CryptoCompare has released its July exchange review. The review aims “to capture key developments within the cryptocurrency exchange market”.

As a leading crypto data aggregator, CryptoCompare’s review analyzes exchange volumes, including crypto derivatives trading, market segmentation by exchange fee models, and crypto to crypto vs. fiat to crypto volumes.

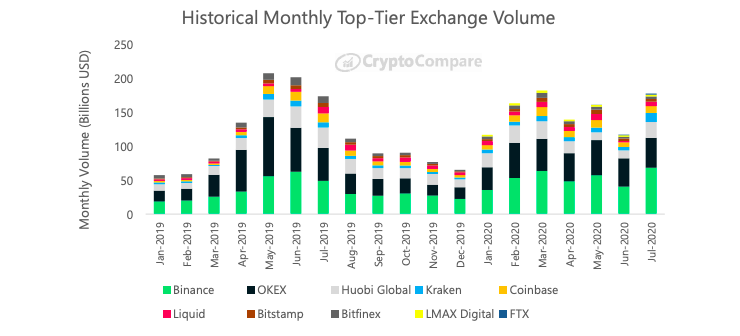

The latest report shows that in July, top-tier exchange volumes increased 42.1% to $334 billion, while lower-tier volumes decreased 38.1% to $224 billion. In other words, the top-tier exchanges now account for over 60% of the total spot volume.

Learn more about CryptoCompare’s benchmarking here. In addition, the report found that the total volume of the top 15 biggest exchanges grew considerably in comparison to June. The average increase was 69%, with a total volume equalling the highs in March.

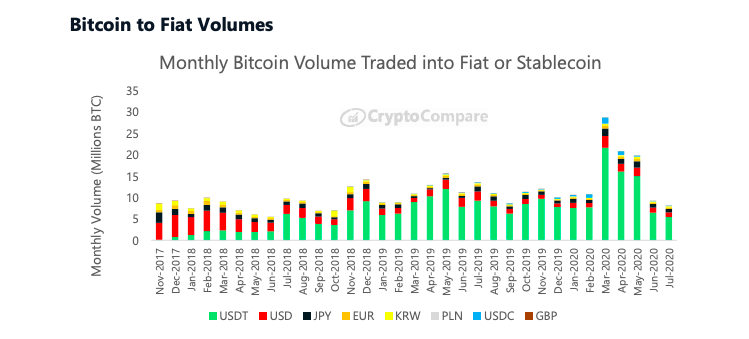

“BTC/USDC fell to 66,800 BTC (down 13.3%) last month. The BTC/USDT pair still accounted for the majority of bitcoin being traded into either fiat or stablecoins for July, at 66% of total volume versus 69 percent in June.”The increase in total volume is yet another bullish sign for crypto. The increased dominance of top tier exchanges may indicate that the market is starting to mature.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Colin Adams

Colin is a writer, researcher, and content marketer with a keen interest in the future of money. His writing has been featured in numerous cryptocurrency publications, and his holdings don't amount to more than a handful of BAT.

Colin is a writer, researcher, and content marketer with a keen interest in the future of money. His writing has been featured in numerous cryptocurrency publications, and his holdings don't amount to more than a handful of BAT.

READ FULL BIO

Sponsored

Sponsored