Crypto market volatility was high this week as regulatory developments, macro tensions, and the Binance exchange’s decisions shook markets.

A brewing trade war, whispers of stealth quantitative easing, and a historic legal truce between Ripple and the SEC are reshaping narratives. The following is a roundup of what happened this week in crypto.

Binance Earmarks 14 Altcoins For Delisting

Binance, the largest crypto exchange by trading volume metrics, announced a decision to delist 14 tokens, including BADGER, BAL, and CREAM.

The decision led to double-digit losses for the affected tokens almost immediately, highlighting the effect of such announcements on investor sentiment.

Binance initiated the delisting process through its vote-to-delist mechanism, where the community participated in deciding the fate of certain tokens. Reportedly, out of 103,942 votes from 24,141 participants, 93,680 were deemed valid.

The exchange cited factors such as development activity, trading volume, and liquidity in its evaluation before earmarking the cited altcoins.

“Following the Vote to Delist results and completion of the standard delisting due diligence process, Binance will delist BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT and VIDT on 2025-04-16,” read the announcement.

Trading for these tokens will cease on April 16, with withdrawal limitations set for June 9. Post this date, any unsold tokens will be converted to stablecoins.

Arthur Hayes: Inevitable Return to Fed Stimulus

This week in crypto, Arthur Hayes returned with a bold thesis. According to the BitMEX co-founder, the unfolding US-China trade war and the inevitable return of Fed stimulus could catapult Bitcoin to $1 million.

Hayes tied Trump’s proposed 125% tariffs on Chinese goods to a broader breakdown in global trade. He also referenced a scenario where the USD/CNY hits 10.00, calling it the “super bazooka” that could propel Bitcoin higher.

According to Hayes, such protectionism will trigger supply chain disruption, inflationary spikes, and, ultimately, a resumption of quantitative easing (QE) as central banks try to stabilize faltering economies.

He sees this monetary pivot as the spark for Bitcoin’s next supercycle.

In a more immediate scenario, the BitMEX executive also argued that if the Fed pivots to QE soon, Bitcoin could hit $250,000 even before a global financial reckoning sets in.

Hayes’s outlook sounds overly ambitious. However, with US liquidity injections already under scrutiny, analysts are increasingly aligning with the idea that macro tailwinds could push Bitcoin far beyond the current $81,000 range.

Is the Fed Already Doing Stealth QE?

BeInCrypto reported this hypothesis this week in crypto. Some analysts are raising red flags about stealth quantitative easing, suggesting the Fed is quietly injecting liquidity into the financial system without formally announcing a new QE program.

“This isn’t hopium. This is actual liquidity being unchained. While people are screaming about tariffs, inflation, and ghost-of-SVB trauma… the biggest stealth easing since 2020 has been underway,” wrote Oz, founder of The Markets Unplugged.

Liquidity metrics such as the Reverse Repo Facility (RRP) hint at significant capital flows, even as the Fed maintains a public anti-inflation stance.

Critics argue that these backdoor injections are fueling asset prices, including crypto, without the transparency or accountability of past QE rounds.

For crypto, stealth QE may be one of the key reasons Bitcoin remains resilient despite calls for significant breakdowns below $70,000.

If confirmed, these quiet interventions could be laying the groundwork for a larger, formal liquidity wave. Such an action would align with Arthur Hayes’s prediction of a new Bitcoin super cycle.

Meanwhile, amid cooling inflation and US growth forecasts softening, the possibility of a formal return to QE in 2025 is gaining traction among economists.

Analysts highlighted that if the Fed pivots to liquidity expansion, Bitcoin and major altcoins could enter a multi-year bull cycle akin to the 2020–2021 rally.

Ripple and SEC File Joint Motion

Another top headline this week in crypto, Ripple and the US SEC (Securities and Exchange Commission) filed a joint motion to settle the remaining remedies phase of their years-long legal battle.

The move signals both parties are ready to wrap up a case that has cast a regulatory shadow over the crypto market since 2020.

“The parties have filed a joint motion to hold the appeal in abeyance based on the parties’ agreement to settle. The settlement is awaiting Commission approval. No brief will be filed on April 16th,” wrote XRP advocate James Filan.

The motion follows Judge Analisa Torres’s 2023 ruling that XRP is not a security when sold to retail investors. This decision marked a partial but critical win for Ripple.

What remains now is a resolution over institutional sales, penalties, and injunctions. According to legal experts, the fact that both Ripple and the SEC are willing to settle suggests neither side wants to prolong the case amid broader legal and political uncertainty.

The resolution will likely influence how the SEC proceeds with other enforcement actions against major crypto firms. For Ripple, regulatory clarity could open the door to US re-listings and deeper integration with traditional finance (TradFi).

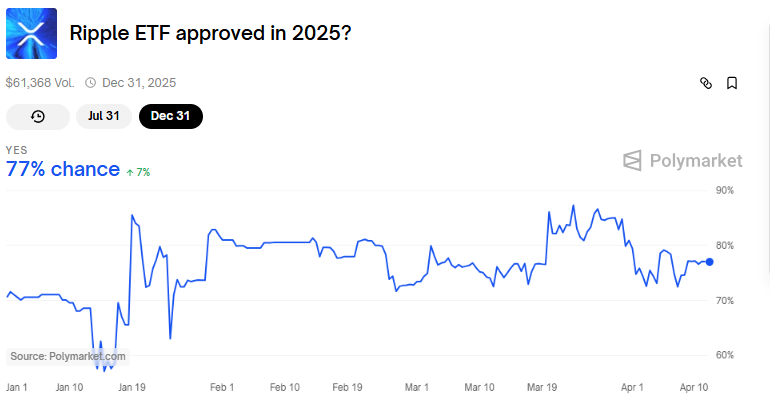

Specifically, it could increase the odds for an XRP ETF (exchange-traded fund) in the US, which now stands at 77%, data on Polymarket shows.

Trump Pauses Tariffs—Except on China

This week in crypto, the crypto market surged over 5% in total capitalization after Donald Trump announced he would pause tariffs on most US trading partners. BeInCrypto reported that China was the only exception.

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately,” Trump shared on Truth Social.

The move reignited risk-on sentiment in markets, particularly crypto, which remains highly sensitive to macro policy shifts.

Analysts interpreted the announcement as a double-edged message. On the one hand, the global economy might get a reprieve from broad-based trade pressure.

On the other hand, China remains a geopolitical target, which could further fragment global trade systems and increase reliance on decentralized assets. In a retaliatory move, China raised tariffs on the US to 125%.