This week is shaping up to be another busy one on the economic calendar with a speech from the Feral Reserve chair. Moreover, escalating geo-political tensions are only adding to the market volatility.

On October 16, macroeconomics outlet The Kobeissi Letter listed this week’s key economic events for the United States. It cautioned that geopolitical tensions are adding to the sentiment, which remains bearish.

This Week’s Economic Calendar

Tuesday will see the release of US retail sales data. This measures the change in the total value of sales at the retail level. It is the foremost indicator of consumer spending, which accounts for the majority of overall economic activity. It is expected to fall a little, which is bearish for the overall economy.

There is some housing and building data released on Wednesday, but neither of these has much impact on broader markets.

On Thursday, October 19, Fed Chairman Jerome Powell will speak. The speech at the Economic Club of New York comes just before the central bank’s blackout period begins ahead of its next interest-rate decision.

US leading economic indicators are also released on Thursday, along with jobless claims, though these are not expected to change.

Any airdrops this week? Find out more: Best Upcoming Airdrops in 2023

None of this week’s events are expected to change crypto markets, which have remained flat over the weekend.

However, the specter of war spilling over into other regions is a real threat, according to billionaire investor Ray Dalio.

The Israel-Hamas clash threatens to spark other bloody battles, and it’s now a coin toss whether a world war including the US and China breaks out, Ray Dalio has said. Dalio said late last week:

“In my opinion, this war has a high risk of leading to several other conflicts of different types in a number of places, and it is likely to have harmful effects that will extend beyond those in Israel and Gaza.”

He added that the odds of a,

“More uncontained hot world war that includes the major powers have risen from 35% to about 50% over the last two years.”

Crypto Market Outlook

A major global conflict is bad news for all markets, but we’re not there yet.

Digital assets are still buried under layers of ice as the crypto winter continues and is likely to do so for the rest of this year at least.

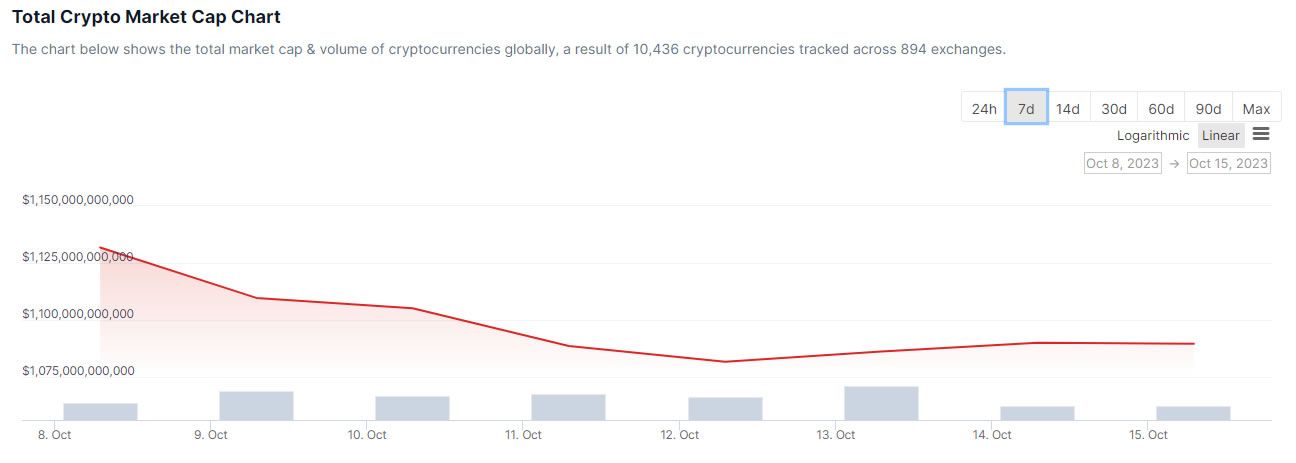

Total market capitalization is up around 1% on the day to reach $1.1 trillion. However, it has remained tightly range-bound since its fall in mid-August.

BTC has reclaimed the $27,000 level during Monday morning trading in Asia. The asset was changing hands for $27,234 at the time of writing, up 1.3% on the day.

The rest of the altcoins were mixed with very little movement in either direction.