Dogecoin (DOGE) started May 2023 negatively as investors turned their attention to new trendy memecoins like PEPE (PEPE) and DogeElon Mars (ELON). On-chain data shows that the bullish $0.10 DOGE price prediction now hangs in the balance as whale investors take opposing positions.

Dogecoin price showed early signs of a bullish reversal after a 3% rebound from its recent low of $0.071 on May 13. But ever since, DOGE price has hovered between $0.072 and $0.075.

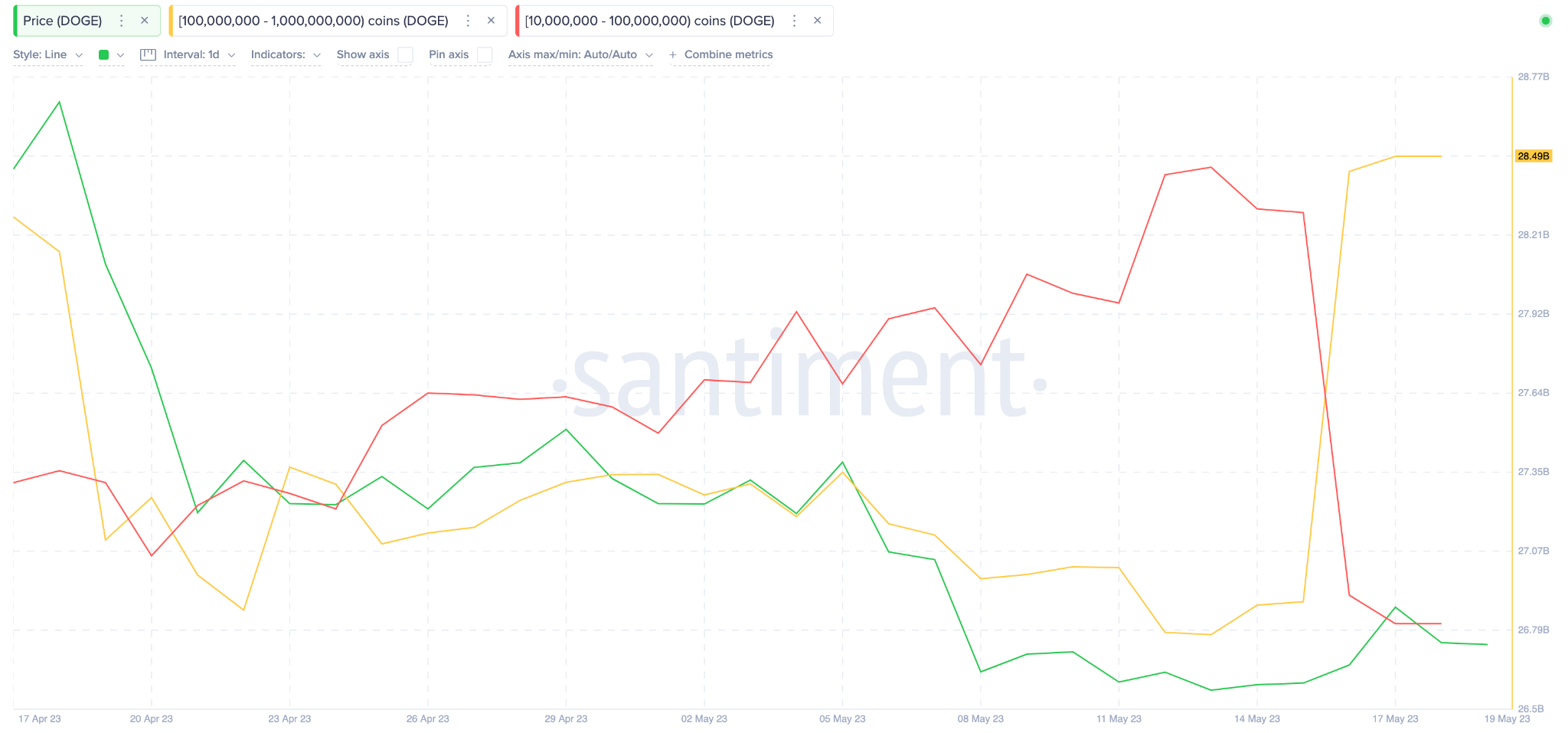

This stagnation could be attributed to the two critical whale cohorts taking opposing stances on DOGE price this week.

Here’s a data-driven on-chain analysis of how the bullish whales could gain the upper hand in the coming days.

Two Dogecoin Whale Cohorts Face Off

According to on-chain data, two critical whale cohorts are taking opposing stances on DOGE this week.

Between May 13 and May 19, Dogecoin Whales holding balances of 10 million to 100 million coins have sold off 860 million DOGE.

But simultaneously, the chart below shows how the whales holding 100 million to 1 billion coins have bought 1.72 billion DOGE.

On-chain data shows that while the divergent trading activity of both cohorts has been synchronized, the bullish whales have bought double the number of coins sold by the bears.

Potentially, excess demand by the bullish whales could drown out the bears’ sell pressure and propel DOGE into another bullish price movement.

At Current Prices, Dogecoin Appears Undervalued

Over the past few weeks, investors’ growing interest in newly-emerged memecoins like PEPE has seen Dogecoin attract much less demand. The decline in Dogecoin Network Value to Transaction Volume (NVT) ratio indicates that DOGE is undervalued.

Additionally, the chart below shows how the NVT ratio has dropped 62% from 163.06 to 63.15 between May 7 and May 17.

Typically, strategic investors use the NVT ratio to evaluate the relationship between a cryptocurrency’s market capitalization and the underlying transactional activity.

When the NVT ratio drops considerably, as observed above, it indicates that the asset is undervalued.

In summary, the low NVT ratio could spur other investors to mirror the trades of the bullish whales. If that happens, the heightened demand could validate bullish DOGE price predictions.

DOGE Price Prediction: Bulls Can Target $0.10

IntoTheBlock’s Global In/Out of Money (GIOM) data suggests that the next Dogecoin price rally could reach $0.10

Bulls could be confident of this bullish DOGE price prediction, but it must first clear the initial critical resistance at $0.075. However, profit-taking by 158,000 investors that bought 44 billion DOGE coins at the maximum price of $0.075 may trigger a pullback.

Nevertheless, if DOGE breaches that resistance, the bulls can garner enough steam to push for the $0.10 target.

Still, the bears could negate the positive Dogecoin price prediction if DOGE retraces unexpectedly below $0.066. Although, 470,000 investors that bought 12.2 billion tokens at an average price of $0.066 can offer support.

However, if that support level breaks, it could trigger a larger drop toward $0.056.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.