The Nasdaq Composite Index (IXIC) broke its all-time high on Thursday, closing over 11,000 for the first time ever.

The main driver for the push into uncharted territory appears to be an improvement in unemployment data.

Unemployment and claims dropped to the lowest level since April.Party like it's 1999: Nasdaq closes >11,000 for the first time ever. pic.twitter.com/N3wzFbL6WS

— Holger Zschaepitz (@Schuldensuehner) August 6, 2020

Bolstered by Tech Stocks

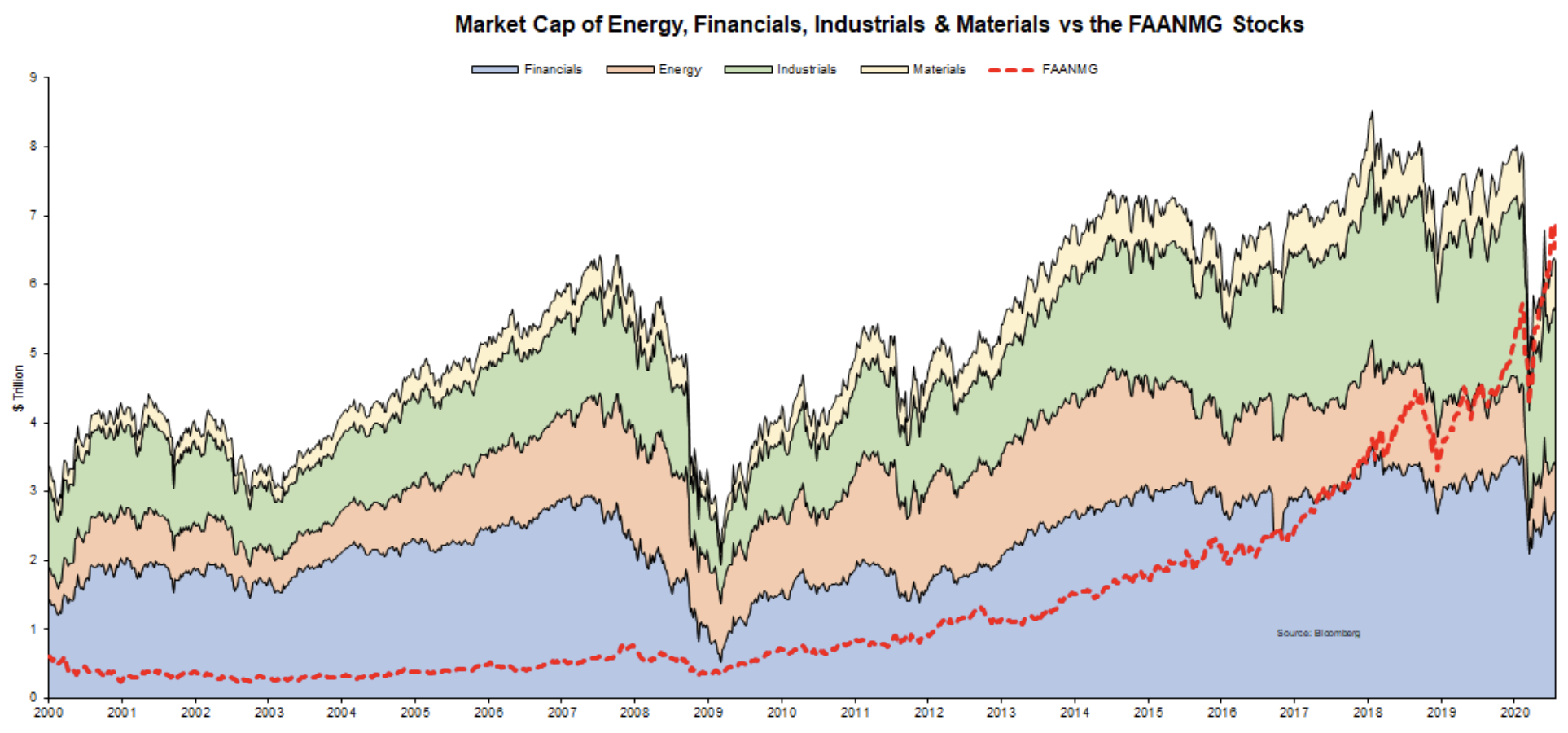

The rise was led chiefly by tech stocks: Facebook, Amazon, Apple, Netflix, Microsoft, and Google (FAANMG). Tech giants are now worth more than $7 trillion, greater than the combined total market capitalization of the financial, energy, industrial, and material sectors.

Mixed Signals

Interestingly, gold is also following the Nasdaq into new all-time highs. However, investor flows into gold, silver, bitcoin, and other store-of-value (SOV) assets present a mixed signal. When both equities and SOV assets rise, investors can become easily confused. Generally, stock rallies go hand in hand with investor flows out of safe-haven positions. The current unusual correlation suggests that tech stocks may be substantially overvalued. Some analysts believe that the long term indicators are nevertheless positive. According to Ryan Detrick, chief investment strategist for LPL Financial:Yes, technology is probably extended in the near-term, but when you look at how strong earnings and guidance have been from the group, you realize there’s a reason the Nasdaq is at 11,000 and why eventual continued strength is quite likely.

Is the Nasdaq in a Bubble?

It’s difficult to tell, at least until some of the air has been let out. The current rally closely mirrors the run-up that took place in 1999 during the dot.com bubble. Substantial liquidity, caused by the Federal Reserve’s (Fed) borrow-and-buy policy with T-bills, could be a major culprit. Generally thought of as a stop-gap measure, the Fed has committed to purchasing $80 billion in notes per month. The purchases have been coupled with further commitments for another $112 billion in issuance this quarter. Together, these indicators have driven yields to record lows. Funds have therefore shifted into both equities and SOV assets, seeking a hedge against inflation, as well as yields from dividends. The jobless claims stoked hopes that companies are making their way out of the Covid-19 crisis. However, despite hopes of stability, difficulties will arise when inflation rates are calculated. If inflation rises, equity investments could lose value, and money would likely flood out of these positions into SOV assets, thus creating the burst that many analysts have long called for.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored