DeFi Tokens Tanking

Historically, when Bitcoin falls, the rest of the market hemorrhages and this has certainly been the case for a large number of DeFi tokens this week. Many of the top DeFi tokens including LEND, CRV, UNI, SUSHI, BAL, UMA, KAVA, REN, SNX, SWRV, and YFI have lost double digits over the past 24 hours:This appears to have been to the delight of a number of Bitcoin maximalists including BTC community member, Zack Voell (@zackvoell), who posted a screenshot of the bleed out; https://twitter.com/zackvoell/status/1308062766318735363 DeFi market capitalization has been hit harder due to the rapid gains that most of these tokens have made over the past couple of months. Analytics websites CoinMarketCap and CoinGecko currently report the market cap for the top DeFi tokens as being around $12 billion, or around 4% of the total for all digital assets.DeFi 7D Loss Leaders $SWRV -75% $BZRX -46%$AKRO -44%$SUSHI -40%$RUNE -40% https://t.co/F0hbHeizQf

— Messari (@MessariCrypto) September 21, 2020

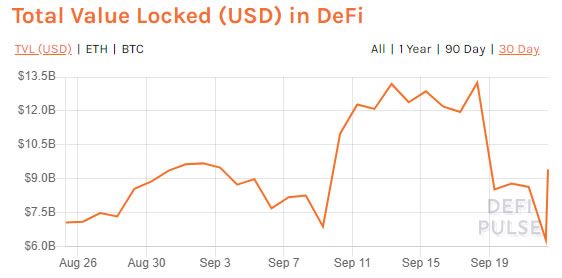

DeFi TVL Falls From Record High

The total value locked across all DeFi platforms hit a record high of $13.2 billion last week according to analytics provider DeFi Pulse. However, the platform has stated that there have been some problems with accurate reporting of the measure which has skewed the leaderboards:At the time of press, TVL is being reported as $9.4 billion with Uniswap leading the pack commanding a market share of just over 20%. The chart does look a bit choppy and analysts have pointed out that TVL is not the best measure of a project’s performance since there are opportunities for double-counting with various liquidity pools.👉👈 We are aware of the issue in the info displayed on the DeFi Pulse leaderboard and are working dilligently to solve it.

— DeFi Pulse 🍇 (@defipulse) September 21, 2020

Worry not, the sky is not falling and project's TVLs will be back to normal soon.

It’s important to keep in mind that market corrections are perfectly natural and should be expected after long periods of gains.Crypto markets are red today. But consensus among most instl investors is that this is macro driven; not crypto driven. The fundamentals for $BTC $ETH and $DEFI have actually never looked better.

— Spencer Noon (@spencernoon) September 21, 2020

Some will BTFD. Others will scale in. I expect both will be rewarded handsomely.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.