In a report dated June 23, China has underlined the role of crypto in drug trafficking, stating, “Drug capital circulation is extended from online banking transfers to virtual currencies and game coins.”

Further noting the 2021 drug situation in China, the translated report remarked, “The drug market continues to extend to the internet, more use of money and drug payment, character separation and trading mode, ‘Internet + logistics delivery’ contactless drug trafficking methods increased.”

Is China overly concerned and misdirected on crypto?

On the concerns of power pressure and illicit use of cryptocurrencies, China announced a blanket ban on crypto usage and mining back in 2021. But, does China have any basis to quantify the role of crypto in buying and selling drugs?

Chainalysis found in its 2022 report that money laundering accounted for just 0.05% of all cryptocurrency transaction volume in 2021. The data platform also cited that the “UN Office of Drugs and Crime estimates that between $800 billion and $2 trillion of fiat currency is laundered each year — as much as 5% of global GDP.”

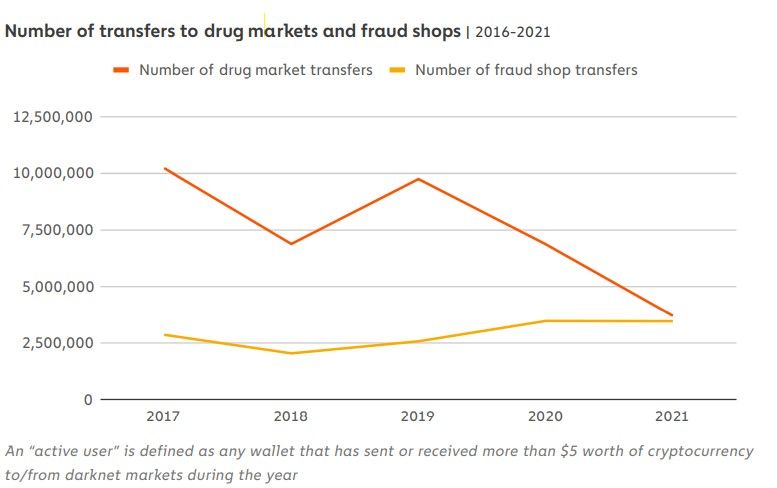

Notably, the report also found that the number of active users on drug markets plunged from around 1.7 million in 2016 to 1.2 million in 2021.

Renewed warnings amid market weakness

A recent report by a Chinese paper under the Communist Party also cited concerns of Bitcoin “heading to zero” amid broader market weakness.

The paper noted, “Bitcoin is nothing more than a string of digital codes, and its returns mainly come from buying low and selling high. In the future, once investors’ confidence collapses or when sovereign countries declare bitcoin illegal, it will return to its original value, which is utterly worthless.”

In the past week, Bitcoin has notably slipped under the crucial level of $20,000 twice, while gaining an average of around 3% during the same period on Coingecko.

SCMP also underlined a fresh warning from the Financial Regulatory Bureau of Shenzhen around the virtual asset sector. The agency said in this week’s release that cryptocurrency trading and speculation harms “property security,” and encourages illicit activities while raising concerns of a larger stability crisis in the economy.

That said, the adoption of the digital yuan backed by the Chinese central bank has grown exponentially over the last year. Be[In]Crypto previously reported that the use of the CBDC increased by 1,800% to 261 million in the country where private crypto is outlawed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.