Ethereum (ETH) price has hovered between $1,930 and $1,960 after another unsuccessful attempt at crossing the $2,000 range this week. While on-chain data currently present risks of an Ethereum supply squeeze, the staking surge is yet to reflect in recent ETH price action.

Since the completion of the Ethereum 2.0 Merge in April 2023, ETH has witnessed an unprecedented surge in staking activity. But remarkably, the persistent rise in Ethereum 2.0 staking activity has not yielded a significant jump in ETH price as many predicted.

Ethereum Staking Activity Is at an All-Time High

According to Glassnode, ETH Staking reached an all-time high in May 2023. But last month, investors continued to lock up more coins, raising the mark even further.

The chart below shows that between June 1 and July 4, ETH holders locked up an additional 1 million ETH coins. This brings the total ETH staked to about 30.6% of the total circulating supply.

Supply in Smart Contracts sums up the total percentage of an asset’s circulating supply that is currently locked up in DeFi staking protocols. It secures the network and provides liquidity for projects built on it.

A supply squeeze typically occurs when the supply of an asset is limited or restricted. This often leads to astronomical price increases due to temporary difficulties in obtaining the asset.

When Staking activity increases, the supply of tokens available to fulfill market orders reduces proportionately. If this condition persists, it could lead to an Ethereum supply squeeze.

Read More: 9 Best Crypto Demo Accounts For Trading

Ethereum Supply Squeeze Unlikely Due to Burn Rate Downtrend

Another critical factor impacting the net supply of Ethereum is the burn rate. This refers to the percentage of existing coins that are burned and taken out of supply. This can be in the form of destroying existing coins or reducing newly created coins.

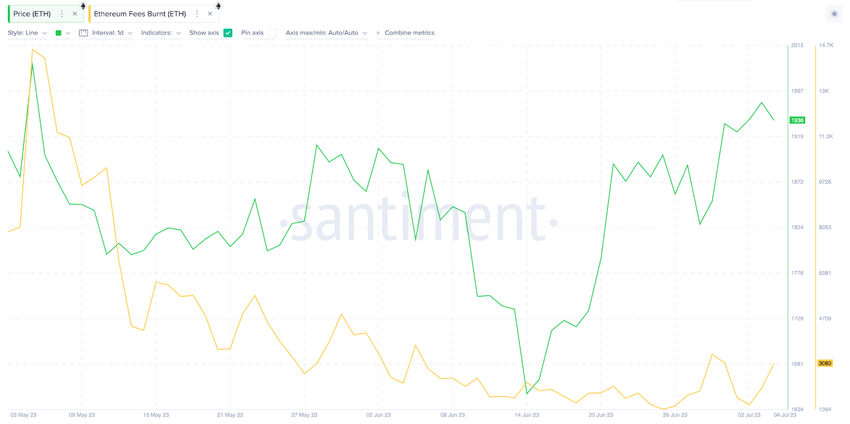

In May 2023, Ethereum witnessed a spike in burn rate due to the memecoin rave triggered by the advent of PEPE. At peak, about 14,600 ETH were burnt on May 5, destroying millions of dollars worth of coins. But since then, the burn rate has reduced significantly.

In the two months between May 5 and July 4, daily ETH burned declined by 80%, from 14,967 to 3,060.

Ethereum Fees Burned is a deflationary mechanism that takes ETH coins out of circulation by permanently destroying some of the fees previously issued to node validators. As seen above, Fees Burned are positively correlated to price.

More ETH coins are taken out of circulation when Fees Burned rises, and the supply shortage triggers a price surge.

But given how the Fees Burned has reduced in recent weeks, it balances out the impact of the ETH staking surge. This can be identified as one of the reasons that the ETH supply squeeze has not set in.

Read More: Best Crypto Sign-Up Bonuses in 2023

ETH Price Prediction: Correction Before Another Attempt at $2,000

Ethereum has been unable to maintain a persistently high transactional activity necessary to trigger an increase in fee burn rate. Hence, ETH will likely retrace below $1,800 again before making another attempt at the $2,000 milestone.

However, the bulls could offer some initial support around $1,850. At that zone, the 6.27 million investors that bought 13.41 million ETH at the average price of $1,867 could prevent the drop.

But if that support line breaks, then ETH will likely drop further toward $1,750

However, the bulls also have a fair chance of staying in control if they can manage to cross the $2,000 milestone. But as seen above, the giant sell-wall mounted by 7.3 million holders that bought 33 million ETH coins at the minimum price of $1,987 could pose a challenge.

Nevertheless, if the Ethereum supply squeeze sets in, ETH could finally scale the $2,000 resistance and push toward $2,700.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits