Indian crypto exchange CoinDCX, which achieved unicorn status in 2021, has announced it is laying off around 12% of its workforce.

As Bitcoin (BTC) fails to hold above $31,000 despite months of attempts, trading volume has been declining, resulting in declining revenues for crypto exchanges.

CoinDCX Cuts Staff Amid Unfavorable Crypto Tax Rules

With Bitcoin rallying over 50% earlier this year, many experts believed that it was the start of a new bull market. But with the market moving sideways combined with record low volumes since then, falling revenues have necessitated layoffs.

A CoinDCX representative told BeInCrypto that exactly 71 employees would part ways with the company, or 12% of the total headcount.

Previously in January 2023, CoinDCX denied reports it had laid off 80–100 employees across marketing, branding, and activation teams, saying it had restructured departments instead.

Click here to learn about the 13 best no-KYC crypto exchanges in 2023.

Meanwhile, CoinDCX will primarily focus on simplifying the Web3 onboarding process for users. Sumit Gupta, the co-founder of CoinDCX, told BeInCrypto:

At present, the foremost priority for CoinDCX is to build Web3 use cases, creating the bridge between Web3 and the users.

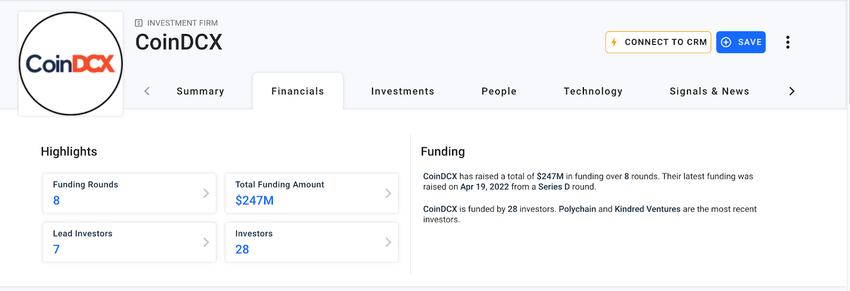

During the bull run in August 2021, CoinDCX announced it had become India’s first crypto unicorn. According to Crunchbase, it raised a total funding of $247 million from 28 investors through eight funding rounds. The Indian exchange’s latest fundraising was in April 2022 through a Series D round.

Strict Crypto Tax Rules

Despite the recent fundraising rounds, CoinDCX had to switch to cost-cutting measures due to a prolonged bear market and unfavorable crypto tax rules such as a 30% flat tax on capital gains and a 1% Tax Deduction at Source (TDS).

Harsh Indian crypto tax rules have severely affected trading volumes on crypto exchanges. Some Indian crypto exchanges have lost over 90% of their trading volume. Gupta further told BeInCrypto that traders opt for international exchanges and peer-to-peer platforms to avoid taxation. He elaborated:

It’s important to note that trading activity hasn’t diminished but has rather shifted. If TDS is reduced or eliminated in the future, it’s highly likely that trading volumes will experience a recovery.

This move could instill more confidence among investors, encouraging them to participate in trading on Indian compliant exchanges, thereby contributing to the resurgence of trading volumes and potentially boosting revenues.

Click here to find out how to get a job in crypto.

Apart from Indian crypto exchanges, many international exchanges such as Binance and KuCoin have laid off their employees recently.

Got something to say about the Indian crypto exchange CoinDCX or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.