The Ethereum (ETH) price is trading in the middle of a long-term pattern. Whether it bounces or breaks down can determine the future trend.

The readings in both the weekly and daily time frames are mixed. As a result, it is still unclear if the price will initiate a rally or if a breakdown will ensue.

SponsoredEthereum Price Deviates Above Resistance

ETH is the native token of the Ethereum blockchain, created by Vitalik Buterin. The ETH long-term outlook is somewhat unclear.

There are positive signs that suggest a bullish trend, such as the price breaking out from a descending resistance line that had been in place since the all-time high.

This type of breakout typically indicates the end of a previous trend and the beginning of a new one in the opposite direction. Additionally, the weekly Relative Strength Index (RSI) shows a bullish signal.

Traders use the RSI as a momentum indicator to determine whether to buy or sell an asset. Readings above 50 and an upward trend signify that bulls are still in control, while readings below 50 indicate the opposite. As the RSI is above 50, it implies a bullish trend.

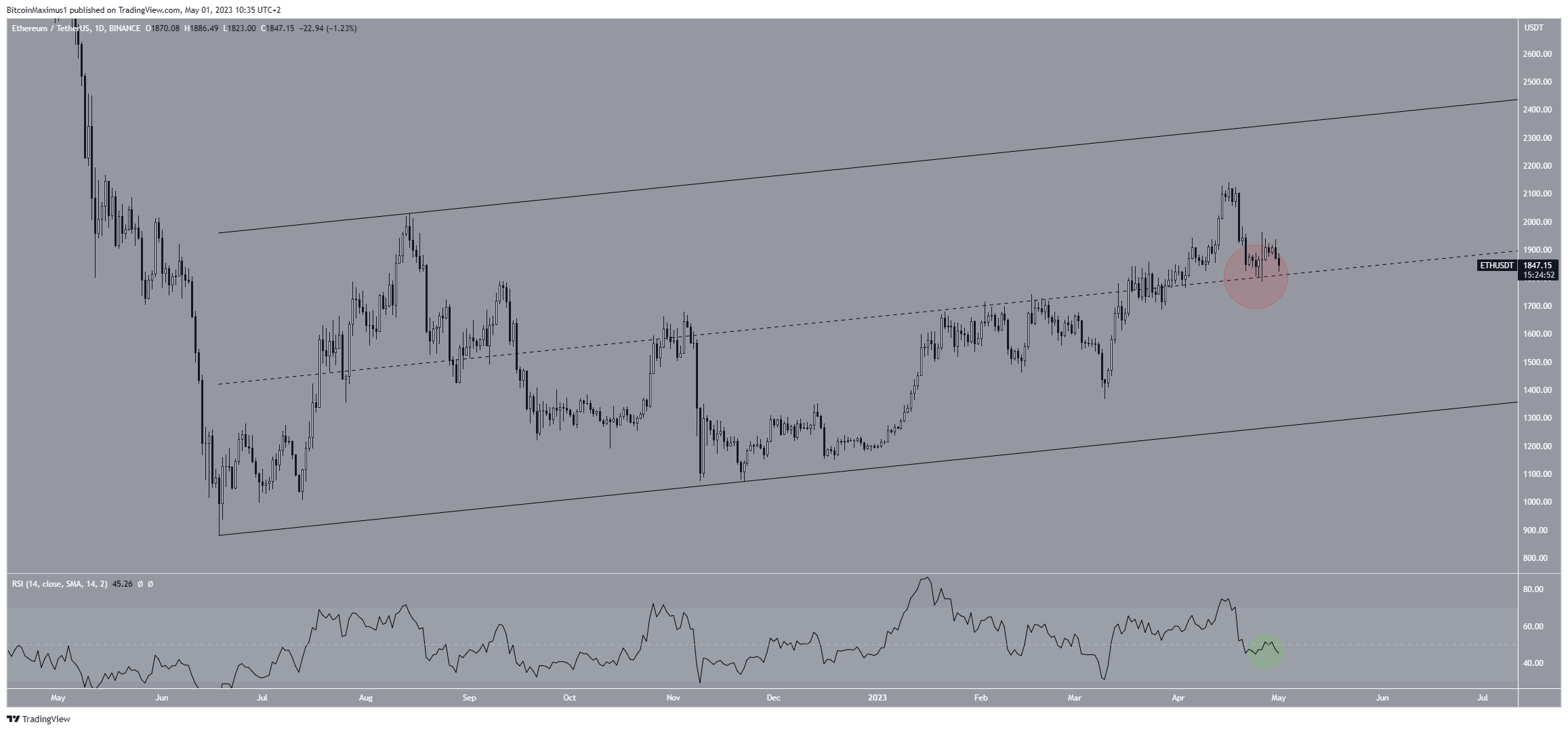

However, the Ethereum price decrease took it below the $1,900 horizontal area, which was validated as resistance again (red icon).

So, the previous breakout is considered a deviation (red circle). Both are viewed as bearish signals and usually lead to downward movements.

SponsoredETH Price Prediction: Bounce or Breakdown?

A closer look at the technical analysis from the daily time frame shows that the price is trading at a crucial level, likely determining the future trend’s direction.

The ETH price trades just above the middle of a long-term ascending parallel channel. The channel’s midline currently acts as support (red circle). If the line successfully initiates a bounce, the price could move to the channel’s resistance line at $2,400.

However, a drop to the channel’s support line at $1,400 could occur if a drop below the line occurs. This is close to the previously outlined horizontal support area.

Moreover, the daily RSI is just below 50 (green circle). When evaluating market conditions, traders use the RSI as a momentum indicator to determine if a market is overbought or oversold and to decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. Since the RSI has not made a decisive move either above or below 50, the trend can be considered undetermined.

Based on the above indicators, if the decline continues, it could drop to the closest support at $1,600, while the next resistance is at an average price of $2,550.

As a result, whether the ETH price bounces at the channel’s midline or breaks down will determine the future ETH price prediction. A bounce can lead to highs near $2,500, while a breakdown will likely cause a fall to $1,500.