Circle CFO Jeremy Fox-Geen published a post that discussed Circle’s aspirations to hold its cash reserves with the United States Federal Reserve. Currently, 20% of its USDC reserves are cash.

Circle, the issuer of the USDC stablecoin, has called for the direct holding of stablecoin reserves with the United States Federal Reserve. The company’s Chief Financial Officer, Jeremy Fox-Geen, published a post on March 28 about trust and general transparency. Fox-Geen opened by stating the following,

“A U.S. dollar backed stablecoin requires access to the U.S. banking system to allow money to seamlessly flow in and out of crypto, enabling the safe, secure bridges between blockchain-based finance and fiat banking that are essential to the long-term growth of digital assets.”

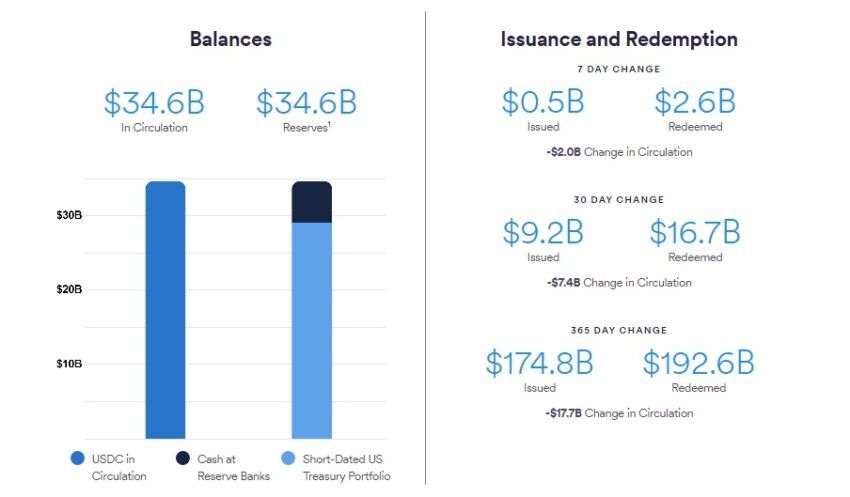

He then stated that about 80% of the reserves for the stablecoin were held in U.S. Treasures, with the remainder in cash deposits in the banking system. He also provided a link to a transparency report. The 20% is held in cash deposits to satisfy immediate liquidity needs.

He then refers to the recent slew of bank failures, which affected Circle as well because the company had the cash within Silicon Valley bank.

Fox-Geen states that Circle has taken steps to reduce any risks from banking systems. At this point, he mentions that Circle has “always aspired to hold the cash portion of the USDC reserve directly with the Federal Reserve, fulfilling our vision of USDC as true tokenized cash.” However, he notes that this will require stablecoin legislation.

USDC Depegs and Regains Peg

The USDC stablecoin has had a rocky period over the past few weeks. The stablecoin fell to as low as $0.87, sparking worries in the crypto community. This depegging was a result of the fact that it had $3.3 billion of its USDC cash reserve in the beleaguered Silicon Valley Bank.

The company and stablecoin have managed to survive that crisis, however, and MakerDAO has also voted to retain USDC as a DAI reserve. The stablecoin did manage to regain its $1 peg, and it appears that the worst is out of the way and that Circle wants to ensure that USDC has more protection measures.

Circle Also Focusing on Growth

Circle has also been announcing other developments, including the fact that USDC would launch on Cosmos through the Noble network. Xapo Bank has also partnered with Circle to integrate USDC payments. The former is a licensed private bank and Bitcoin custodian.

In more significant news, Circle aims to set up a European headquarters in Paris. It has applied to become a fully registered Digital Assets Service Provider in France.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.