There has finally been some movement on crypto markets, but for many, it has been in the wrong direction. Bitcoin and digital asset markets have fallen to a two-month low breaking the deadlock between bulls and bears, with the latter winning this bout.

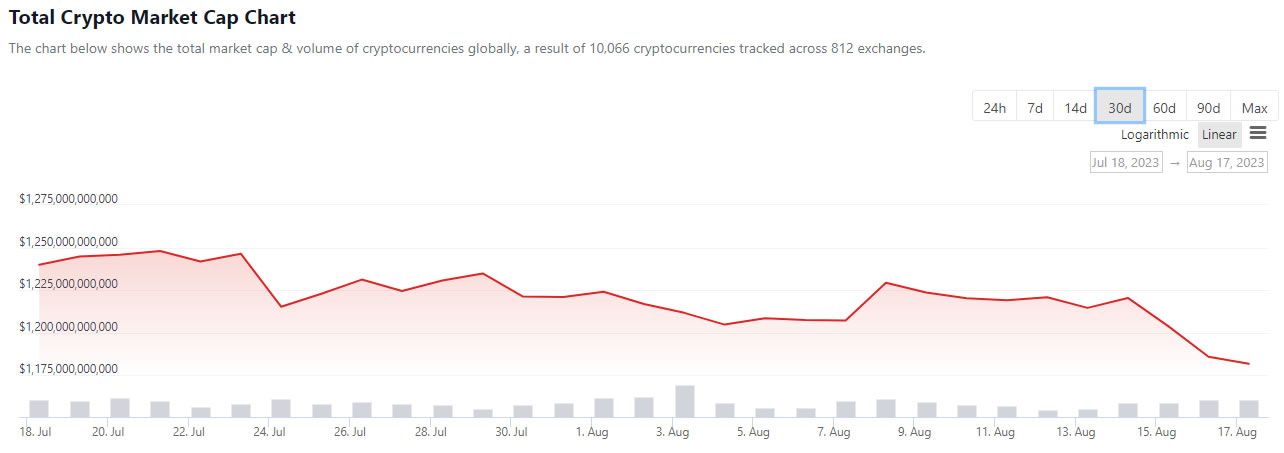

On Aug. 17, crypto market capitalization fell to its lowest level since June 20, with a 2% daily decline to $1.17 trillion.

Crypto Market Selloff Causes Red

Around $30 billion left the digital asset space in less than 24 hours despite otherwise bullish news in the industry.

Coinbase has been granted permission to launch crypto derivatives products, and Ripple is fighting back against regulatory oppression. However, they were not enough to prevent the selloff.

Looking at the bigger picture shows that crypto markets are still sideways, where they have been since the middle of March.

The move follows declines in global stock markets, with Asian indexes falling to a nine-month low. Moreover, major US markets such as the S&P 500 and tech-heavy Nasdaq 100 have been retreating over the past few weeks.

On Aug. 16, the Federal Reserve released the minutes of its last meeting. The US central bank again refuted recession fears though officials still saw the need for higher rates.

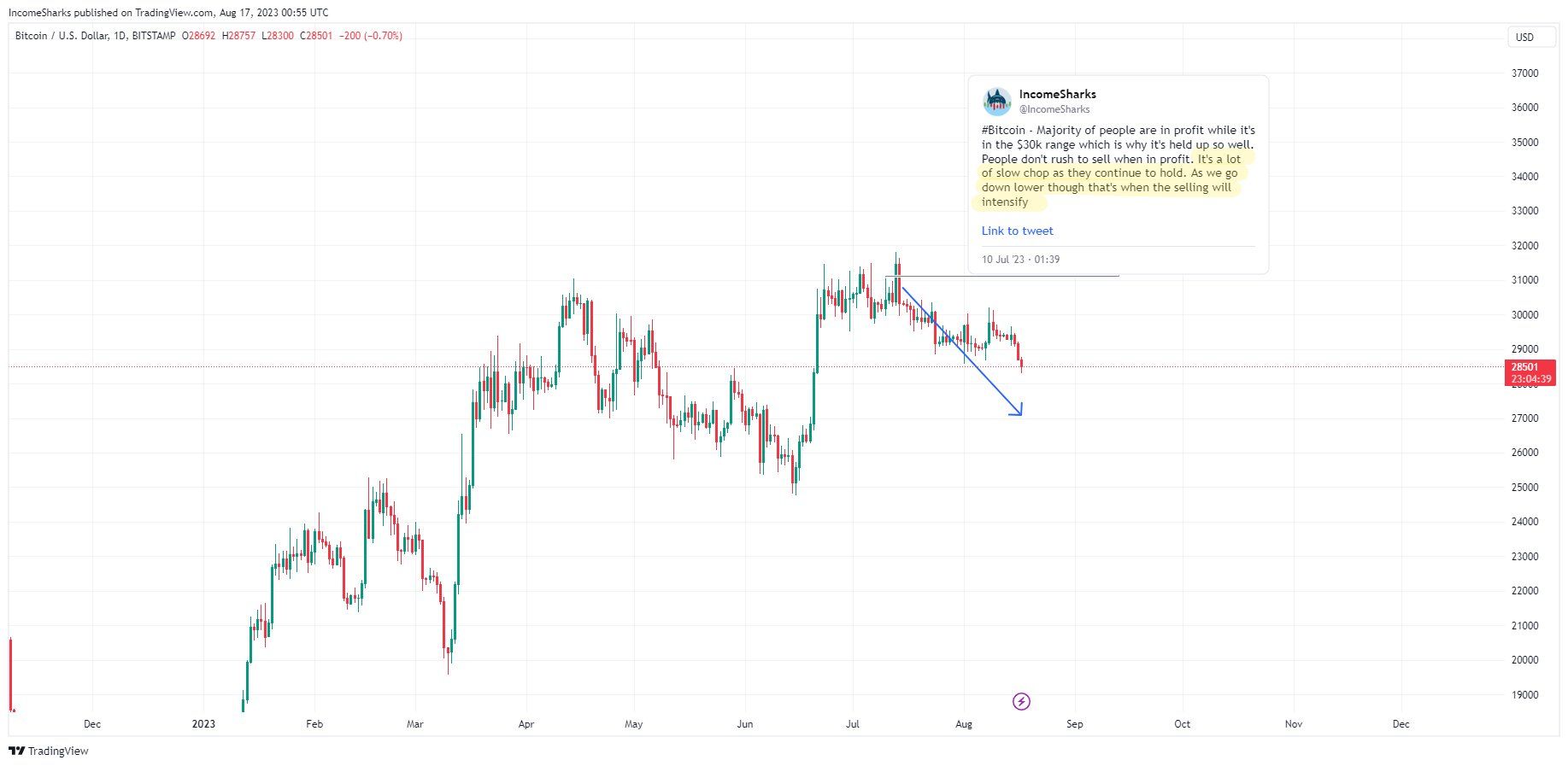

BTC fell 2% on the day to an intraday and two-month low of $28,430 during the Thursday morning Asian trading session. It has since recovered marginally to trade at $28,634 at the time of writing, its lowest level since June 21.

ITC founder Benjamin Cowen said that the Bitcoin correction has “always happened in Aug/Sep of the pre-halving year.” He added that it occurs due to a seasonal correction in the S&P 500 in the pre-election year.

Bitcoin Bears Bounce Back

Additionally, the drop from $29,500 to $28,300 brought the price closer to the realized price of short-term holders. This is considered a macro support level, said CryptoQuant analysts.

Other analysts were leaning bearish with ‘Bluntz’ commenting:

“BTC looking super weak to me with alts looking even worse and I cant help but feel a savage breakdown is near.”

Meanwhile, ‘IncomeSharks’ commented that Bitcoin has been holding steady because traders are in profit and haven’t sold.

“As we go lower now people are starting to lose money and the panic comes. People emotionally sell for losses more often than taking profit.”

The analyst predicted that the selling will intensify as prices drop lower until support is found.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.