China’s digital yuan transactions amounted to 83 billion yuan (about $12.33 billion) by the end of last month as the country forges ahead with plans for the adoption of a digital currency.

The total number of transactions amounted to 264 million, said Zou Lan from the People’s Bank of China (PBoC). More than 4.5 million commercial outlets signed up for the service

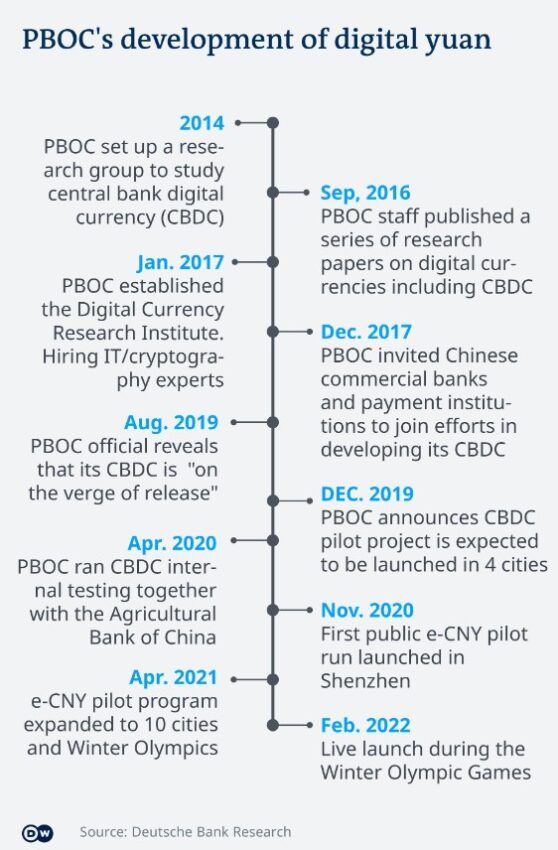

China rolled out its centrally-backed digital currency (CBDC) to the public during the 2022 Winter Games as a way of expanding the digital yuan pilot.

The first stage of the pilot was successfully executed during the Beijing Winter Olympics. The second involved the expansion of pilot testing from the original “10+1″ pilot area to 23 areas in 15 provinces and cities.

Zou noted that digital currency has played a positive role in promoting consumption, boosting domestic demands, and stabilizing economic growth.

The central bank will further expand the scope of its pilot programs, strengthen pilot scenario construction, and enhance international cooperation, Zou added.

China bans private transactions

As the scope of China’s CBDC expands, the private crypto space remains off limits for the citizens. However, the Chinese crypto community believes that Bitcoin and Ethereum could offer investment opportunities at lower prices.

In a survey of over 2,200 people cited by journalist Colin Wu, 8% of respondents believe that the coins will bottom out at $18,000 and $1,000 respectively, while 26% would buy BTC and ETH at $15,000 and $800 respectively.

The non-fungible token (NFT) space is also taking a hit when it comes to private players. China-based Tencent has reportedly shut down one of its NFT marketplaces while its other platform is suffering due to a state-imposed limit on private transactions, Wu noted.

Previously, China’s government-managed bodies, namely the National Internet Finance Association of China, China Banking Association, and the Securities Association of China warned financial institutions against facilitating “illegal” NFT trading in the country.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.