Profit and loss analysis suggests lower-than-expected selling pressure following the Ethereum Shapella upgrade

The highly anticipated Shapella upgrade of Ethereum, a hard fork scheduled for April 12, 2023, brings with it significant implications for the crypto market. Combining elements from the proposed Ethereum Improvement Proposals “Shanghai” and “Capella,” the Shapella upgrade will allow stakers and validators to withdraw assets from the Beacon Chain.

Subdued Selling Pressure After Shanghai Upgrade

With staked Ether accounting for roughly one-seventh of the total supply of about 16 million coins, this development carries immense weight. The current value of all staked Ether is over $26 billion.

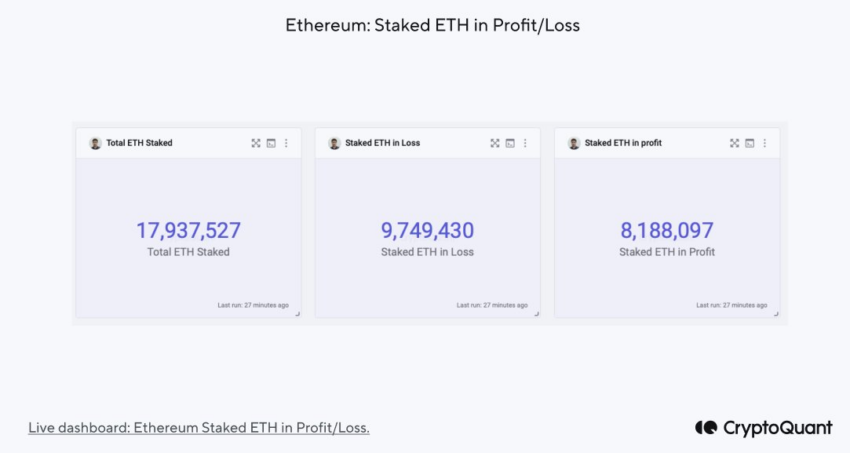

Despite fears of increased selling pressure following the activation of withdrawals on April 12, a profit and loss analysis by CryptoQuant offers a different perspective.

At present, over half of the staked ETH (9.7 million out of 17.9 million) is operating at a loss.

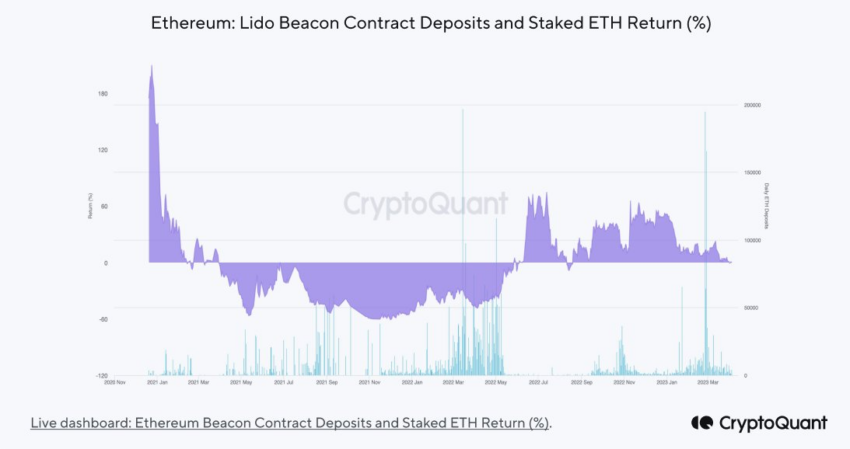

Additionally, a significant portion of deposits made by the Lido pool is currently underwater.

Given the substantial amount of staked ETH in a loss, CryptoQuant anticipates the selling pressure to be lower than expected. This projection is based on the assumption that holders may be hesitant to sell at a loss.

Ethereum Price Prediction: All Eyes on $2,000

Santiment spotted a distinct pattern when comparing exchange and non-exchange addresses. The ten largest exchange addresses are approaching all-time low levels. Meanwhile, the ten largest non-exchange addresses continue to rise.

This divergence between exchange and non-exchange addresses could be signaling a spike in demand for Ether.

From a technical standpoint, the ETH price has yet to surpass the $1,940 horizontal resistance area. Should the upward trend continue and the price close above this threshold, the cryptocurrency could potentially reach the next resistance levels at $2,440 and $3,400.

These values correspond to the 0.382 and 0.5 Fib retracement resistance levels. As the former aligns with the previous channel’s resistance line, it is more likely to serve as a local top.

The Shapella upgrade will undoubtedly impact the Ethereum ecosystem. Still, the selling pressure after the hard fork may not be as significant as initially feared. With a large portion of staked Ether operating at a loss, holders may be more inclined to wait for a price rebound before liquidating their assets.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.