The USDC issuer – Circle, has been considering an Initial Public Offering (IPO) since last year. Finally, reports claim that it has confidentially filed for a US IPO.

In the United States, multiple crypto mining firms and a prominent crypto exchange, Coinbase, are already listed on stock exchanges. Consequently, this establishes a precedent demonstrating that crypto firms can transition to becoming publicly traded companies in the country.

Circle Internet Financial Aims to Become a Publicly Traded Company in the US

According to Reuters, Circle has confidentially filed for a US IPO. However, the company has not disclosed the number of shares it plans to dilute or the price range of its shares.

In November 2023, BeInCrypto reported that the company was exploring the possibility of going public. Not to mention, in 2022, Circle had a valuation of $9 billion.

Read more: A Guide to the Best Stablecoins in 2024

“The IPO is expected to take place after the Securities and Exchange Commission completes its review process, subject to market and other conditions,” the company said.

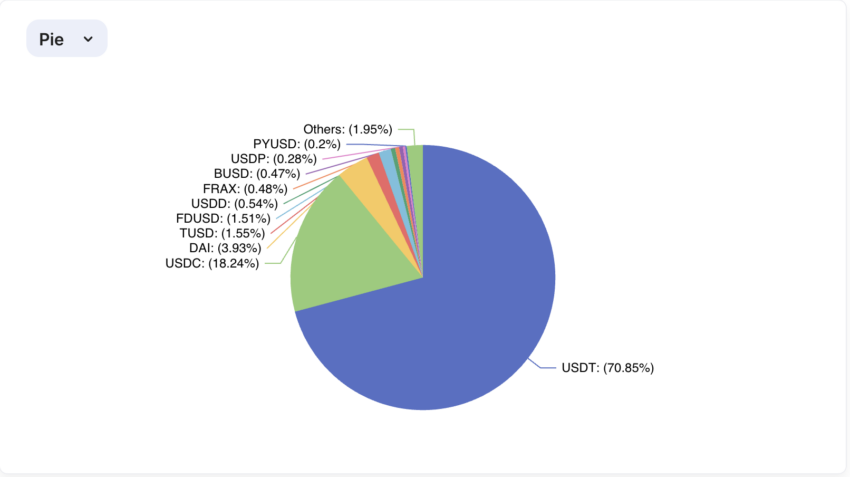

Circle’s USDC is the second largest stablecoin after Tether’s USDT. The screenshot below shows that out of the total stablecoin market capitalization, USDC has a dominance of 18.24%.

Alongside Circle, there have been speculations about Ripple going public in 2024. In October 2023, BeInCrypto reported that Ripple was hiring for a “Shareholders Communications Senior Manager” position. Back then, some community members believed a company might need a Shareholders’ Communications Manager if it planned an IPO.

Read more: Top 12 Crypto Companies to Watch in 2024

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.