Ethereum price look set to enter another bull rally after a negative performance in the second half of April 2023. On-chain metrics show a few validation points for a bullish Ethereum price prediction.

Following the Ethereum 2.0 transition to the Proof of Stake consensus, billions of dollars worth of ETH coins was reintroduced into the market supply. This also sparked bearish price predictions across the Ethereum network and the global crypto markets. But nearly a month later, the media FUD cloud appears to be clearing up.

Here’s how certain bullish actions from Ethereum investors could potentially impact ETH prices in the coming days.

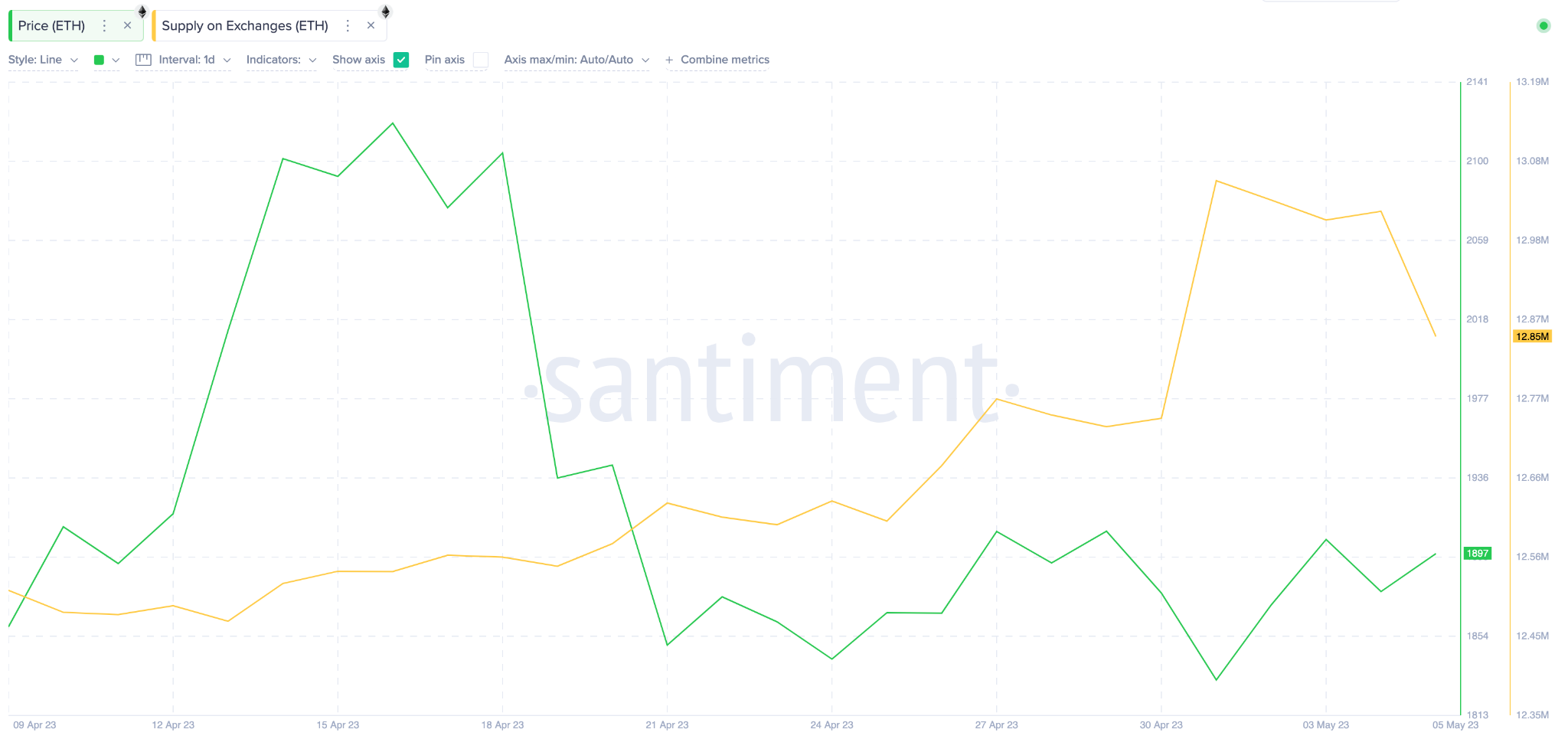

Ethereum Holders are Taking Coins Off Exchanges

Since the beginning of May, Ethereum investors have been moving their ETH coins off exchanges, according to the data from Santiment. Evidently, the chart below depicts how the total ETH Supply on Exchanges has reduced by 210,000 coins between May 1 and May 5.

.

When investors begin to move coins off exchanges, it could have different bullish connotations. Among others, it could mean that they are locking up their tokens in yield-bearing smart contracts or opting for self-custody wallets.

Either way, it means less ETH supply available to be traded in the short-term on exchanges. This could lend some credence to a positive Ethereum price prediction in the coming days.

Whales Are Betting Big Again

Furthermore, there has been a significant surge in whale accumulation across the Ethereum network since May 1. And this also alludes to the bullish Ethereum price prediction.

The blue line in the chart below shows how the whale cohort holding one million to 100 million coins started buying at the close of April. Between April 30 and May 5, they added 950,000 ETH to their wallet balances in just six days.

At a current market price of $2,000, these newly added 950,000 ETH coins are worth $1.9 billion. When crypto whales invest such a huge amount within a week, it suggests that they are in positions of some bullish action.

In summary, the reduction in ETH supply across crypto exchanges combined with the accumulation wave among whale investors could propel Ethereum’s price above $2,000 in the coming weeks.

ETH Price Prediction: Bulls Can Push for $2,400

IntoTheBlock’s In Out of Money Around Price data shows that Ethereum’s next bull rally will likely reach $2,400. But ETH must first clear the resistance of 1.5 million addresses that bought 5.7 million ETH at an average price of $1,970.

If this happens, the ETH price prediction of $2,400 will likely be actualized.

Still, the bears could invalidate the positive outlook if ETH slips below $1,854. Although, as seen above, the bullish support from 2.7 million addresses that had bought 5.7 million Ethereum for a minimum price of $1,854 will likely prevent the drop.

But if that support level fails to hold, Ethereum price could drop as low as $1,674 before the bulls get to regroup.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.