The Ethereum co-founder has been moving ETH to centralized exchanges recently. Moreover, Ethereum’s price, on-chain activity, and sentiment have been dwindling for the world’s second-largest crypto asset.

On September 25, Lookonchain reported that Vitalik Buterin had just deposited 400 ETH valued at around $632,000 on Coinbase. The move may be innocent, but large sums moving to centralized exchanges usually signal that sales preparations are being made.

Ethereum Downsides Expected

Furthermore, Ethereum price, sentiment, and momentum are flat at the moment, and it did not move in tandem with Bitcoin last week.

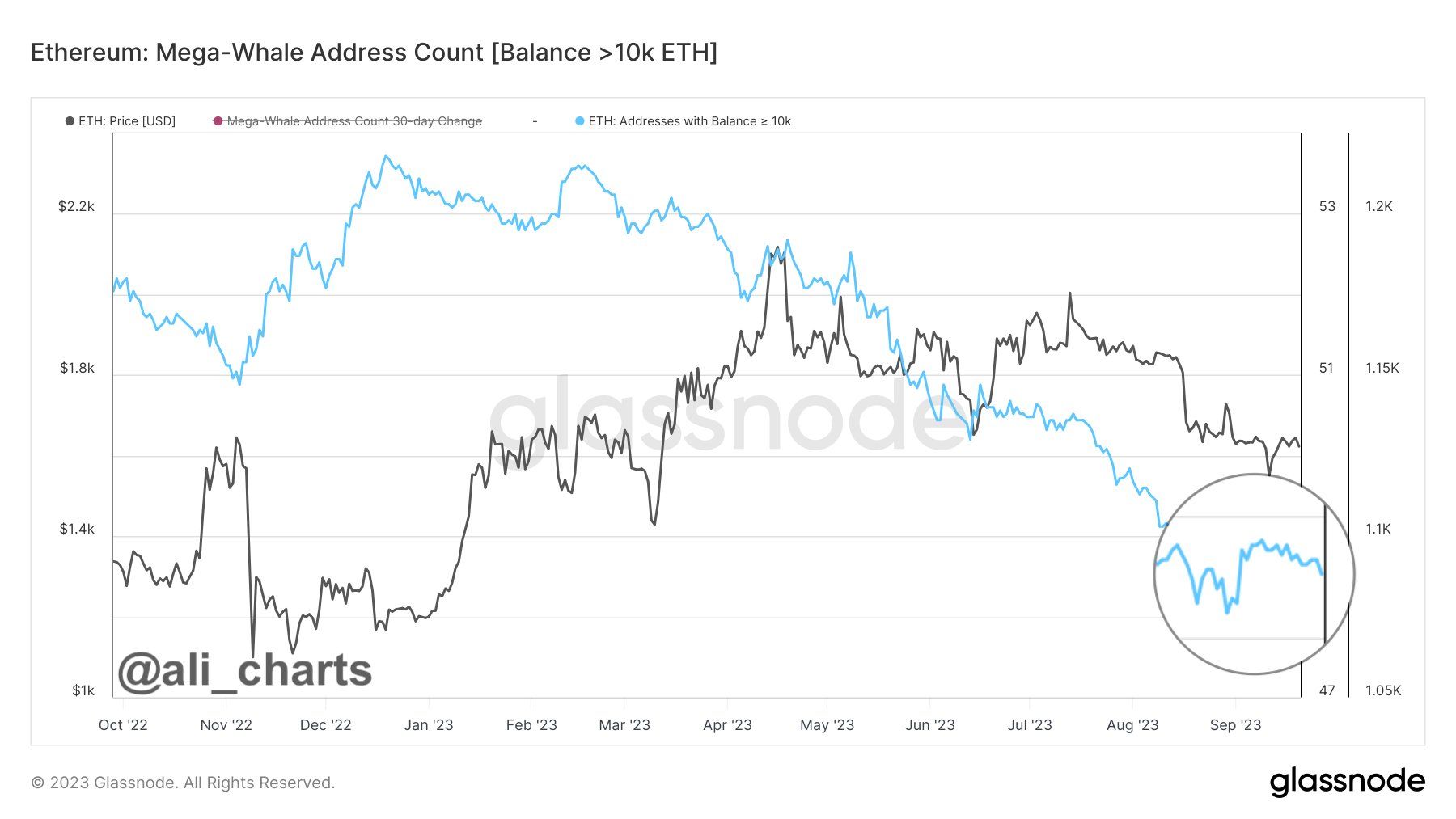

“There are no signs of buying pressure from Ethereum whales yet,” observed @Ali_Charts late last week. ETH whales with balances greater than 10,000 have declined this month, as has the asset’s price.

“Immortal Crytpo” also eyed further downsides for Ethereum. On September 25, he predicted that prices could fall back to $1,300 to $1,500 over the next few weeks.

However, the investor was unperturbed, saying that he planned to keep accumulating at these levels.

“I think ETH will outperform BTC at some point but not like in the previous cycle.”

Most of the respondents agreed that accumulation was a slow and steady strategy for solid gains next year when cycle momentum changes.

Read more: Ethereum Merge: Everything You Need To Know

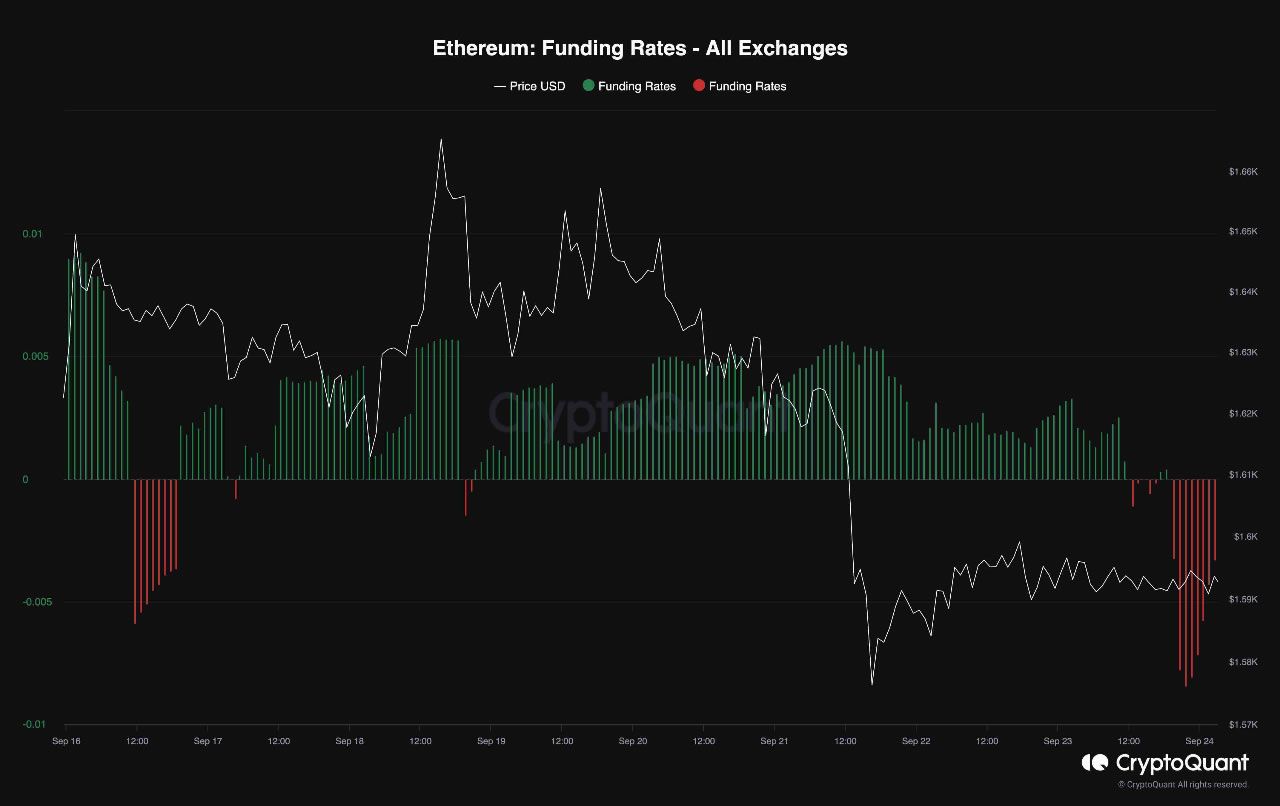

On-chain analytics platform CryptoQuant warned of a potential short squeeze for Ethereum. Moreover, analysts observed the negative funding rates on derivatives markets.

Funding rates represent the periodic payments made to traders based on the difference between perpetual contract markets and spot prices.

“This indicates that futures traders have adopted a pessimistic outlook on ETH, enhancing the possibility of a further price drop,” it stated before adding:

“Consistent negative funding rates can potentially trigger a cascade of short liquidations, which in turn could lead to a sudden price rebound.”

Ethereum Price Outlook

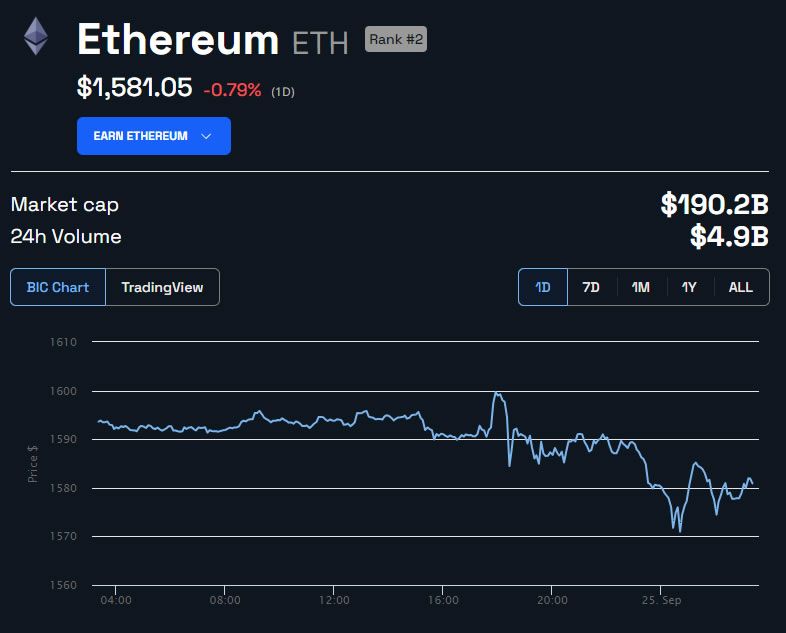

The Ethereum price has dipped again during the Monday morning Asian trading session. As a result, ETH is down 1% on the day, falling to an intraday low of $1,570 a few hours ago.

The asset had rebounded slightly to trade at $1,580 at the time of writing, but further declines looked likely.

October is traditionally a bearish month for both stocks and crypto. Therefore, those price predictions above may play out over the coming weeks.

However, Ethereum staking remains bullish, hitting new milestones, so the long-term outlook is positive.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.