A new report reveals that crypto exchanges rank as the least trusted financial service for non-crypto users. This finding comes despite growing interest in cryptocurrencies from both existing crypto owners and non-owners.

The report by CoinCover, called Securing the Future of Cryptocurrencies, surveyed over 16,000 people across nine countries. It found high levels of distrust towards crypto exchanges compared to traditional financial institutions.

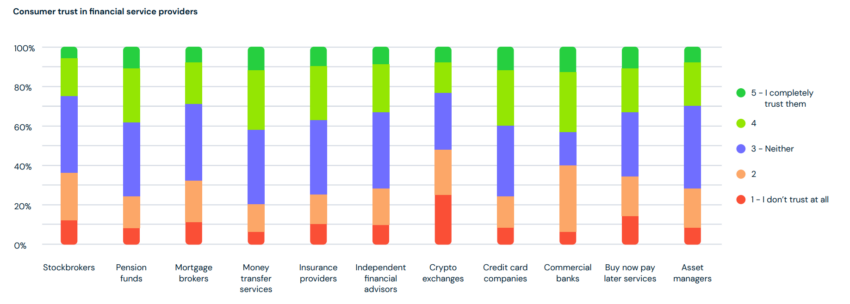

Crypto Exchanges Less Trusted Than Buy-Now-Pay-Later Services

Among non-crypto users, only 10% said they completely trust crypto exchanges. This compares to 24% who completely trust commercial banks.

Crypto exchanges were even less trusted than buy-now-pay-later services like Klarna, which have been accused of pushing young people into debt with frivolous purchases. Unfortunately for the industry, crypto exchanges like Binance and Coinbase are also less trusted than credit card companies. Institutions that do not exactly have a stellar reputation.

This distrust stems largely from recent instability and criminality in the crypto ecosystem. Money laundering and fraud were commonly cited as enabled by cryptocurrencies, with 31% associating crypto more with financial fraud than innovation.

In fact, more survey respondents expressed concerns about crypto (40%) than artificial intelligence (30%). This is likely driven by high-profile hacking incidents and scams eroding trust.

Just starting out in crypto? Look no further: 11 Best Crypto Exchanges for Beginners

However, the report also shows pent-up demand for crypto adoption. Fully 30% of non-crypto owners expect to invest within 12 months, signaling strong interest. But people are holding back due to systemic risks.

Price Volatility Is a Major Barrier for Users and Non-Users

Volatility (47%), hacking (43%), and risk of losing access (36%) were the top hurdles to crypto investment for crypto users. But complexity was a major barrier, with 30% of non-owners saying crypto is too hard to understand. Non-users also cited volatility (42%) and hacking (39%) as reasons for not getting involved.

However, there is some light on the horizon. According to the survey, 40% of 18- to 34-year-olds are likely to invest in crypto soon.

With the right focus on confidence building, the report holds out promise for crypto’s future. Nearly half (48%) of all respondents expressed confidence that crypto will overcome its challenges and find acceptance.

You can read the full report by CoinCover here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.