Cardano (ADA) price dropped 4% as the altcoin markets retracted over the past 7 days. On-chain data shows how recent bullish action from Cardano whales could propel ADA price back above the $0.40 resistance.

Cardano lost the $0.40 support on May 1 as news of regulators rescuing the First Republic Bank collapse sent several Layer-1 coins spiraling. Here’s how crypto whales could force an early ADA price rebound.

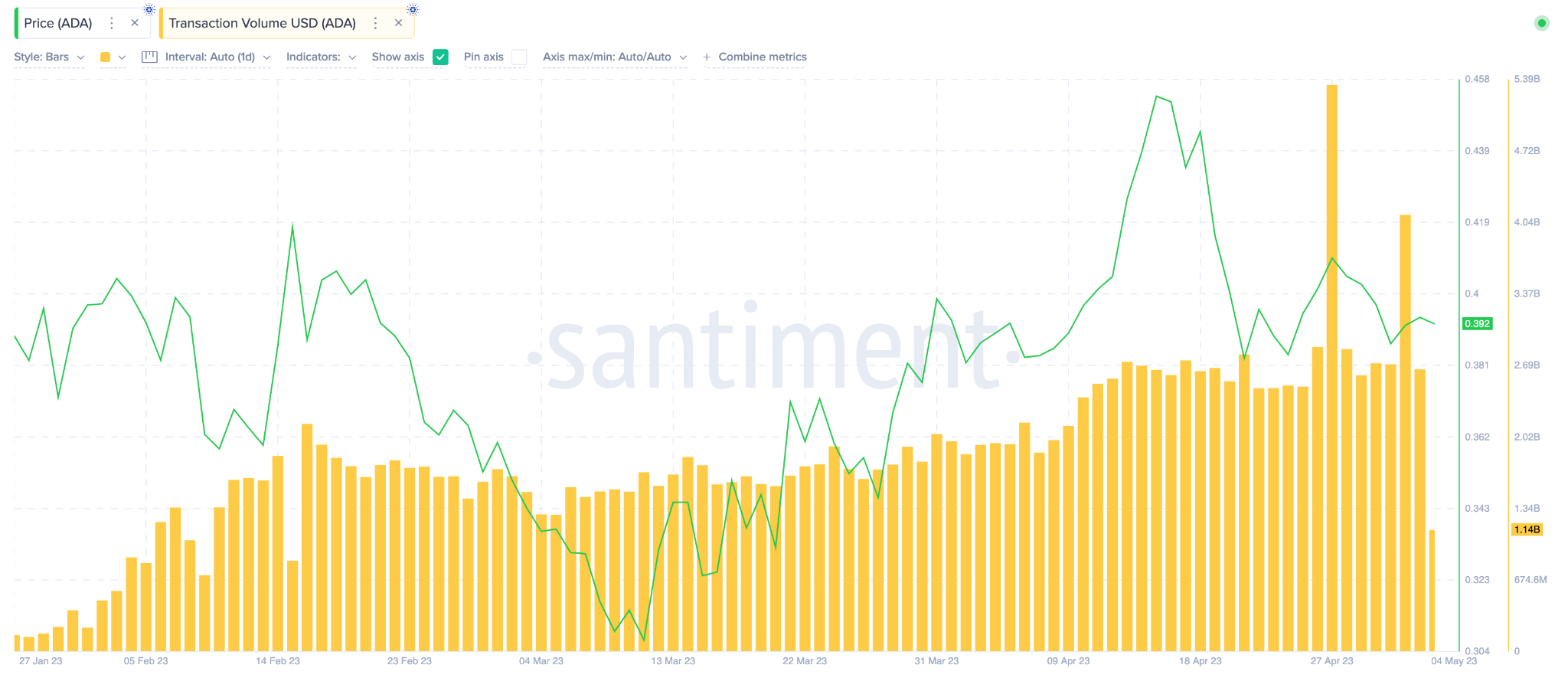

Network Transaction Volumes are on the Rise

Compared to April, there has been a considerable upturn in the volume of USD-denominated transactions completed on the Cardano network.

On-chain data from Cardano shows how the Transaction Volume has consistently stayed above $2 billion since April 10.

Between April 10 and the close of May 3, there has been a 42% rise in the volume of dollars spent on the Cardano network.

When transaction volume rises consistently, it suggests a steady increase in demand for the core services and products hosted on the blockchain network.

For Cardano, it gets even more bullish considering that ADA Transaction volumes only exceeded $2 billion on two occasions in the whole of Q1 2023. If this uptrend in traction remains steady, ADA investors can expect an early price rebound.

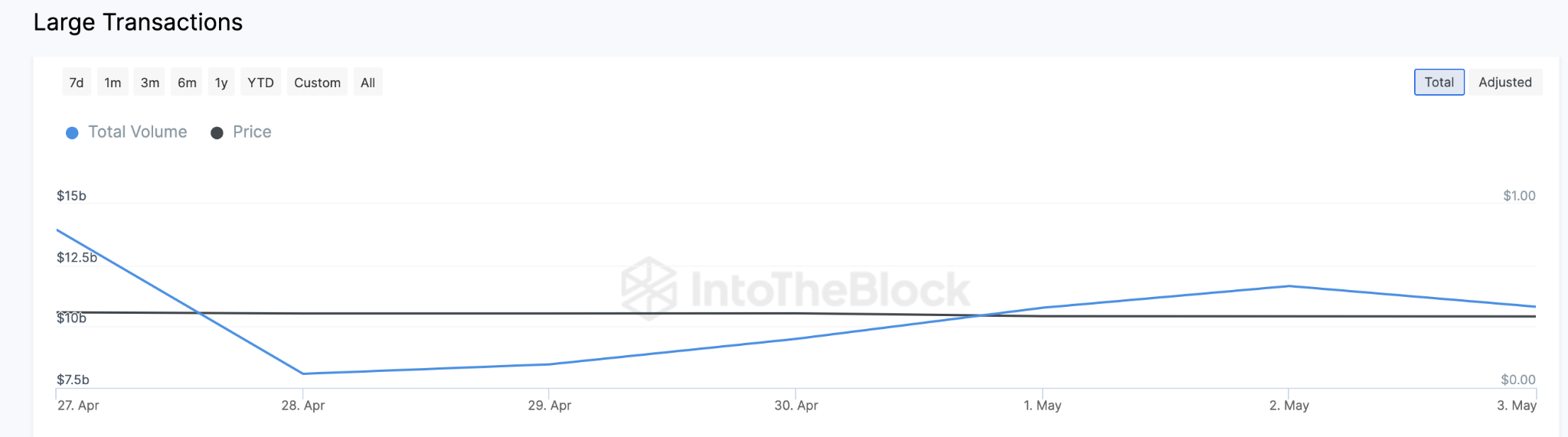

Cardano Whales are Betting Big Despite Recent Retracement

Despite recording the recent 4% price correction, Cardano whales appear unfazed. Over the last seven trading days, whales have increased their trading activity by 33%.

The chart below shows how large daily transactions have increased from $8.07 billion to $10.81 billion between April 28 and May 3.

Large Transaction is a financial metric that sums the total volume of transactions that exceed $100,000 on a given trading day. When it increases, it signals that whale investors are increasing their bets on the underlying asset.

In conclusion, the steady rise in Cardano transaction volumes and the increase in whale activity are critical bullish signals. If these metrics continue to rise, ADA holders can anticipate more price upswing in the coming days.

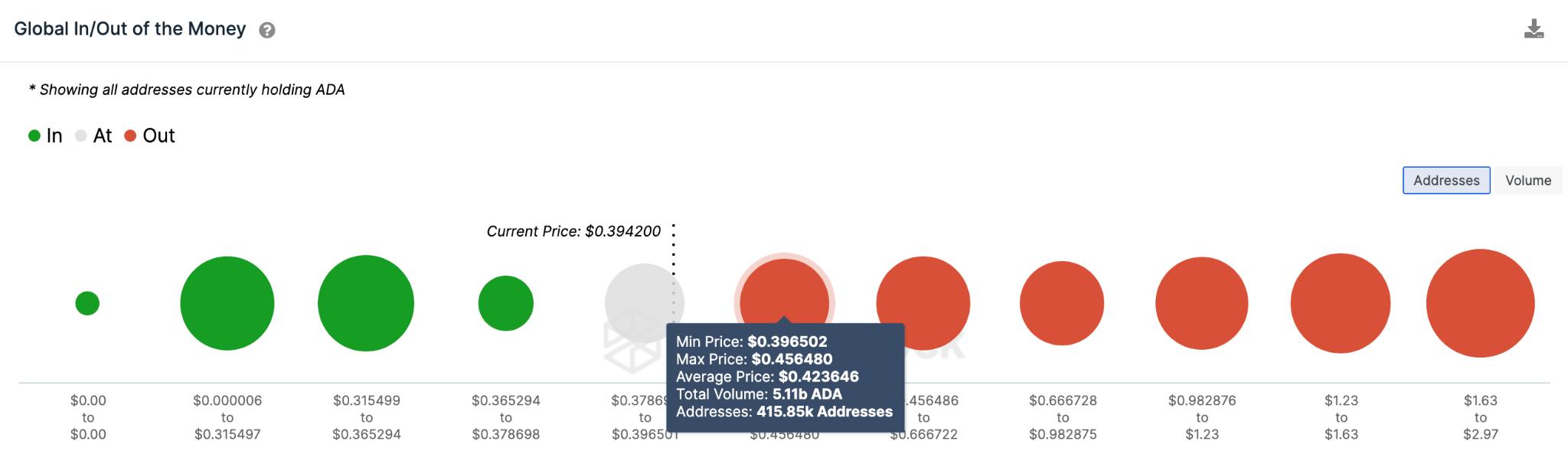

ADA Price Prediction: $0.42 Resistance Could Be Critical

As projected by Global In/Out of The Money Around Price data below, a data-driven ADA price prediction shows a potential rise toward $0.45.

However, the bulls will first have to contend with the selling pressure from 416,000 addresses holding 5.11 billion coins at an average price of $0.42.

But if the bullish outlook plays out, ADA could reach a new 2023 peak of $0.51. At that zone, profit-taking by the cluster of 466,000 investors that had bought 2.47 billion coins at an average price of $0.51 could slow down the rally.

Conversely, the bears can seize control of the market if ADA loses its current support at $0.37.

Although the bullish cluster of 301,000 addresses that 6 billion coins at an average price of $0.37 will likely prevent this.

But if Cardano price loses the support, holders can expect a further decline toward $0.31.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.