The e-rupee (e₹) is India’s central bank digital currency (CBDC). Also called the digital rupee or Indian CBDC, it was introduced by Finance Minister Nirmala Sitharaman in her 2022 Budget speech. The initiative seeks to broaden financial inclusion and deepen digital finance adoption nationwide. Here’s a closer look at the e-rupee, its purpose, and how it contrasts with other digital payment systems.

KEY TAKEAWAYS

• A Central Bank Digital Currency (CBDC) is a digital version of a nation’s currency, issued by the central bank.

• e-rupee is India’s Central Bank Digital Currency (CBDC), designed for secure, cashless transactions.

• You can withdraw e-rupee from your bank, store it in your phone’s digital wallet, and use it for purchases anywhere.

• e-rupee is available in denominations of e₹0.50, e₹1, e₹2, e₹5, e₹10, e₹20, e₹50, e₹100, e₹200, and e₹500.

- What is the Indian e-rupee?

- Digital rupee: Timeline, stakeholders, and scope

- Digital rupee denominations

- What does the digital rupee look like?

- Digital rupee: Key features and traits

- What is the difference between UPI and e-rupee?

- Could privacy be a concern with the digital rupee?

- Digital rupee: The pros and cons

- A calibrated, gradual implementation is the key

What is the Indian e-rupee?

The digital rupee or e-rupee (e₹) is a CBDC issued by the Reserve Bank of India (RBI). It’s the digital counterpart of our familiar physical rupee (INR).

For those out of the loop, Central Bank Digital Currencies, or CBDCs for short, are like the digital twins of a country’s physical currency.

Central banks create and issue them, and they adhere to the same regulations as their physical equivalents. However, CBDCs are not cryptocurrencies. While both are digital, cryptocurrencies are generally decentralized and governed by a community. In contrast, CBDCs are centralized, issued, and controlled by the central bank.

CBDCs come in two types: wholesale and retail. Wholesale CBDCs are used by banks and financial institutions for tasks like interbank settlements. Retail CBDCs are for everyday use, similar to cash.

So, to cut a long story short, the digital rupee is issued as a digital token that represents the Indian rupee. And just like its physical counterpart, the e-rupee also is a legal tender and accepted as a medium of payment and a safe store of value.

Digital rupee in a nutshell:

- The digital rupee or e-rupee is an RBI-issued sovereign digital currency.

- Although it uses blockchain technology, the digital rupee is not actually a cryptocurrency. While cryptocurrencies like bitcoin and ethereum are decentralized, the digital rupee is not.

- It is a legal tender, and you can use it just as you would cash — for example, to buy groceries.

- It is interchangeable with physical currency. For example, once it is publicly available across India, you should be able to walk into any bank and exchange your cash for digital rupees of equal value.

- The digital rupee appears as a liability in the RBI balance sheet. This liability is there because the RBI is responsible for maintaining and ensuring the value of the digital rupee.

- The RBI aims to make the digital rupee a completely fungible asset that anyone can use regardless of whether they have a bank account or not.

Digital rupee: Timeline, stakeholders, and scope

The wholesale version of the digital rupee (e₹-W) was launched in November 2022. Its primary use case was the settlement of secondary market transactions in government securities. The goal was to reduce the cost of such transactions while minimizing settlement risks.

The retail version (e₹-R) launched in December 2022. Initially, only a select group of customers and merchants in cities like New Delhi, Mumbai, and Bengaluru could participate. Since then, the pilot has expanded to most major cities across the country.

The Reserve Bank of India (RBI) reported that its retail central bank digital currency (CBDC) pilot had 5 million users and 420,000+ participating merchants by the end of June 2024. The digital rupee user figures show an increase of 8.7% compared to the previous quarter and merchants have grown by 5%.

Digital rupee denominations

The digital rupee has the same denominations as those you are familiar with in real life — the same physical currency denominations. You get coins of 50 paise (₹0.50) and ₹1 and then tokens of ₹2 all the way up to ₹500.

That means, you get digital tokens off e₹0.50, e₹1, e₹2, e₹5, e₹10, e₹20, e₹50, e₹100, e₹200, and e₹500. There was also an e₹2,000 denomination earlier, but the RBI withdrew it from circulation (along with paper ₹2,000 notes) in 2023.

But, what if you need to send or receive an amount that doesn’t fit neatly into these denominations, like e₹10.43 or e₹10.11?

The digital rupee system handles this by rounding off the amount to the nearest available denomination. It’s similar to how some shopkeepers in India give small items like candies when they don’t have exact change. Instead of offering an item, the system simply rounds the total up or down.

Here’s how it works: the system rounds off the figure being sent or received to the nearest available denomination. So, if you’re dealing with e₹10.43, the system will round it off to e₹10.50. And if it’s e₹10.11, the system will round it down to e₹10.

What does the digital rupee look like?

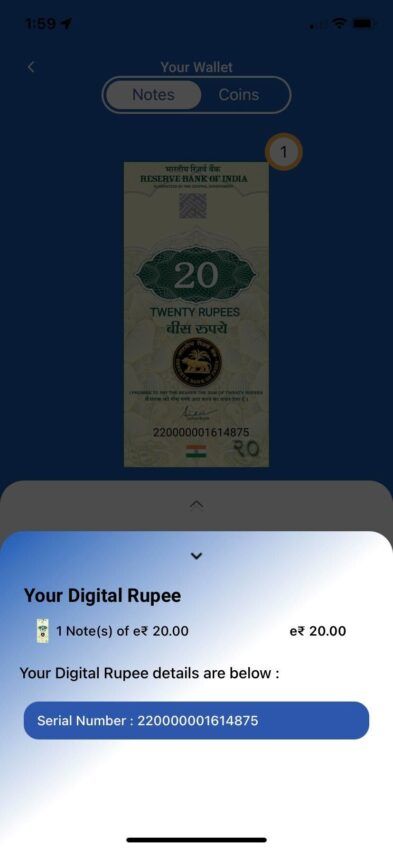

Being a digital currency, the e-rupee doesn’t have a physical form. However, to ease users into this new digital landscape, the RBI has cleverly represented each digital rupee denomination with graphics that bear a striking resemblance to their physical currency counterparts.

For instance, this is the e₹20 token:

And here is the now-discontinued e₹2,000 token:

Notice the resemblance with actual physical currency denominations of equal value?

Just like a physical rupee note carries the RBI name and logo, along with the signature of the RBI Governor, the digital rupee does too.

Each token is assigned a unique serial number, a digital fingerprint of sorts. This serial number can be used to track the specific token on the blockchain, adding an extra layer of security and traceability.

Digital rupee: Key features and traits

Here’s a rundown of some of the key traits and features of the digital rupee:

- Digital representation: The digital rupee is a digital representation of the Indian rupee. Each digital token represents a specific denomination, just like a physical currency.

- Legal tender: Just like the physical rupee, the digital rupee is a legal tender. This means it’s recognized by the government as a valid form of payment.

- Instant transactions: One of the biggest advantages of the digital rupee is the speed of transactions. Payments and transfers are processed instantly, making your financial dealings faster and more efficient.

- Accessibility: The digital rupee is designed to be accessible to everyone, regardless of their location. This could potentially improve financial inclusion, especially in remote or underserved areas.

- Interoperability: The digital rupee is designed to be interoperable with other payment systems. This means you can use it alongside your other digital payment apps.

- Privacy: While the digital rupee allows for traceability of transactions, it also respects users’ privacy. The design ensures that while illegal activities can be traced and prevented, the privacy of ordinary users is respected. More on that in a bit.

Remember, these are just some of the main features of the digital rupee. As the technology evolves and matures, we can expect to see even more features and capabilities added to India’s CBDC infrastructure.

What is the difference between UPI and e-rupee?

| Aspect | e-Rrupee | UPI |

|---|---|---|

| Type | Digital currency (CBDC) | Digital transaction platform |

| Function | Acts as the digital equivalent of physical cash | Facilitates bank-to-bank transactions |

| How It Works | e-rupee is stored in a digital wallet and used for direct transactions like cash | UPI directs the bank to transfer funds from the payer’s account to the vendor’s account |

| Intermediary | You can pay for groceries directly with e-rupee from your wallet, just like cash | Involves intermediaries like banks and mobile wallets for processing payments |

| Source of funds | Withdrawn from your bank account and held in a digital wallet | Linked to bank accounts, debit/credit cards, or mobile wallets for payments |

| Usage example | You can pay for groceries directly with e-Rupee from your wallet, just like cash | You use UPI to instruct your bank to move money to the vendor’s account |

| Settlement | Direct settlement between payer and receiver | Bank settles the transaction between accounts |

| Transaction method | Can be used for person-to-person (P2P) and person-to-merchant (P2M) payments via QR codes | Transactions are typically between two bank accounts |

| Anonymity | Small-value transactions can be anonymous, like using physical cash | Transactions are fully traceable through banks and mobile wallets |

| Security | Backed by the RBI, with high security and traceability for larger transactions | UPI transactions are encrypted and secure, though data is stored by banks and service providers |

| Adoption status | Recently launched, expanding through select banks and cities | Widely adopted, available through multiple platforms like Google Pay and PhonePe |

“In CBDC, you will draw the digital currency and keep it in your wallet on your mobile. When you make a payment at a shop or to another individual, it will move from your wallet to their wallet. There is no routing or intermediation of the bank.”

– T Rabi Sankar, Deputy Governor, RBI, at Post Monetary Policy Press Conference held in Dec. 2022.

Could privacy be a concern with the digital rupee?

Quite the opposite instead. Due to the nature of how digital wallet transactions work, it may offer better privacy than the average UPI app you probably use. That’s because the digital rupee transaction takes place peer-to-peer.

Consider this — you go to a shop and buy a pack of chips by paying with a crisp Rs 20 note. Is there a centralized log or record of this transaction? Not likely! The e-Rupee operates on the same principle, at least for relatively low-value transactions. The RBI has even given the official nod, stating that such transactions will be anonymous.

However, that’s not the same with UPI apps like Google Pay or Amazon Pay. Records of any transaction done through these apps — however big or small — are stored centrally in their servers. So the level of anonymity offered by UPI is far less comparatively.

While the Digital Rupee does offer a degree of anonymity for smaller transactions, it’s important to remember that it operates on a centralized infrastructure. This means that the RBI can trace the transactions of an individual or entity on the blockchain. It can even track the journey of individual tokens as they move across the blockchain.

However, the RBI assures that this capability will be primarily used to trace high-value transactions. The aim is to ensure legal compliance and security rather than playing Big Brother on every minor transaction.

So, while the Digital Rupee offers some privacy, it also has the necessary checks and balances in place to enforce transparency as and when required.

Digital rupee: The pros and cons

| Pros | Cons |

|---|---|

| Transactions are faster than traditional methods | Potential to reduce bank deposits, affecting credit availability |

| Cheaper and quicker international transfers | Could destabilize the banking system if interest is offered on e-rupee |

| Available 24/7, regardless of banking hours or weekends | Increased risk of cyberattacks as usage grows |

| No costs for physical manufacturing or currency wear and tear | Government control could impact inflation management |

| Useful for government payments like subsidies and tax refunds | May challenge RBI’s control over monetary policy |

A calibrated, gradual implementation is the key

Following the success of UPI, the digital rupee marks another significant stride in India’s ongoing journey towards building a comprehensive digitized economy. It promises to offer a safer, cost-effective, and efficient mode of transaction, while also addressing potential challenges related to banking and monetary policy.

That said, CBDCs, including the digital rupee, are in their early stages of adoption. As such, comprehensive research is needed to fully grasp their potential impact on India’s financial system. Given this context, a measured and phased rollout without stifling innovation seems to be the most prudent approach.

What is Indian e-Rupee?

How is UPI different from the e-Rupee?

What is the use of e-rupee?

Which banks are involved in e-rupee?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.