The Ethereum Foundation continues to face criticism for its regular sales of ETH, which some argue increases selling pressure on the digital asset.

In the past 24 hours, the Foundation sold 300 ETH, valued at approximately $763,000. This sale is part of a month-long trend of consistent ETH liquidations by the Foundation.

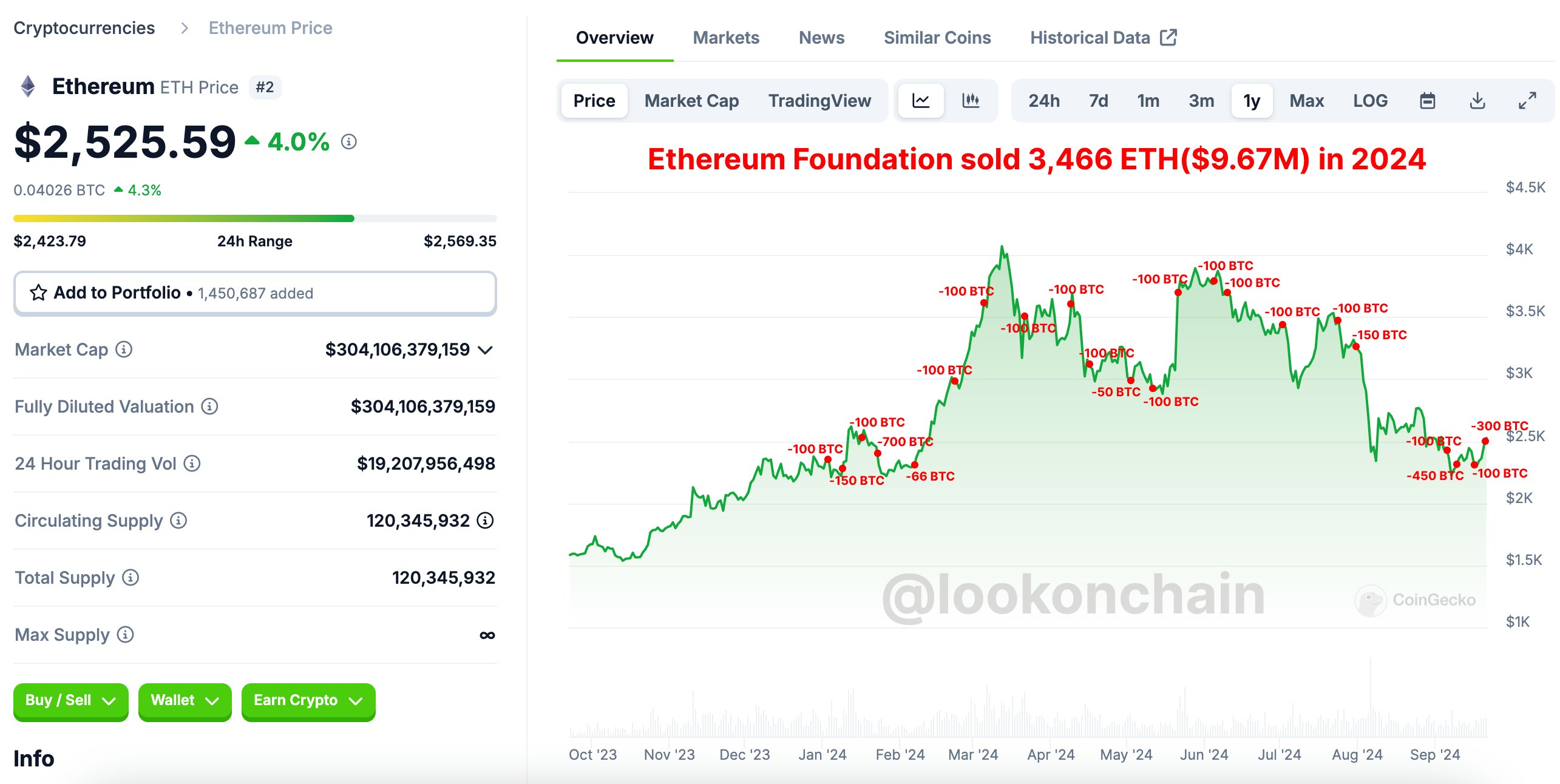

Ethereum Foundation’s Has Sold Nearly 3500 ETH in 2024

Blockchain analysis firm Spotonchain highlighted that since the beginning of the month, the Ethereum Foundation has sold 950 ETH, worth about $2.27 million, with sales occurring every four to seven days.

Another platform, Lookonchain, revealed a larger pattern. Since the start of the year, the Foundation has sold 3,466 ETH, valued at roughly $9.67 million. Lookonchain reports that these liquidations amount to $421,000 in ETH every 11 days. Notably, these numbers did not include the lump transfer of 35,000 ETH, worth about $100 million, to the Kraken exchange in August.

Read more: How to Invest in Ethereum ETFs?

This frequent selling has concerned some community members. Joe Nakamoto, an independent Bitcoin journalist, noted that Ethereum supporters would find the Foundation’s ongoing sales troubling.

However, not everyone shares this view. Justin Drake, a researcher at the Ethereum Foundation, believes these sales are beneficial for the network. In an interview with Colin Wu, Drake explained how reducing the Foundation’s ETH holdings promotes the long-term decentralization of the blockchain network.

“In the long term, the reduction in ETH held by the Ethereum Foundation is a good thing; EF currently controls 0.23% of the ETH supply, and it would be healthy for this figure to approach 0% over the coming decades as it promotes decentralization in the Ethereum ecosystem,” Drake stated.

Despite these sales, the Foundation still holds a significant amount of ETH. Data from Arkham Intelligence shows one of the Foundation’s wallets holds 271,652 ETH, valued at $683.83 million.

These activities come as market sentiment around Ethereum improves. After weeks of underperformance, ETH has reclaimed the $2,500 level and was trading at $2,551 at the time of writing.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

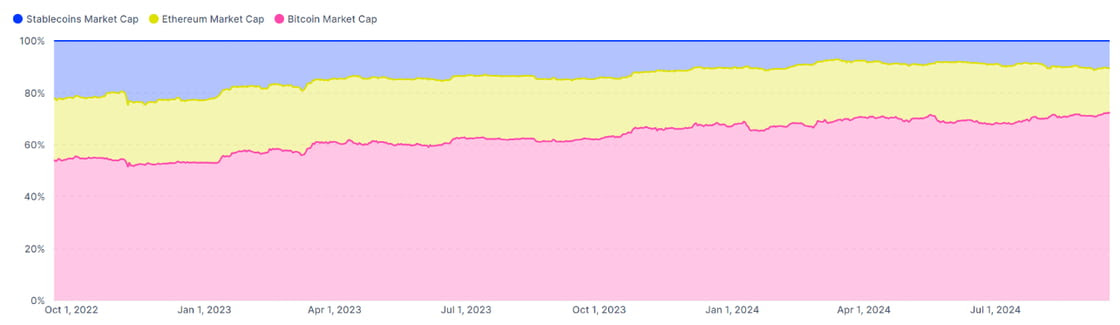

However, ETH is at its lowest level against BTC in over 40 months. Blockchain platform IntoTheBlock attributed this to the ETF flows, which have been mostly positive for Bitcoin. According to the firm, this trend suggests institutional investors are favoring Bitcoin’s relative stability over Ethereum’s higher-risk profile.

“While ETF flows for BTC have been largely positive, ETH has experienced mostly outflows. This trend suggests institutional investors are favoring Bitcoin’s relative stability over ETH’s higher risk, high-reward profile,” IntoTheBlock stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.