Derivative and spot trading saw marked declines, both losing a hefty 17.5% from the previous month. Binance reclaimed the top spot in terms of derivative exchange volume, up 10.7% since August, with $164.8 billion exchanging hands.Daily volume from top-tier #digitalasset exchanges reached a record for the year on the 3rd of September 2020 with $27.6bn traded. The previous high for the year was $27.1bn on the 27th of July 2020.

— CryptoCompare (@CryptoCompare) October 9, 2020

Read the full Exchange Review report: https://t.co/3jq17N0gTa pic.twitter.com/yc3tkIj8wB

The Rise of the Crypto DEX

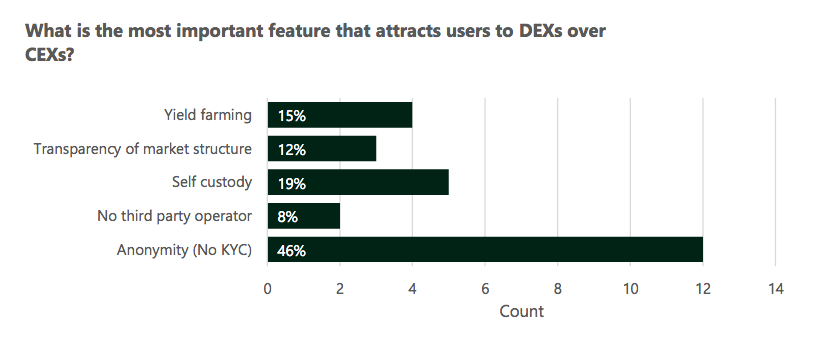

Unsurprisingly, CryptoCompare’s (CC) reports continue to feature stats on the sprawling Decentralized Finance (DeFi) sector. BeInCrypto earlier reported that UniSwap traffic was up some 43% in Sept., exceeding even that of its massive centralized counterpart Coinbase. As part of its report, CC surveyed 26 leading exchanges. One of the key concerns was a notable trend in users moving to decentralized exchange’s (DEX),Centralised exchanges believed that the anonymity afforded by DEXs was the primary reason (46.2%) users traded on DEXs. Self-custody was the secondary driver with 19.2% of respondents saying this was a feature that attracted users to DEXs.

CryptoCompare’s Exchange Benchmark Ranking shows that higher risk exchanges have generally lost market share in the last few months, as users begin shifting to lower risk (Top-Tier) exchanges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.