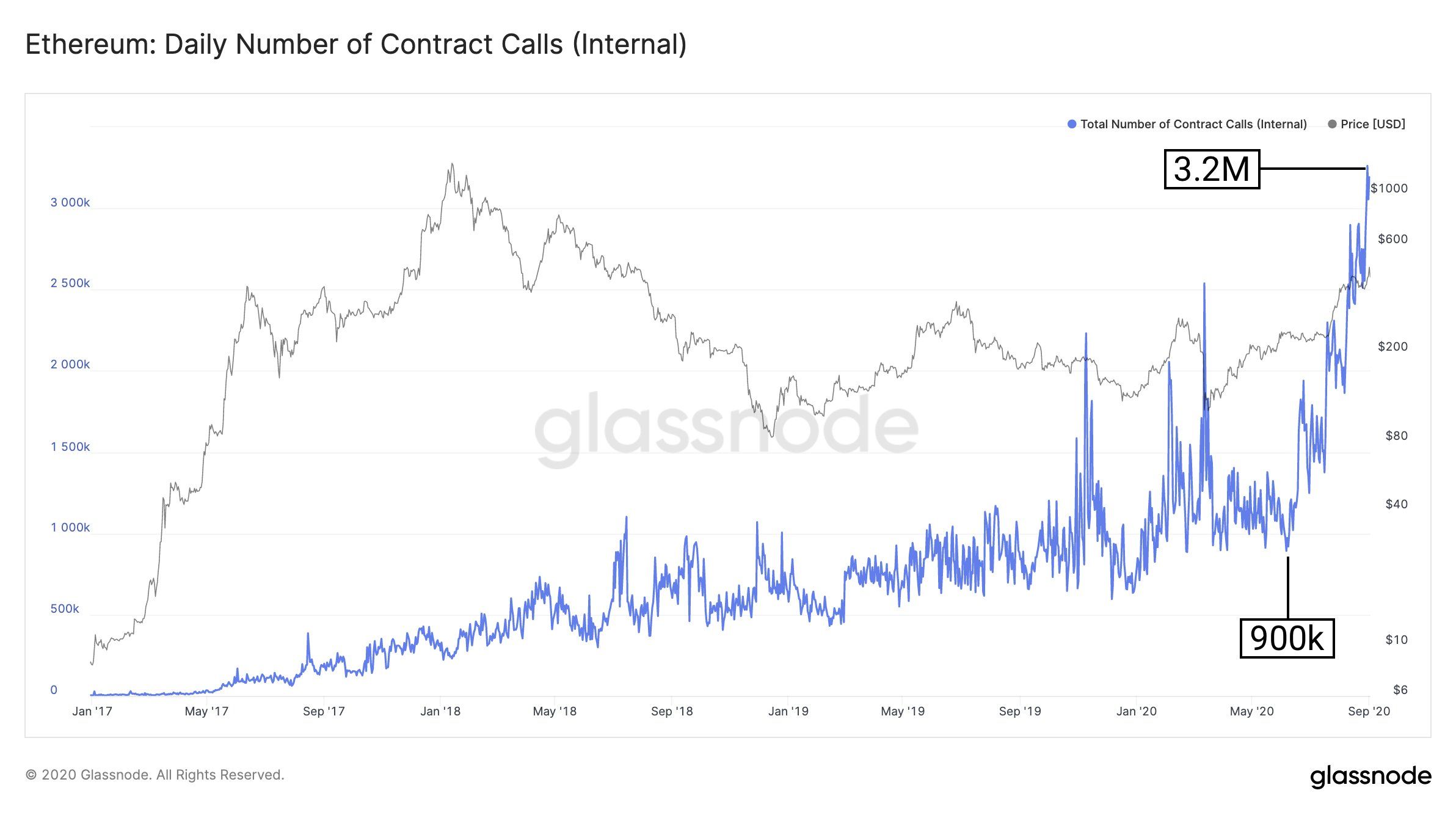

With the flurry of activity in the decentralized finance (DeFi) space, the number of Ethereum (ETH) contract calls continues to increase.

As numerous DeFi projects emerge weekly, dry-runs and tests on smart contracts are increasing as developers work out bugs. The Ethereum blockchain itself is also experiencing significant congestion leading to a massive hike in gas fees.

Internal Ethereum Contract Calls up 3x Since June

According to data from the on-chain analytics platform Glassnode, the number of internal Ethereum contract calls is up to over 3 million per day. This figure represents a 200% increase from the sub-one million call average seen in June.

DeFi Growth Continues Unabated

As previously reported by BeInCrypto, the hype surrounding the DeFi market is causing a massive increase in trading volume on decentralized exchanges (DEXs). In August, DEX volume crossed the $11 billion mark with platforms like Uniswap seeing more trading activity than some major centralized exchanges. However, rogue actors are weaponizing the DeFi hype to create fake tokens designed to defraud yield chasers. The ease of creating a coin and listing on platforms like Uniswap is breathing new life into pump and dump scams reminiscent of the ICO-mania era of 2017.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored