The dYdX (DYDX) has completed a corrective pattern and has possibly initiated a bullish trend reversal toward at least $2.50.

DYDX is the native token for the dYdX Layer 2 protocol of the eponymous decentralized exchange. It is used for governance and staking purposes and offers lower fees for the exchange’s users.

Since the FTX collapse, decentralized exchanges have become much more attractive since users are in full control of their assets. dYdX has consistently been ranked as one of the best currently available due to its clear interface, quick transactions and a large selection of trading orders.

DYDX Price Creates Bullish Pattern

Since June 2022, the DYDX price has created a triple bottom pattern near the lowest price of 2022 at $1.10. Besides being a bullish pattern, the triple bottom was combined with bullish divergence in the weekly RSI (green line).

Divergence in such a high time frame is rare and often precedes bullish trend reversals. Moreover, the RSI has nearly moved above 50, another sign of a bullish trend.

If the upward movement continues, the next closest resistance would be at $4.50. The area has not been reached since April 2022.

On the other hand, a weekly close below $1.10 would invalidate this bullish DYDX price analysis and send the price to a new all-time low.

DYDX Reversal Could Lead to New Highs

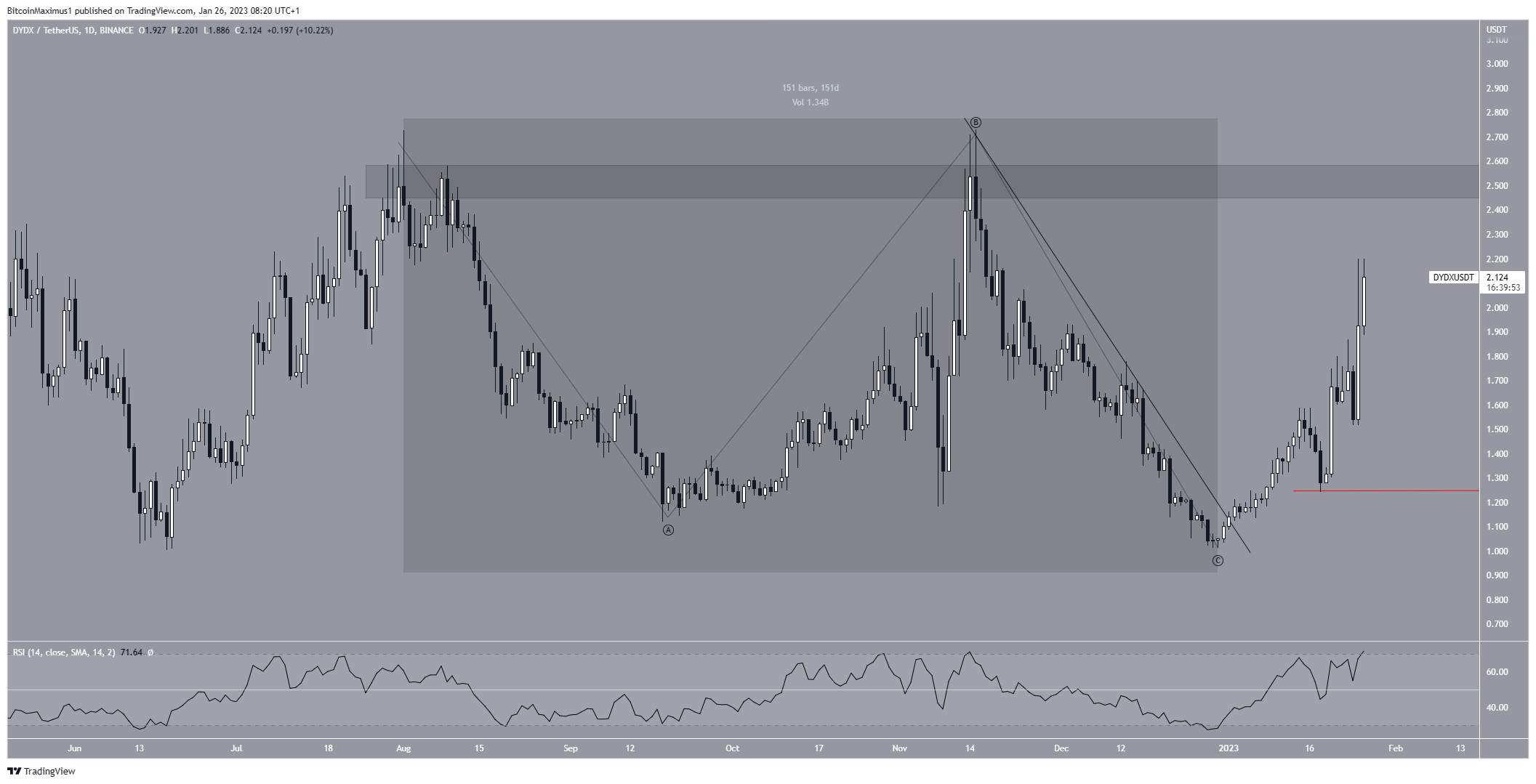

The technical analysis from the daily time frame supports the findings from the weekly one. It provides two main bullish arguments.

Firstly, the entire movement from Aug. 1 to Dec. 30 looks like a completed A-B-C corrective structure. If so, a significant upward movement would be expected to follow. This fits perfectly with the bullish triple-bottom pattern.

Secondly, the DYDX token price broke out from a descending resistance line on Jan. 1, while the RSI moved above 50 four days later. This also indicates that a bullish trend reversal has begun. The DYDX price has increased at an accelerated rate since breaking out from the line, reaching a maximum price of $2.20 over the past 24 hours.

A movement above the $2.50 minor resistance area would hasten the rate of increase further. In this case, the DYDX price could quickly move to $4.50.

On the other hand, a decrease below the Jan. 18 low of $1.24 would invalidate this bullish hypothesis and suggest that a new all-time low is in the cards.

To conclude, the most likely DYDX coin price outline is a movement toward $2.50 and an eventual breakout toward $4.50. Conversely, a decrease below $1.24 would invalidate this forecast and suggest that a new all-time low is expected.

For BeInCrypto’s latest crypto market analysis, click here.