The Indian Goods and Services Tax (GST) Council has implemented a 28% tax on the online gaming industry. The high tax is seen as unfair, just as high crypto taxation has been when it was introduced.

The Indian government has now implemented new tax rules, charging a 28% Goods and Services Tax (GST) on the online gaming industry. The tax rules follow India’s harsh taxation of the crypto market.

28% GST Tax for Online Gaming Industry

Local media outlets have reported that a 28% GST tax would be applied to online gaming, horse racing, and casinos. Of note is that the GST council marked that there was no distinction between games of skill and games of chance.

Analysts and those in the industry criticized the move, stating that it would hamper growth and discourage business. Some have stated that the industry will likely seek relief from the courts in the interim period. Critics also emphasize that it would do little to discourage gambling.

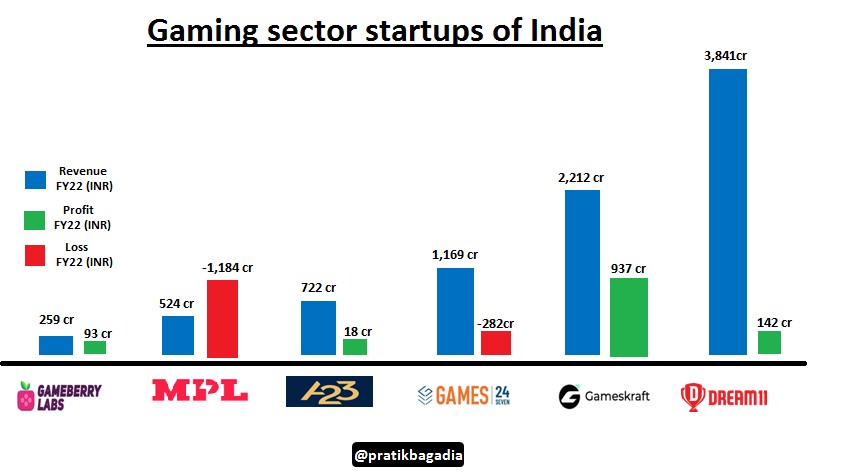

Others note that the tax is unsurprising given the fact that the revenue of the online gaming industry for single companies often exceeds $45 million. They also point to the fact that revenue has increased substantially over recent years.

The market cap of the gaming industry in India is currently $10 billion, and there are, in fact, several startups in the space. These will likely take a hit should the tax be implemented, just as the crypto tax did to the industry.

India Crypto Tax Stands at 18%

India’s version of Value Added Tax (VAT) is GST. It has succeeded VAT and is a replacement for such taxes as services, tax, excise duty, and others. Implemented in 2017, it is a single indirect tax for the entire country.

The Indian government has implemented GST on cryptocurrencies, and any crypto transaction that involves trading it for fiat or other goods and services applies this tax. The tax rate for such transactions is 18%. It has also considered a reverse charge tax for foreign crypto platforms.

While India is imposing higher tax rates on crypto, the country remains bullish on its own CBDC project. Check out our guide on India’s digital rupee project to learn more: Digital Rupee Tutorial — How to Use India’s CBDC e-Rupee

The tax rules on the crypto market have hit the Indian crypto industry hard, as the country has a strong crypto user base. Volumes on exchanges have dropped sharply following the tax rules implemented last year.

Those in the Indian crypto environment have lobbied for some relief, hoping that the government will rethink its strategy. There remains some hope for them, as a budget session will soon be held, though it’s unclear if the crypto tax rules will be reviewed.

The government has also issued a notice to bring cryptocurrencies under the money laundering act. Regulators will require crypto exchanges to report suspicious transactions.