American stablecoin issuer Circle is relying on a $1 billion dollar cash buffer to help reverse a decline in circulating supply and compete with a wave of newcomers. Competition in the stablecoin market is heating up, buoyed by the premise of potential regulations in the United States.

On Aug. 10, Bloomberg reported that Circle Internet Financial, the firm behind USDC, is betting on major global adoption of stablecoins.

Circle CEO on USDC Supplies

Circle CEO Jeremy Allaire told Bloomberg that the company has a $1 billion cash cushion to weather the challenges in the crypto industry. He said that a series of “tail-risk events” in the crypto industry have affected the adoption of USDC.

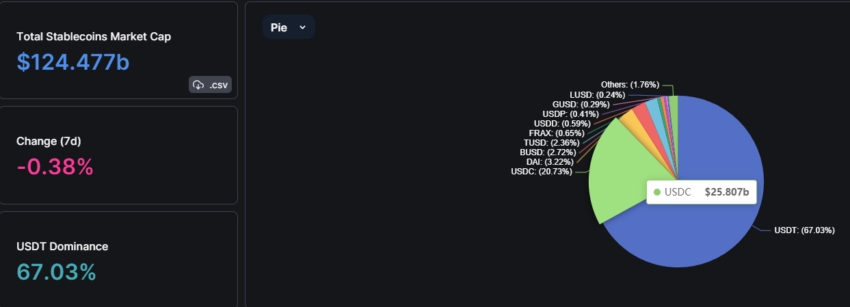

USDC supplies have shrunk 53% since their peak of $56 billion in June 2022. Around 26 billion USDC is circulating, giving the stablecoin a market share of just under 21%.

Allaire blamed the supply decline on Binance. In September 2022, he said Binance decided to pull back from using USDC to drive the usage of its own token.

Circle was also heavily impacted by its $3.3 billion exposure to the now-bankrupt Silicon Valley Bank. USDC heavily de-pegged in March, causing a collapse in confidence in the asset.

Take a look at our explainer for a better understanding of stablecoins: What Is a Stablecoin? A Beginner’s Guide

However, it is not all bad news. Circle has benefitted from rising interest rates, generating $779 million in revenue in the first half of 2023, surpassing all revenue from the previous year. Allaire remained bullish, commenting:

“That’s significantly more than we had expected, and allows us to have a lot of staying power as a company to invest, build out major new revenue streams, build on major new products, and execute global international expansion profitably,”

Stablecoin Newcomers

A slew of new stablecoins have entered the already crowded market this year. The most prominent one is PayPal’s PYUSD, announced earlier this week.

Other newly launched stablecoins include the Binance-supported First Digital USD (FDUSD) and Aave’s algorithmic GHO.

Allaire said that competition was a good thing because “it’s going to drive more and more companies into the field.”

He also said that when regulations are finally rolled out, many of them will not survive.

“My belief is that over the next two years, those players that cannot meet the standards will be crowded out of the mainstream market.”

This week, former acting Comptroller of the Currency, Brian P. Brooks, urged Congress to speed up the prioritization of regulating stablecoins.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.