Circle Internet Financial Ltd., the issuer of the USDC stablecoin, is making a strategic move to re-domicile its legal base. The company plans to move its legal headquarters from the Republic of Ireland to the United States (US).

This decision comes ahead of its highly anticipated initial public offering (IPO). Many see this move as a significant shift for the company as it navigates the regulatory environment and seeks to bolster market confidence.

Moving to the US Might Pose Challenges for Circle

A Bloomberg report recently shared a confirmation from a Circle spokesperson. They confirmed the filing of necessary court paperwork for the move on Tuesday. However, they did not share the reasons for the decision.

BeInCrypto previously reported that Circle had already filed for the IPO to the US Securities and Exchange Commission (SEC) in January. Yet, the company did not disclose the number of shares it plans to dilute or the price range of its shares.

On the other hand, moving to the US may pose challenges for Circle, including stricter taxes and a complex regulatory scene. Indeed, the regulation of cryptocurrencies and stablecoins in the US has been uncertain.

Read more: Top 5 Crypto Companies That Might Go Public (IPO) in 2024

Notably, Ripple Labs, the company behind the XRP cryptocurrency, has faced significant legal challenges with the SEC. This challenge caused Ripple to halt its IPO plans in the US and consider alternatives abroad.

Therefore, Circle’s move suggests a strategic bet on regulatory clarity in the US. Depending on upcoming regulatory decisions, this could either boost or hinder its growth.

Despite potential obstacles, Circle’s CEO, Jeremy Allaire, remains optimistic about the future of stablecoins and their regulatory environment. At the Milken Institute Global Conference 2024, Allaire emphasized the importance of regulatory clarity, scalable technology, and user-friendly applications to widen USDC adoption and integration.

“I’ve always said you need regulatory clarity. You need the technology to become much more scalable and useable. And then, you need the people, the mainstream applications that people are going to be interacting with this, whether you are a business accepting a payment or an end user, you need those to connect up to that. All those three have been happening. We’re getting regulatory clarity on payment stablecoins all around the world and almost every jurisdiction we have a payment stablecoin act that’s at the proverbial one yard line here in the US,” Allaire said.

Allaire’s confidence is further evidenced by Circle’s collaborations with traditional finance giants such as BlackRock. Last month, Circle announced a new exchange feature for BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) investors. They can now exchange their tokenized real-world assets for USDC.

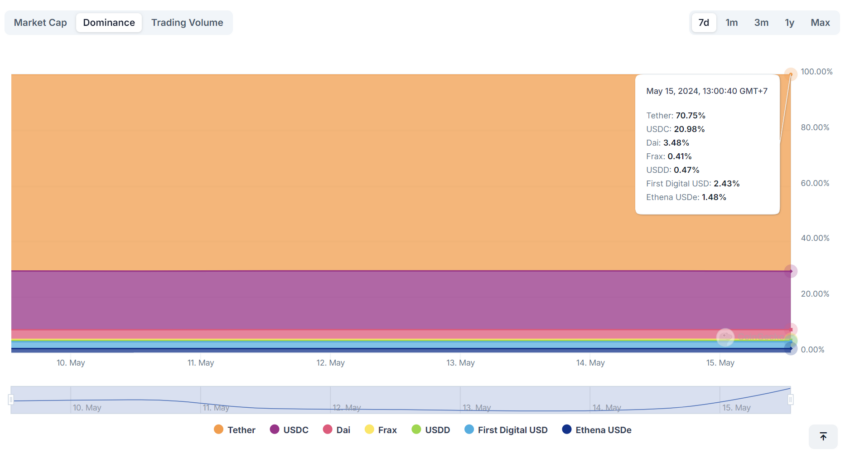

According to CoinGecko data, USDC is the second-largest stablecoin in terms of market capitalization. As of May 15, USDC has a market capitalization of $32.86 billion.

This represents nearly 21% of the stablecoin market share. It trails behind Tether’s USDT, which has a market capitalization of $110.86 billion and a 70.75% market share.

Read more: A Guide to the Best Stablecoins in 2024

In 2022, USDC and USDT were in close competition. In July 2022, USDC held over 40% of the market share, compared to USDT’s roughly 50%.

However, 2023 brought challenges for Circle, particularly due to banking issues in the US. Part of USDC’s reserves were held with Silicon Valley Bank, which faced financial troubles. This caused USDC to temporarily lose its peg, raising concerns among users and investors.

As Circle prepares for its IPO and re-domiciles to the US, its actions reflect a strategic pivot to align with US financial regulations and market dynamics. With its strong industry partnerships and commitment to regulatory clarity, this move also positions Circle to strengthen its place in the stablecoin market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.