The crypto market has been experiencing significant volatility as the US Federal Reserve prepares to release updated economic projections this week.

Despite slower growth, market watchers and investors expect these projections to show fewer interest rate cuts.

JPMorgan and Citi Abandon July Rate Cut Forecasts

The Fed Chair, Jerome Powell, has warned that actual outcomes may vary. Unexpected economic conditions have challenged the Fed’s recent forecasts.

While key inflation measures have remained steady after aggressive rate hikes in 2022 and 2023, economic risks are now more nuanced, with data often contradictory. For instance, US firms added 272,000 jobs in May, and wages rose at a 4.1% annual rate. However, the unemployment rate ticked up to 4%.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

“In recent months, there has been a lack of further progress toward the Committee’s 2% inflation objective,” The Fed wrote after its last meeting on May 1.

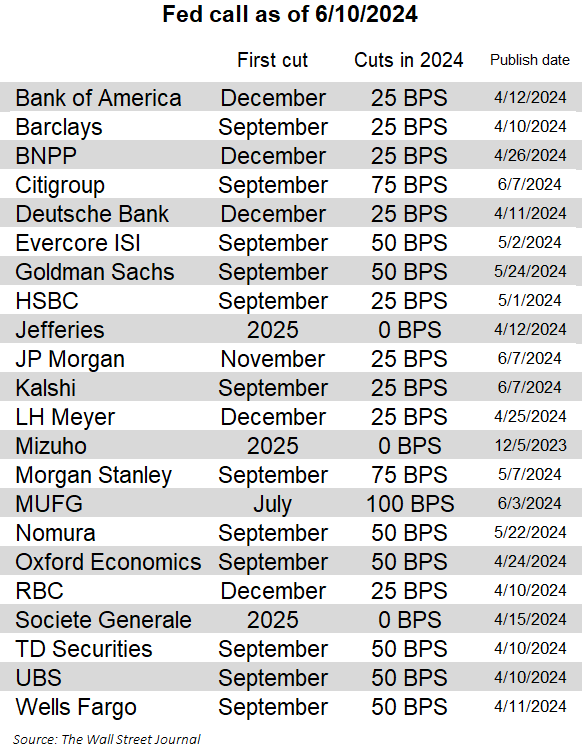

Consequently, the Fed is cautious about rate cuts until inflation significantly improves. Policymakers question whether inflation can hit the 2% target without tight monetary policy. The Fed’s approach to rate cuts contrasts with some global counterparts, like the European Central Bank (ECB) and Bank of Canada (BoC), which have recently cut rates. According to Wall Street Journal reporter Nick Timiraos, JPMorgan and Citigroup abandoned their forecasts for a July rate cut after last Friday’s jobs report.

“Most sell-side economists and other professional Fed watchers now anticipate one or two rate cuts this year in either September or December,” he added.

In addition to JPMorgan and Citigroup, various financial institutions have projected their expectations for Fed interest rate cuts in 2024. Most projections indicate a first-rate cut happening as early as September, while some expect it as late as December.

Matteo Greco, a research analyst at Fineqia, shared his perspective on this current situation with BeInCrypto. He explained that less restrictive monetary policies are generally favorable for risk-on assets such as stocks and cryptocurrencies. This is especially relevant when rate cuts do not foreshadow an impending recession.

“In this case, the central bank’s decision to cut rates despite higher-than-target inflation suggests optimism about managing inflation and maintaining it near desired levels even with more expansionary monetary policies,” he noted.

At the time of writing, Bitcoin (BTC) is trading at $67,482, down 2.8% over the last 24 hours. Meanwhile, major altcoins like Ethereum (ETH) and Solana (SOL) decreased by 3.9% and 3.4% in the same period. The total crypto market capitalization now stands at $2.59 trillion, representing a 2.7% decrease over the same period.

Read more: 7 Ways To Handle Retirement With Increasing Inflation

Indeed, these developments are crucial for crypto traders and investors. The Fed’s decisions on interest rates directly impact market liquidity, borrowing costs, and overall economic conditions, all of which influence crypto market dynamics.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.