The DeFi ‘food farming’ frenzy this past Summer took its toll on the Ethereum network in terms of demand. As a result, a slew of rival platforms emerged and a new report from Coinbase has taken a deep dive into some of them.

In its latest report in the ‘Round the Block’ series titled “ETH Killers and New Chains” published on Dec. 12, the U.S.-based crypto exchange Coinbase has taken a closer look at rising competitors to Ethereum in the smart contract space.

A number of new DeFi-focused blockchains have emerged this year, all with the aim of usurping Ethereum’s dominance in the space by offering faster and cheaper transactions. But as we have seen, that is not enough to become a standard in this rapidly expanding financial landscape.

How to ‘Kill’ Ethereum

The report first acknowledges the Ethereum has a ‘firm and clear first-mover advantage.’

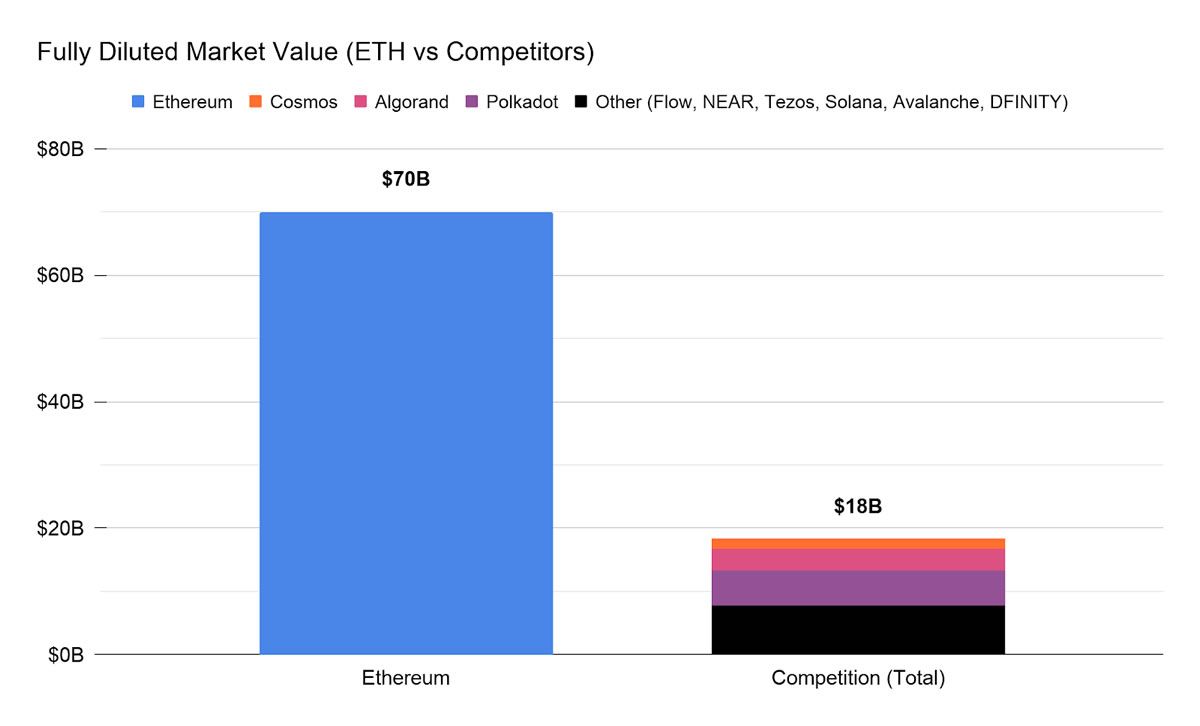

Ethereum is still king in terms of network value at $66 billion but it also dwarfs the competition in several key factors including developer activity and user numbers.

It added that third-party services also lean heavily on the support of Ethereum. These factors include developer tools, wallets, cloud infrastructure, exchange integrations, stablecoins, and more. No rival chain at present comes close to having the support that Ethereum has.

It also touts network security as a key factor. The cost of attacking the Ethereum network is high compared to other chains. Ethereum Classic, which has suffered several 51% attacks, was used as an example. The report added;

“Above all, Ethereum has demonstrated the power of open-source development, where Dapps are able to interact with each other.”

Regarding the rivals, Coinbase stated that any opponent must compete on several levels, and simply offering faster transactions is not enough.

Developer experience, tooling, and programmability need to be considered for dApp and smart contract coding. User experience and scaling is a key factor and many competing platforms do have the advantage with this at the moment.

However, Ethereum has a clear lead in infrastructure, node support, staking services, and security.

Coinbase added that the success case for the competition will depend largely on how well Ethereum is satisfying current developer needs, and how difficult it would be for developers to switch to a new environment, concluding;

“But to be clear, if Ethereum can sufficiently scale throughput and continue to improve developer experience, it will be challenging for any other competitive platform to emerge at a scale that would threaten Ethereum.”

Looking at the Lineup

Coinbase listed the following blockchains as the biggest competitors to Ethereum: Cosmos, Polkadot, Flow, NEAR, Tezos, Solana, Avalanche, Algorand, and DFINITY. It should be noted that Flow and NEAR are part of the Coinbase ventures portfolio company.

Notably absent from the report were other possibly more significant rivals, Cardano, EOS, TRON, NEO, and Binance Smart Chain.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.