A positive reaction has been observed within the DeFi ecosystem After the successful completion of this week’s Shapella upgrade.

Prior to the latest Etheruem network upgrade, some had speculated that a mass selloff of staked ETH would negatively affect its market price. But in the end, the opposite happened. Despite large volumes of ETH being unstaked on Thursday and Friday, its trading price remained buoyant to hit an eleven-month high.

The price of key DeFi tokens like UNI and AAVE also reflects the overall market’s optimistic response to the Shapella upgrade. Both assets saw their price rise alongside Ethend in the months to come, the DeFi ecosystem will continue to adapt to the new changes.

One possible implication is a reshuffling of the Ethereum card deck as investors look to redistribute their previously locked-up assets. With Ether holders now able to easily unstake and restake as part of a different pool, decentralized exchanges could become beneficiaries of any such shakeup. Likewise, more Ethereum-based assets could now flow into various decentralized protocols.

Olympus DAO Backs More Exposure to Decentralized Assets

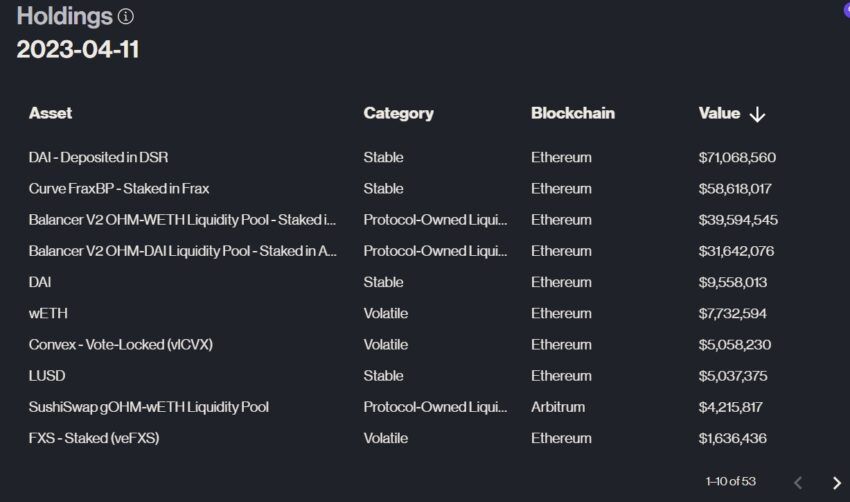

So far, decentralized organizations are reacting positively to the new Ethereum paradigm. For example, on Friday the Olympus DAO voted in favor of a modified treasury framework. Following the changes, the Olympus Treasury, which backs OHM tokens, is able to hold more “volatile assets” like Ether.

Previously the Olympus treasury was composed of approximately 79% stable assets and 21% volatile assets. But the new framework adjusts the ratio to just 75% stablecoin holdings.

The Olympus treasury team’s approved proposal states that increasing Ether exposure is one step in the direction toward ending its reliance on stablecoins with centralized backing. However, it acknowledges that a greater emphasis on purely decentralized stablecoins is also needed.

To that end, the new framework increases the cap for holdings of the decentralized stablecoin LUSD to 10%. In line with the changes, the Olympus DAO hopes to reduce its exposure to centralized stablecoins by more than 10%.

With a view to further shifting away from centrally administered assets, the treasury team said that as Olympus matures, the DAO should reevaluate these ratios every six months. “This may include increasing ETH exposure or introducing more purely decentralized stablecoins as they become available,” a statement noted.

SEC Moves to Regulate DeFi Ecosystem

News that the Shapella upgrade went smoothly comes as the US Securities and Exchange Commission (SEC) moves to regulate decentralized exchanges.

On Friday, the SEC voted to approve an updated proposal for the regulation of crypto exchanges first published last year. The latest changes include a number of amendments that appear to specifically target DeFi platforms. And updated definitions could bring many within the commission’s regulatory perimeter.

Although the SEC approved the new amendments, it was not unanimous in its decision. Two commissioners, Hester Peirce and Mark Uyeda, voted against changes to the proposal.

During an open meeting prior to the vote, Peirce argued the new text “doubles down on defects” from the original. Moreover, she cautioned that the proposed rules could place limits on the decentralized governance that is critical to DeFi. “Have we thought about how forcing centralization would benefit the American public?” she asked. It seems perverse to me that we would be encouraging centralization,” Peirce added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.