Ethereum 2.0 staking skyrocketed after the successful Shanghai upgrade, sending ETH price to a 2023 peak of $2,120 on April 17. On-chain data examines the negative correlation emerging between smart contract deposits and the ETH price.

The much-anticipated Shanghai upgrade went live on April 12, marking Ethereum’s full transition to the Proof of Stake (PoS) consensus mechanism. As the crypto market momentum cooled in Q2, ETH holders began to stake their coins for passive income rather than perform productive DeFi transactional activity.

Now, 4 months later, it appears that the ongoing, unprecedented rise in ETH 2.0 staking has started negatively impacting the Ethereum price.

ETH 2.0 Staking Has Risen to an Unprecedented Level

Ethereum’s transition to the PoS consensus has triggered an astronomic rise in the ETH staking. According to data from Glassnode, about 37.8 million ETH (31.4% of the total circulating supply) is now locked up in DeFi smart contracts.

Typically, increased staking is often bullish for price. But worryingly, with more than 30% of the ETH supply now locked up, the chart below illustrates an emerging adverse effect.

Between July 25 and August 10, Ethereum Supply in Smart Contracts nominally increased from 31.08% to 31.4%. This saw another 432,547 ETH worth approximately $800 million temporarily removed from the global market supply.

In reaction, Ethereum price has remained relatively stagnant, hovering between the 2% price boundary, around $1,850 and $1,890, during that period.

Supply in Smart Contracts tracks the total percentage of the asset’s circulating supply currently locked up in DeFi staking protocols. In the short-term, increased staking can be bullish, as it secures the network and temporarily mops up excess market supply.

However, it could lead to a drastic change in investor behavior in the long term. According to official data from Ethereum mainnet, 22.9 million or 60.58% of the total 37.8 million ETH staked are currently deposited in ETH 2.0 staking contracts.

This depicts a significant change in Ethereum investors’ behavior. With the current APR of 4.3%, investors now appear to prefer ETH 2.0 staking to DeFi protocols.

This effectively means that investors inadvertently deprive DeFi protocols built on the Ethereum network of much-needed liquidity and funding. If this trend continues, ETH prices could stagnate in a vicious cycle of utility decline.

Ethereum Transactional Activity Has Been Gradually Dropping

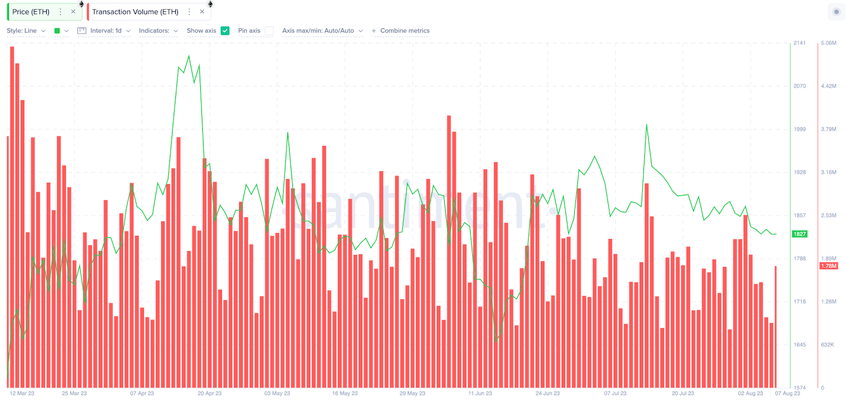

Furthermore, the volume of transactional activity on the Ethereum network has declined since March 2023. This also validates of the emerging negative impacts of Ethereum 2.0 staking on ETH price.

The Santiment chart below shows how ETH Transaction Volume has further dropped in August. Evidently so, between August 1 and August 6, it dropped by 62% from 2.53 million ETH to 955,000 ETH transacted.

Although it has since recovered slightly to hit 1.77 million ETH on August 9, this is still far off last month’s peak of 3 million ETH transacted on July 14.

Transaction Volume evaluates changes in the overall economic activity on a blockchain network. It is often bearish when it persistently declines over an extended period, as observed above.

In conclusion, it appears the heightened ETH 2.0 staking has caused a decline in the overall economic activity on the Ethereum network. If this pattern persists, ETH prices could grow increasingly sticky over time.

Read More: How To Make Money in a Bear Market

ETH Price Prediction: Big Moves Unlikely

Considering ETH 2.0 staking’s negative impacts identified above, ETH’s short-term price action could remain neutral.

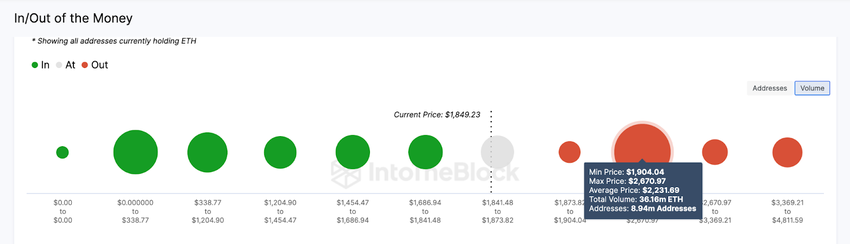

The In/Out of Money (IOMAP) data shows the distribution of current ETH token holders within the 20% price range. It also corroborates the prediction that the Ethereum price could continue hovering below $1,900.

At that zone, 8.94 million wallets had bought 36.16 million ETH coins at a minimum price of $1,904. If they decide to exit their positions after breaking even, the ETH price will likely retrace.

Conversely, the bears will struggle to force a downswing below $1,700. As seen above, a cluster of 7.32 million holders had bought 9.8 million ETH at the maximum price of $1,841.

They could mount a formidable support buy wall to avoid slipping into a net-loss position. But if that support level cannot hold, ETH could drop toward $1,650.

Read More: : Best Cloud Mining Sites 2023: A Beginners Guide