Ethereum briefly lost the critical $1,850 critical support. Still, on-chain data shows that ETH 2.0 validators appear to be re-staking their new withdrawals on DeFi protocols to earn a higher yield. Will this trigger an ETH price recovery in the coming days?

Ethereum has failed to consolidate its price gains from the Shapella Upgrade. But strong on-chain fundamentals suggest that investors remain confident in the long-term prospects of the Ethereum network.

ETH Coins are Flying off Exchanges

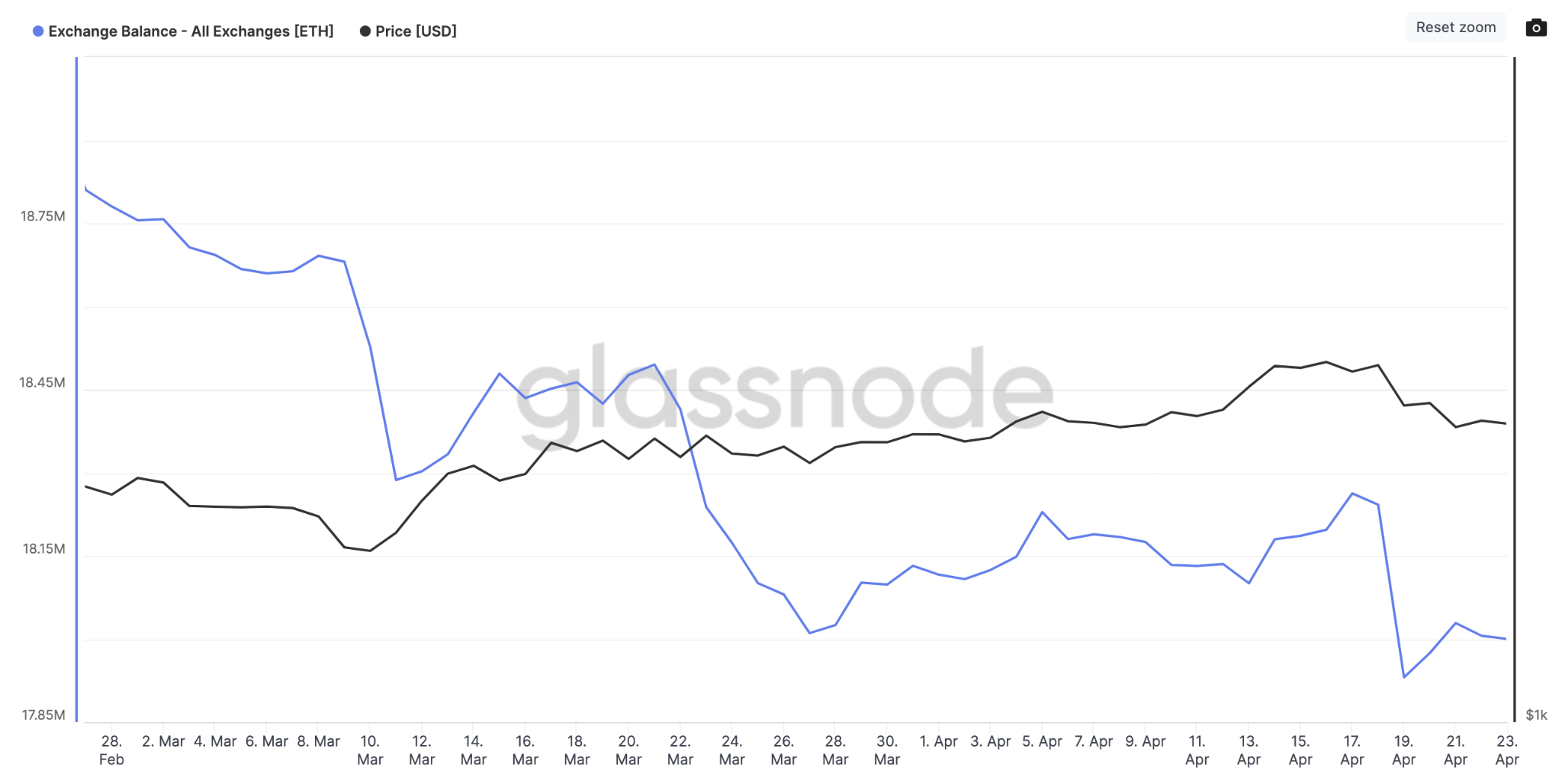

Profit-taking could be across the Ethereum ecosystem in the coming days as the balance of coins deposited on exchanges continues to reduce at the current rate. Shortly after the completion of the Shappella Upgrade, there was an uptick in the volume of ETH moved into known exchange wallets. This was on the back of ETH2.0 stakers and other investors strategically placing their coins on exchanges for potential sell-offs and short-term profit-taking opportunities.

However, in the past week, investors started moving their coins off exchanges, suggesting that the sell-off frenzy might be over.

After a sharp increase after the Shapella Upgrade, Glassnode data below shows that the balance of ETH deposited on exchanges has been in a decline since April 18.

Specifically, between Apr. 18 and 24, ETH balance on exchanges was reduced by 262,000 coins. At current market value, this means that $484 million worth of coins have been moved off exchanges in the 5 days.

Notably, this recent decline has seen the amount of Ethereum (ETH) held on cryptocurrency exchanges drop to the lowest level since March 2021. This reduction can be seen as a bullish signal for a number of reasons.

Firstly, when the supply of ETH on exchanges reduces, it means fewer coins available for purchase on the open market. This could lead to an ETH price upswing as potential buyers now have to compete for a smaller pool of coins.

Secondly, large investors often move their ETH off exchanges as a strategy for long-term holding. This indicates confidence in the fundamental value of the Ethereum network.

If that trend continues this week, a bullish accumulation wave could spread across the Ethereum ecosystem.

ETH Moving From Exchanges to DeFi Smart Contracts

In further confirmation of the bullish outlook, the decline in ETH balance on Exchanges appears to have coincided with a comparable increase in the number of coins locked up in DeFi smart contracts.

The Glassnode chart below depicts how ETH supply in Smart Contracts has increased considerably. But this comes following the completion of the Shapella Upgrade.

Between Apr. 11 and 13, about 462,000 ETH were withdrawn from DeFi smart contracts. However, over 600,000 ETH (0.504% of Circulating Supply) have been deposited back into Ethereum-hosted DeFi protocols since then.

The deposit of over 600,000 ETH back into DeFi protocols suggests that investors are willing to provide liquidity to the Ethereum ecosystem.

This suggests that bearish investors who panicked ahead of the Shappella Upgrade are regaining confidence. Rather than making a sell-off, they appear to be reallocating their ETH into DeFi protocols to earn a higher yield.

Generally, the influx of funds could further the growth of decentralized finance applications and yield-generating platforms. This can create a bullish cycle of increased liquidity and adoption, leading to greater network value and Ethereum price appreciation.

Ethereum Price Prediction: Likely to Hold $1,850 Support

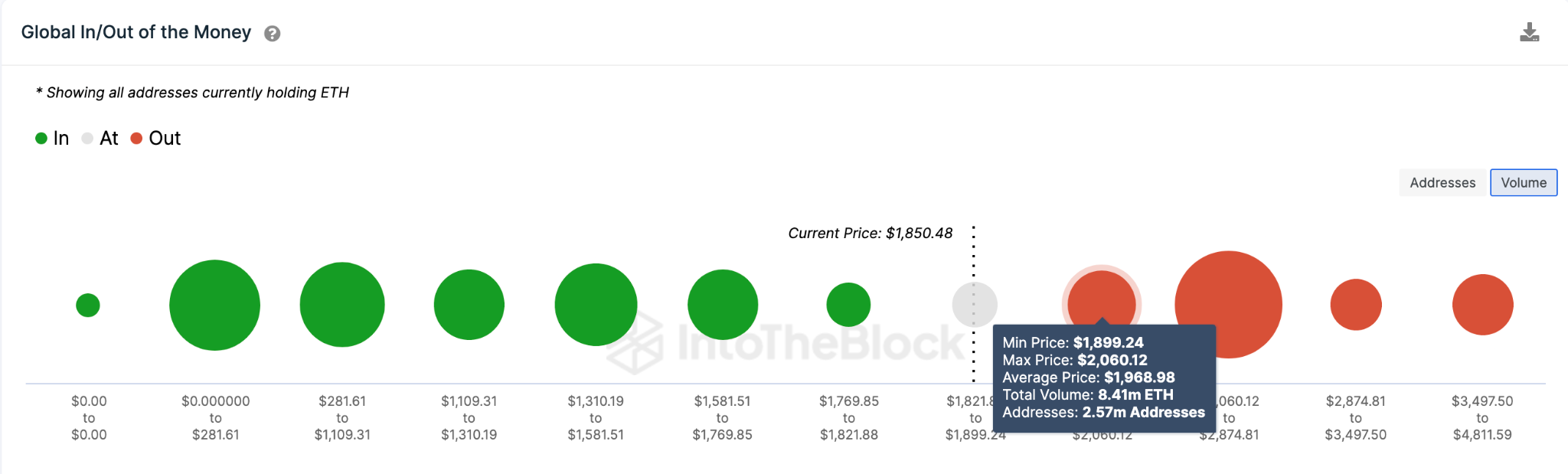

Given the bullish momentum bubbling around the Ethereum ecosystem, the $1,850 support level will likely prove too tough for the bears to crack.

IntoTheBlock’s Global In/Out of The Money data shows that ETH price must break above $1,960 to enter a bullish reversal. However, the resistance of 2.5 million holders that bought 8.4 million coins around that price level could pose a challenge.

If Ethereum price can break above $1,950, it could head on a prolonged rally towards $2,450. But around that zone, a potential sell-off from 8.4 million addresses holding 27.8 million ETH will likely mount a formidable roadblock.

The bears could negate the bullish stance if ETH fails to stay above $1,850. Although, the support from 2.09 million addresses holding 3.11 million Ethereum coins could help prevent the drop. If that fails, Ethereum holders can brace for a steep price decline to the next significant support level of $1,450.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.