Digital Currency Group (DCG) has posted a 23% increase in third-quarter revenue after repaying loans to its subsidiary Genesis. Its consolidated revenue increased from $153 million in Q2 to $188 million in Q3 despite the slump in crypto prices.

DCG’s earnings before interest, taxes, depreciation, and amortization were $69 million. The company repaid $225 million of the money it owes Genesis, one of the first companies to build its business around lending money to crypto companies.

Numbers Are Promising for DCG

The company’s encouraging numbers come on the back of a surge in Bitcoin’s price to over $35,000. DCG’s Grayscale Investments, which operates the world’s largest Bitcoin fund, recently scored a legal victory that may attract institutional inflows into Bitcoin, giving its parent and the market a further boost.

Read more: What Causes Bitcoins Volatility?

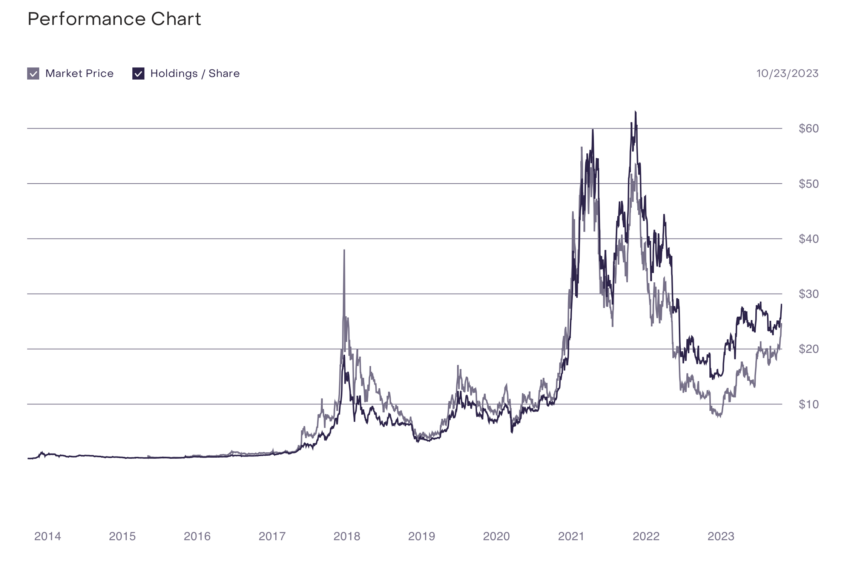

Grayscale fought the US Securities and Exchange Commission (SEC) over the agency’s rejection of Grayscale’s application to convert a closed-ended Bitcoin fund to an exchange-traded fund (ETF). The fund’s lack of a redemption mechanism means the price of its shares has fallen below the net asset value of the underlying Bitcoin.

Read more: 12 Best Bitcoin Exchanges and Platforms in 2023

The expectation of the SEC’s approval of several ETFs has since caused the discount to narrow. An actual approval could see Grayscale rake in millions in management fees.

DCG and Genesis Blamed in New Lawsuit

Last week, New York Attorney General Letitia James sued DCG, Genesis, and crypto exchange Gemini for allegedly defrauding Gemini customers. The $1.1 billion lawsuit said Gemini exposed its customers to undue risk despite knowing the state of Genesis’ financials.

DCG has vowed to contest the allegations in court.

“We assure you that we will vigorously defend against these claims and look forward to being vindicated in this case.”

Genesis and Gemini also face accusations from the SEC that they offered Gemini’s Earn products as unregistered securities. Genesis profited from the difference between Earn yield and its own lending rate.

Do you have something to say about the increase in DCG revenue, the surge in Bitcoin price, the Grayscale ETF case, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.