below 50 in August (red). Last week, it validated the 50 trendline as resistance (red icon). This suggests that the trend is bearish.

If the ETH price breaks down from the support line, it could fall by nearly 20% and reach the $1,300 horizontal support area.

Despite this bearish ETH price prediction, a bullish weekly close will mean that the support line is held.

In that case, the price can increase by 25% and reach the $1,950 resistance area.

Looking to be profitable? Learn how to make money in a bear market.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.