Circle, a global financial technology firm, has joined forces with Nubank, a major digital financial platform, to enhance the reach of the US Dollar Coin (USDC) in Brazil.

This strategic partnership has the potential to reach over 90 million customers across Brazil, Mexico, and Colombia.

Circle Offers USDC Stablecoin to Nubank Clients in Brazil

Circle’s USDC, a leading regulated dollar stablecoin, operates as a digital dollar over the internet, offering a stable, inflation-resistant store of value. The introduction of USDC to Nubank’s clientele will begin with its integration into Nubank Cripto. It will enable Brazilian users to buy and hold digital dollars. This step is a gateway to the broader potential of blockchain-based financial services, with USDC at its core.

Jeremy Allaire, CEO and Co-Founder of Circle highlighted the growing demand for dollar access in Latin America, particularly in Brazil, a hotbed for digital currency use and adoption. Allaire underscored the move as a pivotal step in building a new internet financial system:

“Our partnership with Nubank marks a significant moment in expanding the global reach of USDC.”

Nubank Cripto’s platform, known for its robust educational content on digital currencies, empowers users to make informed financial decisions. Thomaz Fortes, General Manager of Nubank Cripto, elaborated on the integration of USDC. He noted its potential to open up significant opportunities for customers. Fortes explained:

“Through this offering and the characteristics of Circle’s USDC, we are considering future possibilities to integrate Nubank Cripto with other financial services available in our app.”

Read more: What Is a Stablecoin? A Beginner’s Guide

Brazil Crypto Industry Boom

Parallel to this development, Brazil’s banking sector is witnessing a surge in crypto offerings. Itaú Unibanco, the nation’s largest lender, recently launched Bitcoin and Ethereum trading services.

This move, as Guto Antunes, the head of digital assets at Itaú Unibanco, indicated, is the beginning of a broader strategic plan to expand into other crypto assets.

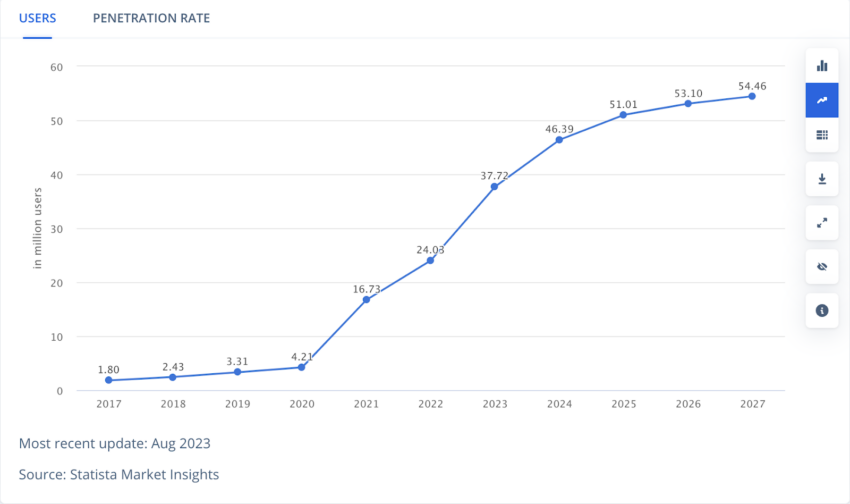

The Brazilian crypto market currently has approximately 37.72 million users in 2023. However, Statista forecasted growth to 54.46 million by 2027.

The collaboration between Circle and Nubank, alongside Itaú Unibanco’s foray into crypto trading, signals a significant shift towards integrating digital currencies into mainstream financial services in Brazil.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.