Amidst a global reduction in startup funding, the crypto market grapples with its own set of unique challenges and opportunities. Although entrepreneurs are adapting to these challenges by exploring alternative funding avenues and navigating regulatory environments, the scarcity of funding prevents innovation.

Latin America’s crypto scene reveals a story of resilience, paving the way for a more inclusive and technologically advanced future.

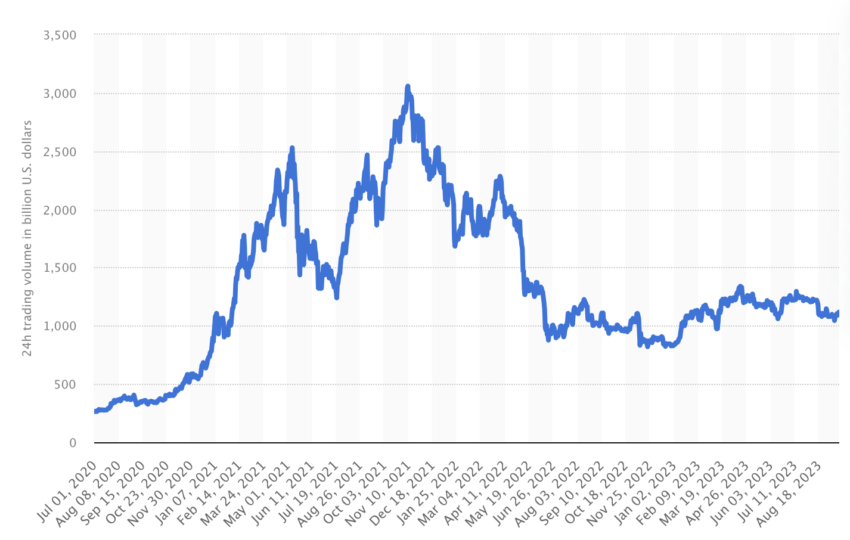

Interest In Cryptocurrency Wanes

The funding environment, a critical aspect for startups, has seen a dramatic downturn. In 2023, startup funding in Latin America decreased by 83% compared to the previous year, with only $1.1 billion invested.

Likewise, global venture capital funding for crypto firms experienced a substantial decrease in the first quarter of 2023, plummeting by 80% compared to the previous year. This drop brought the investment down from $12.3 billion in 2022 to $2.4 billion in 2023.

“Only 12% [of family offices] expressed potential future interest [in crypto], down from 45%. The extreme crypto market volatility of the past year seems to have cooled their interests, as 62% report being not invested and not interested in crypto in the future, up from 39%,” a Goldman Sachs survey revealed.

This decline reflects a broader global trend influenced by macroeconomic factors, such as high-interest rates directing capital towards lower-risk investments. As these rates adjust, there is potential for a resurgence in startup investments, but the situation remains challenging.

For crypto entrepreneurs in Latin America, acquiring funding is a crucial but difficult task, especially this year. While startups have the potential for organic growth, robust financial support could significantly accelerate their development.

Read more: High-Performing Crypto Ad Campaigns and What We Can Learn From Them

In response to the contraction of venture capital, Cristobal Pereira, Executive Director at Blockchain Summit Latam, told BeInCrypto that crypto entrepreneurs must explore alternative funding sources. Though often smaller in amount, grants from various protocols and quadratic funding provide a “solid alternative” support for businesses operating with limited resources.

“Grants are specifically designed to support the deployment of applications on new infrastructures. It is crucial to stay vigilant for these opportunities as any assistance is valuable when working with limited budgets,” Pereira said.

Overcoming Regulatory Hurdles

Government and regulatory frameworks also significantly impact crypto entrepreneurship. Brazil is a leader in adopting Web3 innovations, with progressive technological infrastructures and regulations. However, the rest of the region lags, with many countries still debating regulations that other jurisdictions resolved years ago.

Robust regulation is crucial, especially in the financial system, where blockchain technologies can fundamentally alter the sector.

“In cases related to the financial system, the absence of a basic regulation often leads to issues. This is because banks in Latin America tend to close the bank accounts of entrepreneurs and their startups when they are associated with digital assets. This clearly poses a significant challenge for those looking to venture into this field,” Pereira added.

For this reason, education can play a fundamental role in fostering a robust blockchain ecosystem.

Comprehensive understanding among entrepreneurs, users, investors, and regulators is crucial for identifying opportunities and mitigating risks. Especially in a region where only about 50% of the population can access a bank account, and 80% has a smartphone.

“I believe there is an opportunity for crypto startups in this area. Demonstrating how simple and easy it can be to use this technology by providing the opportunity for usage showcasing the potential for financial operations at any time and day, highlights the technology’s potential. The majority of the population could easily download an application and start receiving digital assets, using them in their day-to-day life,” Pereira emphasized.

Still, the current state of funding capital presents challenges. Although Web3 financial products and services can offer superior savings and credit rates than traditional mediums, investment also impacts this. The scarcity of available capital restricts investment opportunities in crypto startups, adversely affecting their growth potential.

Read more: A Guide to Crypto PR: How to Maximize Your Brand’s Visibility

Looking to the future, Latin America holds immense potential for the crypto industry’s growth despite facing significant challenges. While international companies are recognizing the region’s potential, local crypto entrepreneurs also have the opportunity to create globally scalable solutions.

“Latin America has the potential to lead the adoption of cryptocurrencies and contribute significantly to reaching the first billion crypto users. Considering the widespread adoption of crypto in the region, I can assert that a substantial portion is already in progress. With a market in place, entrepreneurs can explore innovative solutions to offer to these users, contributing to the professionalization and growth of the market itself,” Pereira concluded.

Education, adaptive strategies, and a focus on building consumer trust and understanding are key to overcoming the current obstacles and fostering mainstream adoption.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.