The Dogecoin (DOGE) price lost its bullish structure by breaking down from a short-term support line. The price is likely not done falling.

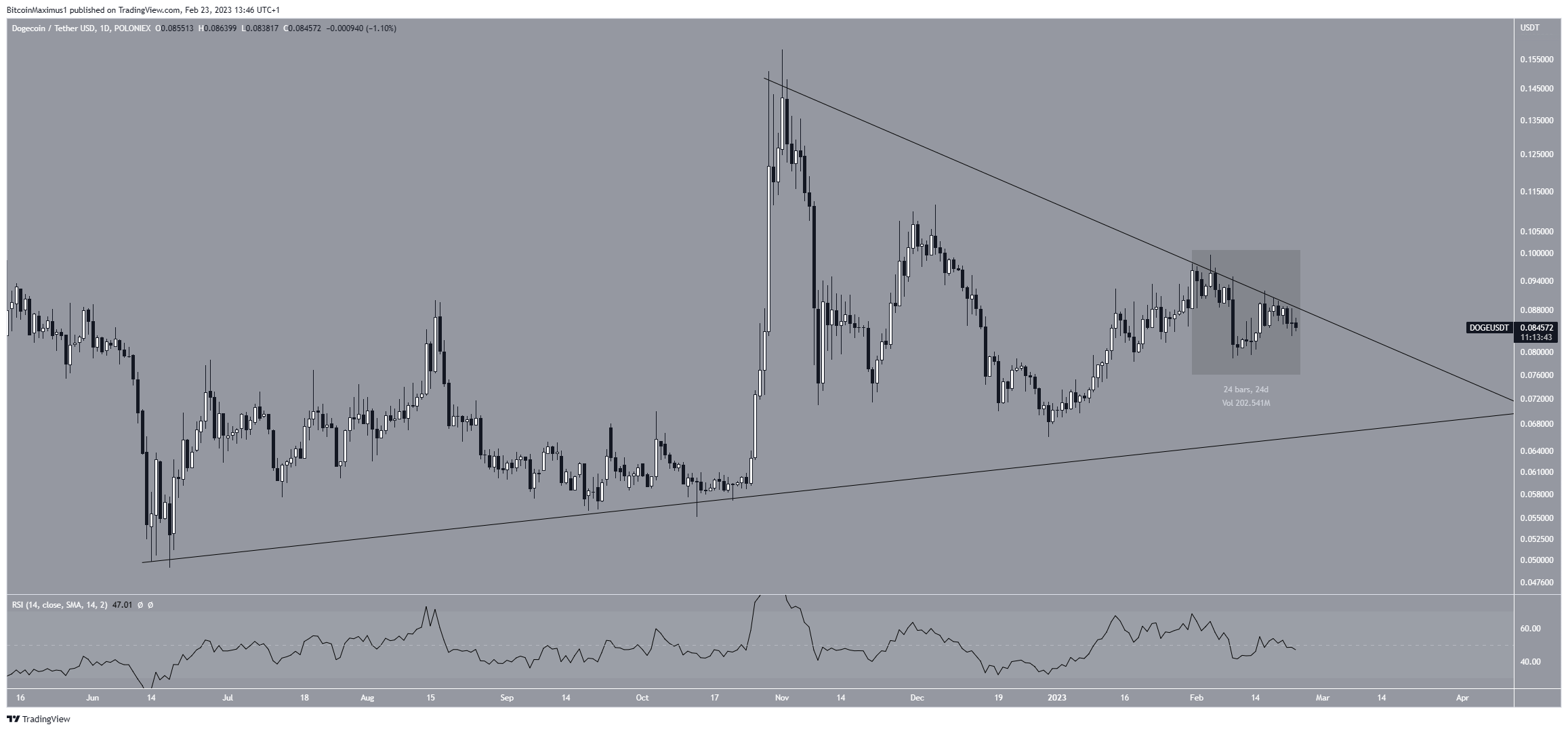

The Dogecoin price has traded in a long-term symmetrical triangle since June 16 2022. The triangle’s support line was validated in October of the same year.

However, the price has fallen under a descending resistance line since reaching a high of $0.158 on Nov. 1, the highest price for more than six months. The price of DOGE made numerous attempts at breaking out over the past 24 days, all unsuccessful. However, an eventual breakout is expected since lines get weaker each time they are touched.

The daily RSI is at 50, signifying a neutral trend. Therefore, it does not help determine if the price will break out from the resistance line or drop to its support line.

Dogecoin (DOGE) Price Is Not Done Decreasing

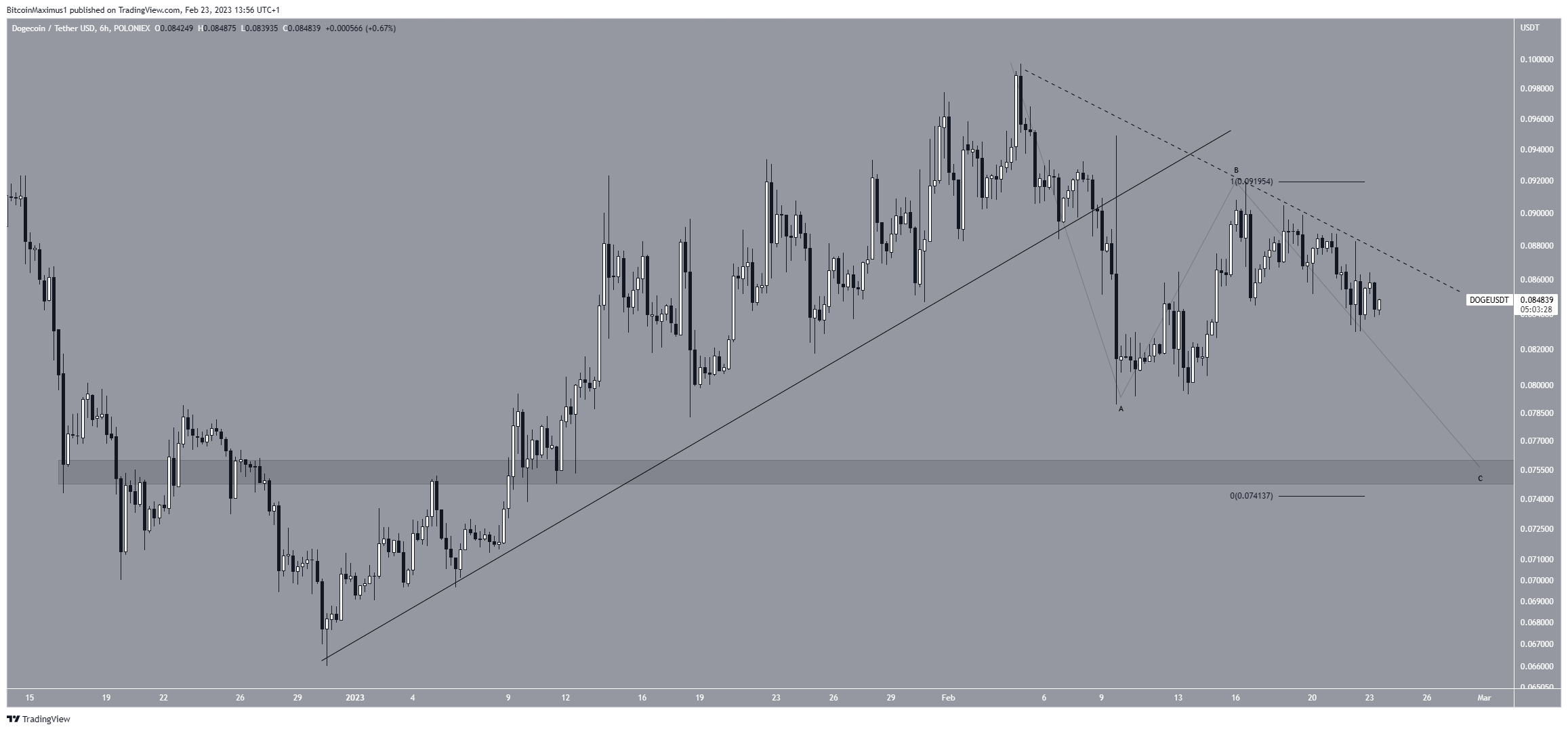

The technical analysis from the short-term six-hour chart shows that the DOGE token price broke down from an ascending support line. It is possible that the decrease was part of wave A of an A-B-C structure (black). Therefore, a relief rally ensued, and the DOGE price is now in the C wave. Giving waves A:C a 1:1 ratio would lead to lows near $0.074, close to a horizontal support area. The decrease could begin in the next 24 hours.

There is also a short-term descending resistance line (dashed) whose slope coincides with the previously outlined long-term one. Therefore, a breakout above it would invalidate the bearish forecast. In that case, the digital currency could increase to highs near $0.110.

To conclude, the most likely Dogecoin price forecast is a drop toward $0.075. Afterward, the upward movement could continue. However, a breakout from the short- and long-term descending resistance lines would invalidate this bearish outlook. In that case, the DOGE price could increase to $0.11.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.